Table of Contents

List of Tables

- Chapter 2

- Chapter 3

- Chapter 4

- Chapter 5

- Chapter 6

- Chapter 7

- Chapter 10

- Chapter 11

- Chapter 12

- Chapter 13

- Chapter 14

- Chapter 15

- Chapter 16

- Chapter 17

- Chapter 18

- Chapter 19

- Chapter 20

- Chapter 21

- Chapter 22

- Chapter 23

List of Illustrations

- Chapter 1

- Chapter 2

- Chapter 3

- Chapter 4

- Chapter 5

- Chapter 6

- Chapter 7

- Chapter 8

- Chapter 9

- Chapter 10

- Chapter 11

- Chapter 12

- Chapter 13

- Chapter 14

- Chapter 15

- Chapter 16

- Chapter 17

- Chapter 18

- Chapter 19

- Chapter 20

- Chapter 21

- Chapter 22

- Chapter 23

Guide

Pages

PRAISE FOR FINANCIAL PLANNING & ANALYSIS AND PERFORMANCE MANAGEMENT

A comprehensive work on FP&A and Performance Management, covering fundamental topics through best practices and advanced topics. Terrific framework for assessing, improving and expanding the contribution of FP&A. The accompany website, with models and analysis introduced in the book, provides substantial additional value to finance teams.

Joseph Hartnett, COO and CFO, EventLink, LLC

Financial Planning & Analysis and Performance Management is a musthave reference manual for FP&A and Investor Relations teams. I found this text extremely helpful, with its useful tools for setting strategy and its practical guides to implementing process improvements and to innovating.

Sally J. Curley, CEO, Curley Global IR, LLC and former Senior Vice President, Investor Relations, Cardinal Health, Inc.

The concepts addressed in this book both challenged and inspired our team to reassess and identify the drivers of value in our enterprise, top to bottom. We are using the examples and suggestions contained throughout the book to develop a single page dashboard that will keep us focused on the key elements of our strategic plan, concentrate on the most relevant metrics, and react quickly to any unexpected deviations and opportunities. This book is a must read and will serve as a great resource for future reference.

Paul McGowan, Jr., CPA, CVA, Global Managing Partner, MDD International LTD.

Using decades of experience as CFO and business consultant, Jack Alexander offers a practical guide to bridge the gap between planning and performance. The tools and models in this book will help leverage corporate assets and create shareholder value.

Jennifer Bethel, Professor, Babson College

Founded in 1807, John Wiley & Sons is the oldest independent publishing company in the United States. With offices in North America, Europe, Australia, and Asia, Wiley is globally committed to developing and marketing print and electronic products and services for our customers' professional and personal knowledge and understanding.

The Wiley Finance series contains books written specifically for finance and investment professionals as well as sophisticated individual investors and their financial advisors. Book topics range from portfolio management to ecommerce, risk management, financial engineering, valuation, and financial instrument analysis, as well as much more.

For a list of available titles, visit our website at www.WileyFinance.com.

FINANCIAL PLANNING & ANALYSIS AND PERFORMANCE MANAGEMENT

Jack Alexander

Copyright 2018 by Jack Alexander. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate percopy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 7508400, fax (978) 6468600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 7486011, fax (201) 7486008, or online at www.wiley.com/go/permissions.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 7622974, outside the United States at (317) 5723993, or fax (317) 5724002.

Wiley publishes in a variety of print and electronic formats and by printondemand. Some material included with standard print versions of this book may not be included in ebooks or in printondemand. If this book refers to media such as a CD or DVD that is not included in the version you purchased, you may download this material at http://booksupport.wiley.com. For more information about Wiley products, visit www.wiley.com.

Library of Congress Cataloging-in-Publication Data is Available

ISBN 9781119491484 (Hardback)

ISBN 9781119491439 (ePDF)

ISBN 9781119491453 (ePub)

Cover Design: Wiley

Cover Image: Lava 4 images | Shutterstock

To my wife Suzanne, for four decades of love, support, and friendship

PREFACE

WHY THIS BOOK?

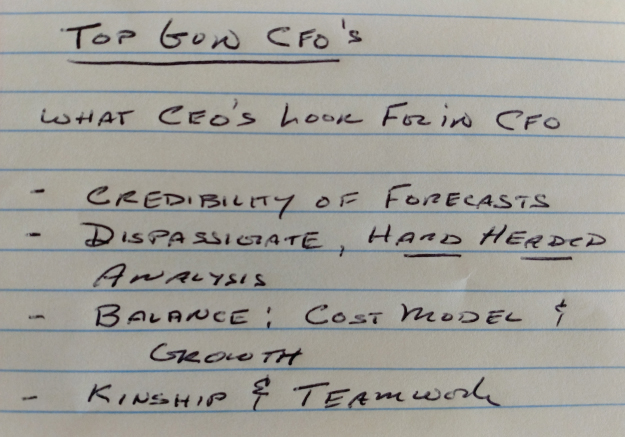

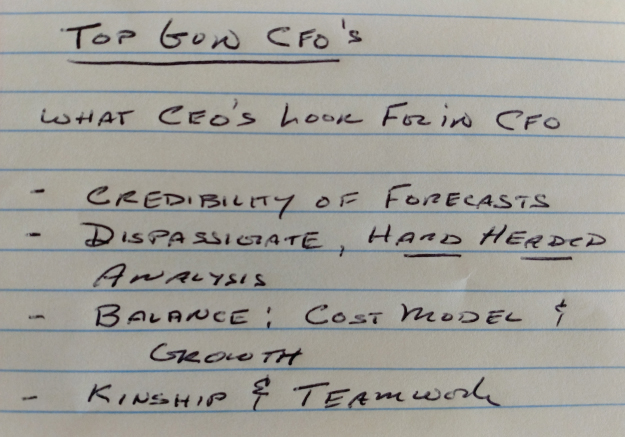

In the late 1970s, as I was starting my career, I came across an article that identified the traits a chief executive officer was looking for in a chief financial officer. Since I had already set my sights on becoming a CFO, I jotted down the key takeaways from the article, something that I developed a habit of doing over my career and continue to this time. Unfortunately, I did not note the article, publication, or CEO to give them credit here or to recognize the soundness of the points articulated in the article. Here is a copy of my notes, that I have retained to this day:

Each of these recommendations has proven to be true in my experience. Of course, this assumes that financial controls and reporting are also well executed. CFOs and finance teams must be able to develop, evaluate, and assist in achieving planned and forecast results. The phrase dispassionate, hard headed analysis struck and stuck with me. Financial planning and analysis (FP&A) must be impartial and objective. Finance teams must be prepared to identify and expose both problems and opportunities, often in a hardheaded way. CFOs and their teams must strike a balance between focusing on the cost model and directly and indirectly contributing to growth. Kinship refers to a trusted adviser and partner relationship with the CEO. And of course, finance must be viewed as a member of the team, supporting and executing to achieve the organization's objectives.

Next page