Daniel Crosby [Daniel Crosby] - The Laws of Wealth: Psychology and the secret to investing success

Here you can read online Daniel Crosby [Daniel Crosby] - The Laws of Wealth: Psychology and the secret to investing success full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2016, publisher: Harriman House, genre: Romance novel. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

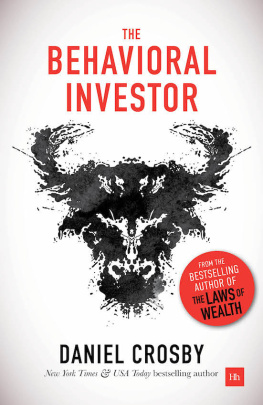

- Book:The Laws of Wealth: Psychology and the secret to investing success

- Author:

- Publisher:Harriman House

- Genre:

- Year:2016

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

The Laws of Wealth: Psychology and the secret to investing success: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "The Laws of Wealth: Psychology and the secret to investing success" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

In The Laws of Wealth, psychologist and behavioral finance expert Daniel Crosby offers an accessible and applied take on a discipline that has long tended toward theory at the expense of the practical. Readers are treated to real, actionable guidance as the promise of behavioral finance is realised and practical applications for everyday investors are delivered.Crosby presents a framework of timeless principles for managing your behavior and your investing process. He begins by outlining ten rules that are the hallmarks of good investor behavior, including Forecasting is for Weathermen and If Youre Excited, Its Probably a Bad Idea. He then goes on to introduce a unique new taxonomy of behavioral investment risk that will enable investors and academics alike to understand behavioral risk in a newly coherent and complete way.From here, attention turns to the four ways in which behavioral risk can be combatted and the five equity selection methods investors should harness to take advantage of behaviorally-induced opportunities in the stock market. Throughout, readers are treated to anecdotes, research and graphics that illustrate the lessons in memorable ways. And in highly valuable What now? summaries at the end of each chapter, Crosby provides clear, concise direction on what investors should think, ask and do to benefit from the behavioral research.Dr. Crosbys training as a clinical psychologist and work as an asset manager provide a unique vantage and result in a book that breaks new ground in behavioral finance. You need to follow the laws of wealth to manage your behavior and improve your investing process!

Daniel Crosby [Daniel Crosby]: author's other books

Who wrote The Laws of Wealth: Psychology and the secret to investing success? Find out the surname, the name of the author of the book and a list of all author's works by series.

![Daniel Crosby [Daniel Crosby] The Laws of Wealth: Psychology and the secret to investing success](/uploads/posts/book/124058/thumbs/daniel-crosby-daniel-crosby-the-laws-of-wealth.jpg)

![Tim Richards [Tim Richards] - Investing Psychology: The Effects of Behavioral Finance on Investment Choice and Bias, + Website](/uploads/posts/book/124122/thumbs/tim-richards-tim-richards-investing-psychology.jpg)