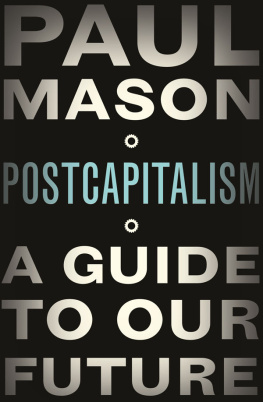

Paul Mason [Mason - PostCapitalism: A Guide to Our Future

Here you can read online Paul Mason [Mason - PostCapitalism: A Guide to Our Future full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2015, publisher: Penguin Books Ltd, genre: Politics. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:PostCapitalism: A Guide to Our Future

- Author:

- Publisher:Penguin Books Ltd

- Genre:

- Year:2015

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

- 60

- 1

- 2

- 3

- 4

- 5

PostCapitalism: A Guide to Our Future: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "PostCapitalism: A Guide to Our Future" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Paul Mason [Mason: author's other books

Who wrote PostCapitalism: A Guide to Our Future? Find out the surname, the name of the author of the book and a list of all author's works by series.

PostCapitalism: A Guide to Our Future — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "PostCapitalism: A Guide to Our Future" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Thanks are due to my editor at Penguin, Thomas Penn, and to copy-editors Shan Vahidy and Bela Cunha. Thanks also to my agent Matthew Hamilton, Andrew Kidd before him and the team at Aitken Alexander. The following people and organizations gave me a platform to present early versions of this work, and interrogated it: Pat Kane at NESTA FutureFest; Mike Haynes at Wolverhampton University; Robert Brenner at the Centre for Social Theory and Comparative History, UCLA; Marianne Maeckelbergh and Brandon Jourdan at the Global Uprisings! Conference in Amsterdam, 2013; and Opera North, Leeds. Thanks specifically to Aaron Bastani, Eleanor Saitta, Quinn Norton, Molly Crabapple, Laurie Penny, Antonis Vradis and Dimitris Dalakoglou, Ewa Jasciewicz, Emma Dowling, Steve Keen, Arthur Bough and Syd Carson of Morson Group, who have contributed to my thinking about the subjects in this book. Thanks also to my editor at Channel 4 News, Ben De Pear, who gave me a months unpaid leave to finish the first draft; to Channel 4 for giving me the headspace to write it; and to Malik Meer, the editor of the Guardians G2, who gave me column inches to try out some of these ideas in print. Finally thanks to my wife, Jane Bruton, without whose support, love and brilliance this book would not be possible.

When Lehman Brothers collapsed, on 15 September 2008, my cameraman made me walk several times through the clutter of limos, satellite trucks, bodyguards and sacked bankers outside its New York HQ, so he could film me amid the chaos.

As I watch those rushes nearly seven years later with the world still reeling from the consequences of that day the question arises: what does that guy in front of the camera know now that he did not know then?

I knew that a recession had begun: Id just trekked across America filming the closure of 600 Starbucks branches. I knew there was stress in the global finance system: Id reported concerns that a major bank was about to go bust six weeks before it happened. I knew the US housing market was destroyed: Id seen homes in Detroit on sale for $8,000 cash. I knew, in addition to all this, that I did not like capitalism.

But I had no idea that capitalism in its present form was about to self-destruct.

The 2008 crash wiped 13 per cent off global production and 20 per cent off global trade. It took global growth negative on a scale where anything below +3 per cent is counted as a recession. In the West, it produced a depression phase longer than in 192933 and even now, amid a pallid recovery, has got mainstream economists terrified about the prospect of long-term stagnation.

But the post-Lehman depression is not the real problem. The real problem is what comes next. And to understand that we have to look beyond the immediate causes of the 2008 crash to their structural roots.

Ultimately, though, we were all flying blind. And thats because there is no model of a neoliberal economic crisis. Even if you dont buy the whole ideology the end of history, the world is flat, friction-free capitalism the basic idea behind the system is that markets correct themselves. The possibility that neoliberalism could collapse under its own contradictions was then, and remains now, unacceptable to most.

Seven years on, the system has been stabilized. By running government debts close to 100 per cent of GDP, and by printing money worth around a sixth of the worlds output, America, Britain, Europe and Japan injected a shot of adrenaline to counteract the seizure. They saved the banks by burying their bad debt; some of it was written off, some assumed as sovereign debt, some buried inside entities made safe simply by central banks staking their credibility on them.

Then, through austerity programmes, they transferred the pain away from people whod invested money stupidly, punishing instead welfare recipients, public sector workers, pensioners and, above all, future generations. In the worst-hit countries, the pension system has been destroyed, the retirement age is being hiked so that those currently leaving university will retire at seventy, and education is being privatized so that graduates will face a lifetime of high debt. Services are being dismantled and infrastructure projects put on hold.

Yet even now many people fail to grasp the true meaning of the word austerity. Austerity is not seven years of spending cuts, as in the UK, or even the social catastrophe inflicted on Greece. Tidjane Thiam, the CEO of Prudential, spelled out the true meaning of austerity at the Davos forum in 2012. Unions are the enemy of young people, he said, and the minimum wage is a machine to destroy jobs. Workers rights and decent wages stand in the way of capitalisms revival and, says the millionaire finance guy without embarrassment, must go.

This is the real austerity project: to drive down wages and living standards in the West for decades, until they meet those of the middle class in China and India on the way up.

Meanwhile, lacking any alternative model, the conditions for another crisis are being assembled. Real wages have fallen or remained stagnant in Japan, the southern Eurozone, the USA and the UK. New rules demanding banks hold more reserves have been watered down and delayed. And the 1 per cent has got richer.

If there is another financial frenzy followed by another collapse, there can be no second bailout. With government debts at a post-war high and welfare systems in some countries crippled, there are no more bullets left in the clip at least not of the kind fired in 200910. The bailout of Cyprus in 2013 was the test bed for what happens if a major bank or a state goes bust again. For savers, everything in the bank over 100,000 was wiped out.

Heres a summary of what Ive learned since the day Lehman died: the next generation will be poorer than this one; the old economic model is broken and cannot revive growth without reviving financial fragility. The markets that day were sending us a message about the future of capitalism but its a message that, at the time, I only partially understood.

In future, we should look for the emoticons, the smileys and digital winks in emails that the finance guys use when they know theyre doing wrong.

Its another drug were on, admits the Lehman executive running the infamous Repo 105 tactic in an email. The tactic involved hiding debts away from Lehmans balance sheet by temporarily selling them and then buying them back once the banks quarterly report had been submitted. Another Lehman exec is asked: is the tactic legal, do

At the ratings agency Standard & Poors, where theyve knowingly mispriced risk, one guy messages another: Lets hope we are all wealthy and retired by the time this house of cards falters, adding the emoticon :O).

Meanwhile, at Goldman Sachs in London, trader Fabrice Tourre jokes:

More and more leverage in the system, the entire system is about to crumble any moment the only potential survivor the fabulous Fab standing in the middle of all these complex, highly levered, exotic trades he created without necessarily understanding all the implications of those monstrosities !!!

As more evidence of criminality and corruption emerges, there is always this knowing informality among bankers as they break the rules. Done, for you big boy, writes one Barclays employee to another as they manipulate LIBOR, the rate at which banks lend to each other, the most important interest rate on the planet.

We should listen carefully to the tone in these emails the irony, the dishonesty, the repeated use of smileys, slang and manic punctuation. It is evidence of systemic self-deception. At the heart of the finance system, which is itself the heart of the neoliberal world, they knew it didnt work.

Font size:

Interval:

Bookmark:

Similar books «PostCapitalism: A Guide to Our Future»

Look at similar books to PostCapitalism: A Guide to Our Future. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book PostCapitalism: A Guide to Our Future and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.