HBRs 10 must reads on managing risk

Here you can read online HBRs 10 must reads on managing risk full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2020, genre: Business. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

HBRs 10 must reads on managing risk: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "HBRs 10 must reads on managing risk" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Unknown: author's other books

Who wrote HBRs 10 must reads on managing risk? Find out the surname, the name of the author of the book and a list of all author's works by series.

HBRs 10 must reads on managing risk — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "HBRs 10 must reads on managing risk" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

HBRs 10 Must Reads series is the definitive collection of ideas and best practices for aspiring and experienced leaders alike. These books offer essential reading selected from the pages of Harvard Business Review on topics critical to the success of every manager.

Titles include:

HBRs 10 Must Reads 2015

HBRs 10 Must Reads 2016

HBRs 10 Must Reads 2017

HBRs 10 Must Reads 2018

HBRs 10 Must Reads 2019

HBRs 10 Must Reads 2020

HBRs 10 Must Reads for CEOs

HBRs 10 Must Reads for New Managers

HBRs 10 Must Reads on AI, Analytics, and the New Machine Age

HBRs 10 Must Reads on Boards

HBRs 10 Must Reads on Building a Great Culture

HBRs 10 Must Reads on Business Model Innovation

HBRs 10 Must Reads on Change Management

HBRs 10 Must Reads on Collaboration

HBRs 10 Must Reads on Communication

HBRs 10 Must Reads on Design Thinking

HBRs 10 Must Reads on Diversity

HBRs 10 Must Reads on Emotional Intelligence

HBRs 10 Must Reads on Entrepreneurship and Startups

HBRs 10 Must Reads on Innovation

HBRs 10 Must Reads on Leadership

HBRs 10 Must Reads on Leadership, Vol. 2

HBRs 10 Must Reads on Leadership for Healthcare

HBRs 10 Must Reads on Leadership Lessons from Sports

HBRs 10 Must Reads on Making Smart Decisions

HBRs 10 Must Reads on Managing Across Cultures

HBRs 10 Must Reads on Managing in a Downturn

HBRs 10 Must Reads on Managing People

HBRs 10 Must Reads on Managing People, Vol. 2

HBRs 10 Must Reads on Managing Risk

HBRs 10 Must Reads on Managing Yourself

HBRs 10 Must Reads on Mental Toughness

HBRs 10 Must Reads on Negotiation

HBRs 10 Must Reads on Nonprofits and the Social Sectors

HBRs 10 Must Reads on Public Speaking and Presenting

HBRs 10 Must Reads on Reinventing HR

HBRs 10 Must Reads on Sales

HBRs 10 Must Reads on Strategic Marketing

HBRs 10 Must Reads on Strategy

HBRs 10 Must Reads on Strategy, Vol. 2

HBRs 10 Must Reads on Strategy for Healthcare

HBRs 10 Must Reads on Teams

HBRs 10 Must Reads on Women and Leadership

HBRs 10 Must Reads: The Essentials

HBR Press Quantity Sales Discounts

Harvard Business Review Press titles are available at significant quantity discounts when purchased in bulk for client gifts, sales promotions, and premiums. Special editions, including books with corporate logos, customized covers, and letters from the company or CEO printed in the front matter, as well as excerpts of existing books, can also be created in large quantities for special needs.

For details and discount information for both print and ebook formats, contact .

Copyright 2020 Harvard Business School Publishing Corporation

All rights reserved

No part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted, in any form, or by any means (electronic, mechanical, photocopying, recording, or otherwise), without the prior permission of the publisher. Requests for permission should be directed to , or mailed to Permissions, Harvard Business School Publishing, 60 Harvard Way, Boston, Massachusetts 02163.

First eBook Edition: May 2020

ISBN: 978-1-63369-886-4

eISBN: 978-1-63369-887-1

WHEN TONY HAYWARD BECAME CEO OF BP , in 2007, he vowed to make safety his top priority. Among the new rules he instituted were the requirements that all employees use lids on coffee cups while walking and refrain from texting while driving. Three years later, on Haywards watch, the Deepwater Horizon oil rig exploded in the Gulf of Mexico, causing one of the worst man-made disasters in history. A U.S. investigation commission attributed the disaster to management failures that crippled the ability of individuals involved to identify the risks they faced and to properly evaluate, communicate, and address them.

Haywards story reflects a common problem. Despite all the rhetoric and money invested in it, risk management is too often treated as a compliance issue that can be solved by drawing up lots of rules and making sure that all employees follow them. Many such rules, of course, are sensible and do reduce some risks that could severely damage a company. But rules-based risk management will not diminish either the likelihood or the impact of a disaster such as Deepwater Horizon, just as it did not prevent the failure of many financial institutions during the 20072008 credit crisis.

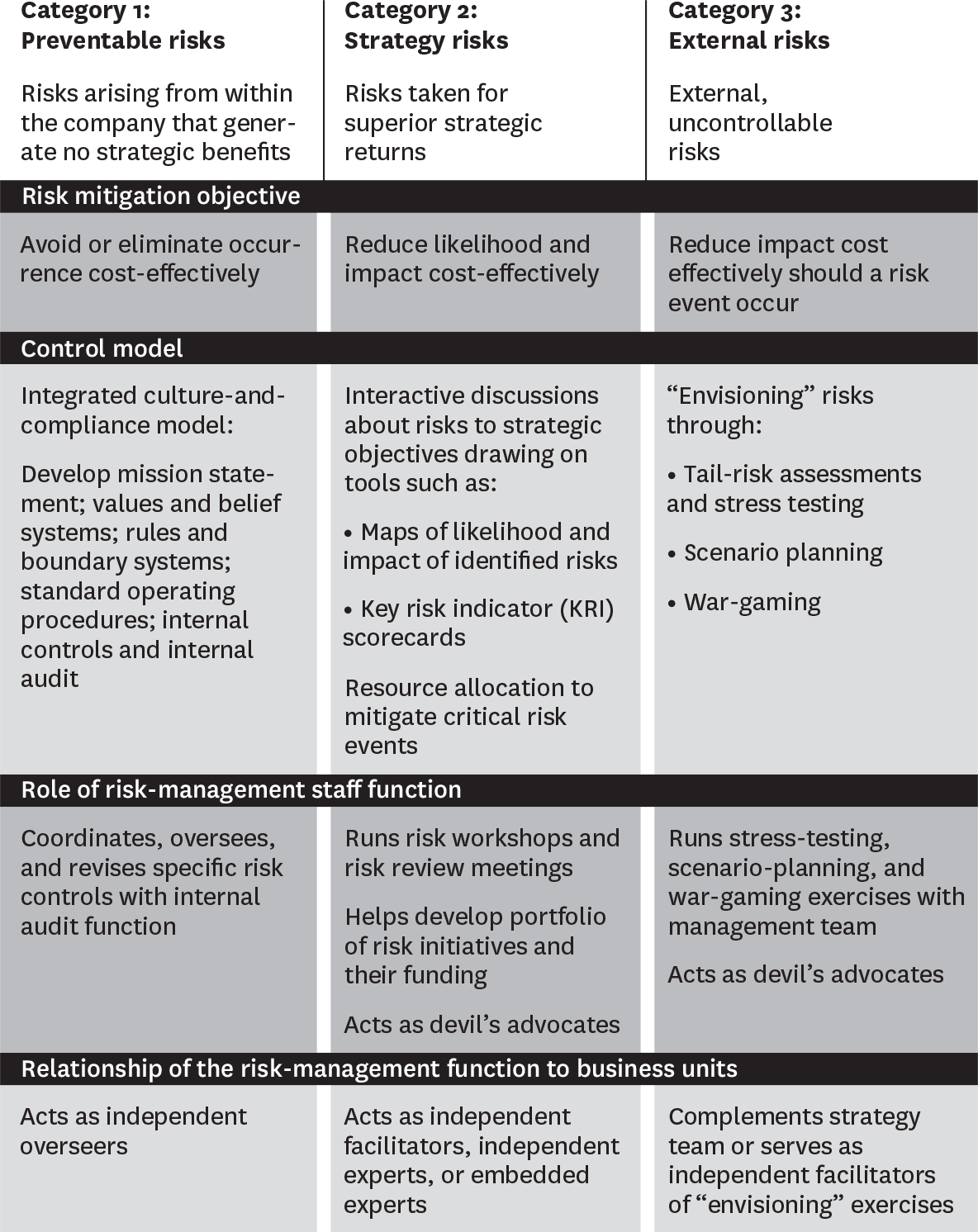

Understanding the three categories of risk

The risks that companies face fall into three categories, each of which requires a different risk-management approach. Preventable risks, arising from within an organization, are monitored and controlled through rules, values, and standard compliance tools. In contrast, strategy risks and external risks require distinct processes that encourage managers to openly discuss risks and find cost-effective ways to reduce the likelihood of risk events or mitigate their consequences.

In this article, we present a new categorization of risk that allows executives to tell which risks can be managed through a rules-based model and which require alternative approaches. We examine the individual and organizational challenges inherent in generating open, constructive discussions about managing the risks related to strategic choices and argue that companies need to anchor these discussions in their strategy formulation and implementation processes. We conclude by looking at how organizations can identify and prepare for nonpreventable risks that arise externally to their strategy and operations.

For all the rhetoric about its importance and the money invested in it, risk management is too often treated as a compliance issue.

A rules-based risk-management system may work well to align values and control employee behavior, but it is unsuitable for managing risks inherent in a companys strategic choices or the risks posed by major disruptions or changes in the external environment. Those types of risk require systems aimed at generating discussion and debate.

For strategy risks, companies must tailor approaches to the scope of the risks involved and their rate of change. Though the risk-management functions may vary from company to company, all such efforts must be anchored in corporate strategic-planning processes.

To manage major external risks outside the companys control, companies can call on tools such as war-gaming and scenario analysis. The choice of approach depends on the immediacy of the potential risks impact and whether it arises from geopolitical, environmental, economic, or competitive changes.

The first step in creating an effective risk-management system is to understand the qualitative distinctions among the types of risks that organizations face. Our field research shows that risks fall into one of three categories. Risk events from any category can be fatal to a companys strategy and even to its survival.

These are internal risks, arising from within the organization, that are controllable and ought to be eliminated or avoided. Examples are the risks from employees and managers unauthorized, illegal, unethical, incorrect, or inappropriate actions and the risks from breakdowns in routine operational processes. To be sure, companies should have a zone of tolerance for defects or errors that would not cause severe damage to the enterprise and for which achieving complete avoidance would be too costly. But in general, companies should seek to eliminate these risks since they get no strategic benefits from taking them on. A rogue trader or an employee bribing a local official may produce some short-term profits for the firm, but over time such actions will diminish the companys value.

Font size:

Interval:

Bookmark:

Similar books «HBRs 10 must reads on managing risk»

Look at similar books to HBRs 10 must reads on managing risk. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book HBRs 10 must reads on managing risk and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.