Anatomy of a Ponzi

Scams Past and Present

Colleen Cross

ANATOMY OF A PONZI

Schemes Past and Present

Colleen Tompkins writing as Colleen Cross

Copyright 2013 by Colleen Cross, Colleen Tompkins

First Smashwords Edition: 2013

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any meanselectronic, mechanical, recording, or otherwisewithout the prior written consent of the copyright holder and publisher. The scanning, uploading and distribution of this book via the Internet or any other means without the permission of the publisher is illegal and punishable by law.

Please purchase only authorized electronic or printed editions, and do not participate in or encourage electronic piracy of copyrighted materials. Your support of the authors rights is appreciated.

ISBN: 978-0-9878835-3-7 Paperback

ISBN: 978-0-9878835-4-4 Ebook

Published by Slice Publishing

Cover art: Streetlight Graphics

Author Photo: Trevor Hallam

For information contact Colleen Cross: http://www.ColleenCross.com

Epigraph

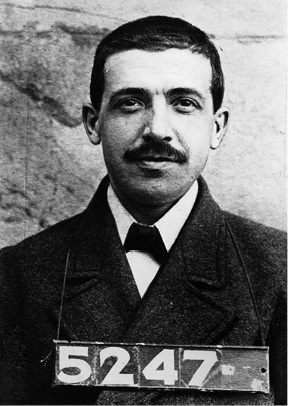

My business was simple. It was the old game of robbing Peter to pay Paul.

Charles Ponzi, (1882-1949)

Books by Colleen Cross

Novels

Katerina Carter Fraud Thriller Series:

Exit Strategy (2011)

Game Theory (2012)

Nonfiction

Anatomy of a Ponzi (2013)

Chapter 1:

The Makings of a Ponzi Scheme

C harles Ponzi wasnt the first Ponzi schemer, though he did lend his catchy name to this age-old fraud. Before Ponzi became a household word, this time-tested swindle went by other names. Shady characters have always practiced the art of deception to enrich themselves at the expense of others.

Since Ponzis scam in 1920, more than one hundred massive Ponzi schemes have been uncovered in the United States alone. That equals more than one per year, counting only the ones where the perpetrators were caught. Those discovered represent the tip of an iceberg in a sea of undetected frauds. Ponzi schemes are now more common than ever and on a financial scale that dwarfs Ponzis $20-million scam.

More than a few large Ponzi schemes are in play right now, operating under the radar and duping ordinary people like you and me. Many have operated unhindered for decades. When the next big one is finally exposed, it will dwarf Bernard Madoffs massive $65-billion fraud of the century. The Ponzi schemes in this book appear complicated at first blush, but they are not. The illusion of complexity is an integral part of the fraud itself. Distill a Ponzi down to its essential ingredients and you will see how surprisingly simple it is to spot one.

Ponzi 101

A Ponzi scheme is a fraudulent investment scheme promising unusually high returns, often over a short period of time. The get-rich-quick promise is so attractive that even conservative investors find it impossible to pass up. Fantastic returns are the hallmark of a Ponzi scheme.

In reality, the profits investors are paid are just a return of their original investment, or the capital of later investors. The scam works as long as new money keeps flowing in. That money can be from new investors, but an integral part of most Ponzi schemes is convincing existing investors to re-invest their proceeds and ideally contribute even more.

Many do, since the Ponzi scheme promises much higher returns than an investor can find anywhere else. This is how otherwise astute investors succumb to greed and put all (or most of) their funds into one investment. More often than not, they lose their lifes savings. Usually the investment is described in vague terms or in jargon too complicated for the average person to fully understand. This is done on purpose. Complexity obfuscates the painful truth: there is no underlying investment.

Charles Ponzi and the other swindlers portrayed in this book were exceptionally talented at obtaining new money from investors (or individuals). They were superb promoters and sealed the deal with lucrative payments, at least at first. Investors saw fantastic returns from their initial investments, far exceeding what they could earn elsewhere. They let their greed sway them into investing more and more money into the scheme.

Before a fraudster can separate you from your money, he or she must build your confidence. A common selling technique of Ponzi schemes is the lure of a practically risk-free investment that pays off over a very short period. Many Ponzi victims are skeptical until they receive the first payment or two of the promised returns. Thats usually enough to convince them of the investments legitimacy. They then reinvest the proceeds and often increase the size of their investment. In order for the schemes to work, there is almost always initial success for the investor. The early payout is the carrot. From that point on, its much easier to dupe the investor into contributing more money.

Think it couldnt happen to you? Bernie Madoffs hedge fund investors never expected to be swindled either. Madoff defrauded seasoned investment professionals, astute managers of family trusts and even other hedge funds, the so-called feeder funds that invested their money into the Madoff fund. Despite their financial sophistication, these experts were captivated by the promise of lucrative returns.

Many charitable organizations were duped into investing with Madoff, including Steven Spielbergs Wunderkinder Foundation. Madoffs victims list reads like a whos who of celebrities. Kevin Bacon, Kyra Sedgwick, Larry King, and even the late John Denvers estate all had a stake in his scheme. Former New York state attorney general Eliot Spitzers family firm was also defrauded.

In the chapters that follow, we will study Madoffs Ponzi scheme and others. Once you know how to spot a Ponzi scheme, you can avoid becoming a victim.

A Ponzi Page from the Middle Ages

Ponzi schemes have occurred in one form or another since bartering began, becoming more sophisticated as the concepts of currency and investing evolved. The age-old con plays out repeatedly on unsuspecting investors today.

You have probably heard the phrase rob Peter to pay Paul. Simply put, the phrase means to take money from one person only to pay a debt owed to another. This phrase has been in use as far back as 1450, and it likely referred to the same ruse. Here is the original phrase from around 1450 when it appeared in Jacobs well: an English Treatise on the cleansing of mans conscience :

To robbe Petyr & geve it Poule, it were non almesse but gret synne.

While today (and todays English) differs from 1450 England, the phrase describes exactly what a Ponzi scheme does. It pays returns to earlier investors with the money from later contributors. The schemer gives you money he claims is your investment profits. And what profits they aremultiples of the best return you could achieve anywhere else.

The investment earnings are a fabrication, a ploy to build trust and convince you to part with even more of your money. As your confidence builds, the fraudster hopes you will increase your investment and convince others to invest too. He uses illusion and psychological tricks to cheat you out of your own money in this old-fashioned confidence game.