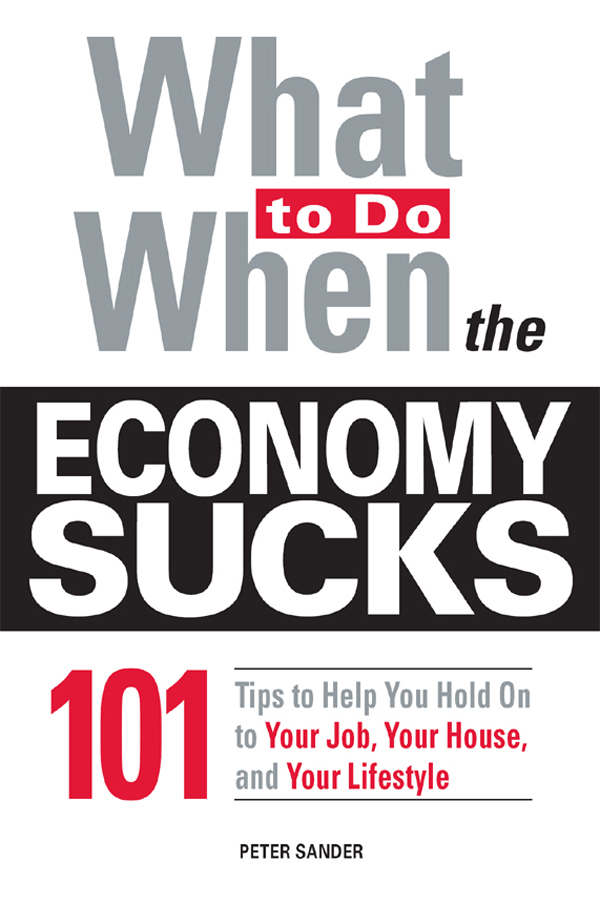

Tips to Help You Hold On

to Your Job, Your House,

and Your Lifestyle!

PETER SANDER

Copyright 2009 by F+W Media, Inc.

All rights reserved.

This book, or parts thereof, may not be reproduced in any

form without permission from the publisher; exceptions are

made for brief excerpts used in published reviews.

Published by Adams Business, an imprint of

Adams Media, a division of F+W Media, Inc.

57 Littlefield Street, Avon, MA 02322. U.S.A.

www.adamsmedia.com

ISBN-10: 1-60550-095-X

ISBN-13: 978-1-60550-095-9

eISBN: 978-1-44051-832-4

Printed in Canada.

J I H G F E D C B A

Library of Congress Cataloging-in-Publication Data

is available from the publisher.

This publication is designed to provide accurate and authoritative information with regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional advice. If legal advice or other expert assistance is required, the services of a competent professional person should be sought.

From a Declaration of Principles jointly adopted by a Committee of the

American Bar Association and a Committee of Publishers and Associations

Many of the designations used by manufacturers and sellers to distinguish their product are claimed as trademarks. Where those designations appear in this book and Adams Media was aware of a trademark claim, the designations have been printed with initial capital letters.

This book is available at quantity discounts for bulk purchases.

For information, please call 1-800-289-0963.

Dedication

I dedicate What to Do When the Economy Sucks to all hardworking individuals and families who have the serenity to accept financial conditions they cannot change, the will to change the things they can, and the wisdom to know the difference. Not surprisingly, this book is designed to help you change the things you can and deal with the rest as best possible.

Acknowledgments

A lot of folks deserve credit as role models, but Id especially like to recognize my parents Jerry and Betty Sander, now deceased, who taught me frugal living at an early age, how to play financial defense (and why!), and how not to sweat the financial small stuff. I should also thank my family, namely Jennifer and boys Julian and Jonathan, for their prudence with money and tolerance for my spending yet another summer writing a book.

Contents

How to play defense in your job, how to become more valuable to your organization in your existing role, how to achieve just a little more and market it more effectively in your organization to immunize yourself from upcoming layoffs.

Hanging on to your job is one thing, finding another within your industry or outside your industry is another matter. How to make yourself more valuable to the broader job market, acquiring new skills, learning new businesses or industries, making yourself visible, using the network, working with recruiters.

Yes, the grass may be greener. Maybe its time for a bigger changetime to work for yourself? This option can make a lot of sense in a downturn, if handled right. How to decide if the entrepreneurship/solopreneurship option is right for you, and how to prepare for it.

How to cope with the change and the transition, what to do next, how to keep your financial and emotional wits about you, what to do, and what not to do.

Losing a home can be one of the hardest things to deal with both financially and emotionally. This chapter gives tips for pulling out all the stops to keep making those mortgage or rent payments on time.

A look at the anatomy and timing of the foreclosure process, who the parties are in the process, and how you can work a deal with them if the cards line up right. Government programs to help those in mortgage trouble are also described.

Sometimes it just doesnt make financial or emotional sense to keep beating your head against a housing-related wall. Tips on how to sell your home and make a sensible relocation decision, how to make the best of a bad situation.

Where does the money go? This chapter explains how to take a hard, objective, and actionable look at what you spend money on and why. The idea being, of course, to learn how, as a family unit, to cut the waste and spend smart.

Everyone hates to budget, but it doesnt have to be so bad. The word budget is usually equated with detail and control, neither of which are very appetizing ideas in family finance. This chapter shows how to make big-picture budgeting work to preserve your lifestyle, and improve it in better economic times.

In a downturn, how you manage debt and use credit will influence your lifestyle more than ever. How to do the right things, avoid common debt problems, improve credit, and recover from a debt crisis.

A bad economy can not only knock a hole in your income, but also your wealth baseyour investments. How to protect your savings and investments, including retirement investments, and how to make the most of your investments in a down economy.

Small defenses might help, but sometimes a bigger solution or readjustment is in order. How to migrate to a less costly lifestyle that is just as fulfillingor even more fulfillingthan before.

Introduction

The headlines wont go away. Anywhere, everywhere, in the paper, on the web, on television news. All grim.

Initial jobless claims were 373,000 last week, far more than economists had expected, and the unemployment rate edged up to the highest level in three years.

Durable goods orders fell 2.5 percent, and factory orders resumed their year-long slump.

Consumer confidence fell to the lowest level in almost 5 years.

The stock market dropped 777 points on fresh worries about the financial sector.

Consumer prices shot up by a record 1.5 percent last month, while housing starts fell to a new 3-year low.

Consumer debt rose last month to the highest level ever.

Foreclosures were up a stunning 33 percent from the same time last year, and show no signs of abating.

Somebody make it stop, please.

If It Walks, Talks, and Acts Like a Duck...

When you hear this sort of news, you know the economy sucks. And now it comes closer to home. Your next-door neighbors car is in the driveway at 9:30 on Tuesday morning. You finally get up the nerve to ask. A pink slip last Friday. Your young childs best friend no longer shows up at the Montessori schoolbecause the parents cant afford it. Your other neighbor just sold his boat at a fire-sale priceneeds the money to get his furnace fixed and pay this winters heating bills.

You feel your businessyour companyslowing down. Less overtime, fewer rosy revenue projections. Nobodys talking about expanding the building or adding a new location. Everyones talking about downsizing. If youre in a public agency, your funding is being cut. Things arent growing anymore or even staying the same. Everything feels slower and smaller.

Your job is probably at risk. Less income, no incomeyikes! Of course, your bills wont get laid off; theyll keep coming. They may even get bigger. Finding a new job costs money, too.