International GAAP 2021: Generally Accepted Accounting Practice under International Financial Reporting Standards

Here you can read online International GAAP 2021: Generally Accepted Accounting Practice under International Financial Reporting Standards full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2020, publisher: John Wiley & Sons, genre: Romance novel. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:International GAAP 2021: Generally Accepted Accounting Practice under International Financial Reporting Standards

- Author:

- Publisher:John Wiley & Sons

- Genre:

- Year:2020

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

- 80

- 1

- 2

- 3

- 4

- 5

International GAAP 2021: Generally Accepted Accounting Practice under International Financial Reporting Standards: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "International GAAP 2021: Generally Accepted Accounting Practice under International Financial Reporting Standards" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

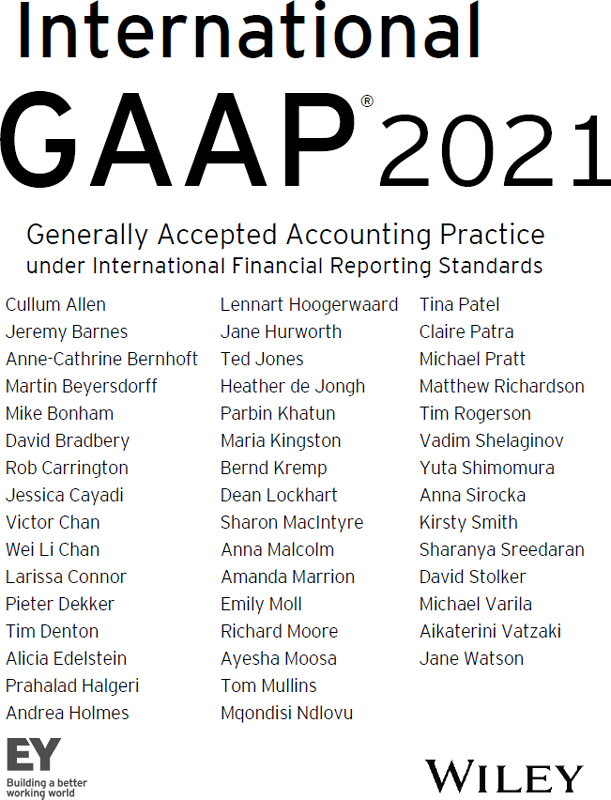

Unknown: author's other books

Who wrote International GAAP 2021: Generally Accepted Accounting Practice under International Financial Reporting Standards? Find out the surname, the name of the author of the book and a list of all author's works by series.

International GAAP 2021: Generally Accepted Accounting Practice under International Financial Reporting Standards — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "International GAAP 2021: Generally Accepted Accounting Practice under International Financial Reporting Standards" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

- Chapter 55

- Chapter 2

- Chapter 6

- Chapter 7

- Chapter 8

- Chapter 10

- Chapter 14

- Chapter 20

- Chapter 23

- Chapter 27

- Chapter 28

- Chapter 29

- Chapter 30

- Chapter 31

- Chapter 32

- Chapter 34

- Chapter 42

- Chapter 43

- Chapter 51

- Chapter 52

- Chapter 53

This edition first published in 2021 by John Wiley & Sons Ltd.

Cover, cover design and content copyright 2021 Ernst & Young LLP.

The United Kingdom firm of Ernst & Young LLP is a member of Ernst & Young Global Limited.

International GAAP is a registered trademark of Ernst & Young LLP.

This publication contains copyright material and trademarks of the IFRS Foundation. All rights reserved. Reproduced by Ernst & Young LLP with the permission of the IFRS Foundation. Reproduction and use rights are strictly limited. For more information about the IFRS Foundation and rights to use its material please visit www.ifrs.org.

Disclaimer: To the extent permitted by applicable law the Board and the IFRS Foundation expressly disclaims all liability howsoever arising from this publication or any translation thereof whether in contract, tort or otherwise (including, but not limited to, liability for any negligent act or omission) to any person in respect of any claims or losses of any nature including direct, indirect, incidental or consequential loss, punitive damages, penalties or costs.

Registered office

John Wiley & Sons Ltd, The Atrium, Southern Gate, Chichester, West Sussex, PO19 8SQ, United Kingdom

For details of our global editorial offices, for customer services and for information about how to apply for permission to reuse the copyright material in this book please see our website at www.wiley.com

The right of the author to be identified as the author of this work has been asserted in accordance with the Copyright, Designs and Patents Act 1988.

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, except as permitted by the UK Copyright, Designs and Patents Act 1988, without the prior permission of the publisher.

Wiley publishes in a variety of print and electronic formats and by print-on-demand. Some material included with standard print versions of this book may not be included in e-books or in print-on-demand. If this book refers to media such as a CD or DVD that is not included in the version you purchased, you may download this material at http://booksupport.wiley.com. For more information about Wiley products, visit www.wiley.com.

Designations used by companies to distinguish their products are often claimed as trademarks. All brand names and product names used in this book are trade names, service marks, trademarks or registered trademarks of their respective owners. The publisher is not associated with any product or vendor mentioned in this book.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. It is sold on the understanding that the publisher is not engaged in rendering professional services and neither the publisher nor the author shall be liable for damages arising herefrom. If professional advice or other expert assistance is required, the services of a competent professional should be sought.

This publication has been carefully prepared, but it necessarily contains information in summary form and is therefore intended for general guidance only, and is not intended to be a substitute for detailed research or the exercise of professional judgement. The publishers, Ernst & Young LLP, Ernst & Young Global Limited or any of its Member Firms or partners or staff can accept no responsibility for loss occasioned to any person acting or refraining from action as a result of any material in this publication. On any specific matter, reference should be made to the appropriate adviser.

ISBN 978-1-119-77243-9 (paperback)

[EY personnel only ISBN 978-1-119-77244-6]

ISBN 978-1-119-77245-3 (ebk)

ISBN 978-1-119-77266-8 (ebk)

A catalogue record for this book is available from the British Library.

About this book

The 2021 edition of International GAAP has been fully revised and updated in order to:

- Provide expanded discussion and practical illustrations on the many implementation issues arising as entities continue to apply IFRS 16 Leases, including those related to recent rent concessions and the associated narrow scope amendment issued by the International Accounting Standards Board (IASB).

- Include an updated chapter on the new insurance contracts standard IFRS 17 Insurance Contracts, which reflects the IASB's recently issued Amendments to IFRS 17, resulting in a number of significant changes as well as many other editorial alterations. The chapter also discusses implementation issues and explores other matters arising as insurers prepare for the adoption of the standard.

- Continue to investigate the many application issues arising as entities apply IFRS 9 Financial Instruments and IFRS 15 Revenue from Contracts with Customers.

- Discuss the IASB's amendments to IFRS 9 and related standards to address the effects of the Interbank Offered Rates (IBOR) reform on financial reporting.

- Illustrate the application of IFRS to the accounting for natural disasters highlighted by the accounting issues related to the recent coronavirus pandemic.

- Discuss the new agenda decisions issued by the IFRS Interpretations Committee since the preparation of the 2020 edition.

- Address the amendments to standards and the many other initiatives that are currently being discussed by the IASB and the potential consequential changes to accounting requirements.

- Provide further insight on the many issues relating to the practical application of IFRS, based on the extensive experience of the book's authors in dealing with current issues.

The book is published in three volumes. The 56 chapters listed on pages xi to xiii are split between the three volumes as follows:

- Volume 1 - ,

- Volume 2 - ,

- Volume 3 - .

Each chapter includes a detailed list of contents and list of illustrative examples.

Each of the three volumes contains the following indexes covering all three volumes:

- an index of extracts from financial statements,

- an index of references to standards and interpretations,

- a general index.

Preface

The IASB noted in its 2018 analysis of the use of IFRS around the world that, other than China, India, Japan and the United States, the vast majority of the 166 jurisdictions they have researched require the use of IFRS for all or most domestic publicly accountable entities (listed companies and financial institutions) in their capital markets. Maintaining the current international alignment of accounting standards requires an ongoing commitment on the part of all jurisdictions involved, but the benefits of IFRS are clear when looking at the way in which the IASB was able to consider the impact of the coronavirus pandemic on financial reporting.

Next pageFont size:

Interval:

Bookmark:

Similar books «International GAAP 2021: Generally Accepted Accounting Practice under International Financial Reporting Standards»

Look at similar books to International GAAP 2021: Generally Accepted Accounting Practice under International Financial Reporting Standards. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book International GAAP 2021: Generally Accepted Accounting Practice under International Financial Reporting Standards and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.