Clown Publishing

PO Box 1764, North Sydney NSW 2059, Australia

Telephone: (02) 9923 0800 Facsimile: (02) 9923 0888

Email:

www.brettkelly.com.au

Copyright Text (Australia) Brett Kelly

First published January 2020

All rights reserved. Without limiting the rights under copyright recorded above, no part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted, in any form or by any means (electronic, mechanical, photocopying, recording or otherwise), without the prior written permission of both the copyright owner and the publisher of this book.

Every effort has been made by the editors and publisher to trace and acknowledge copyright material. The publisher would be pleased to hear from any copyright holders who have not been acknowledged.

National Library of Australia

Catalogue-in-Publication data:

Author Kelly, Brett, 1974

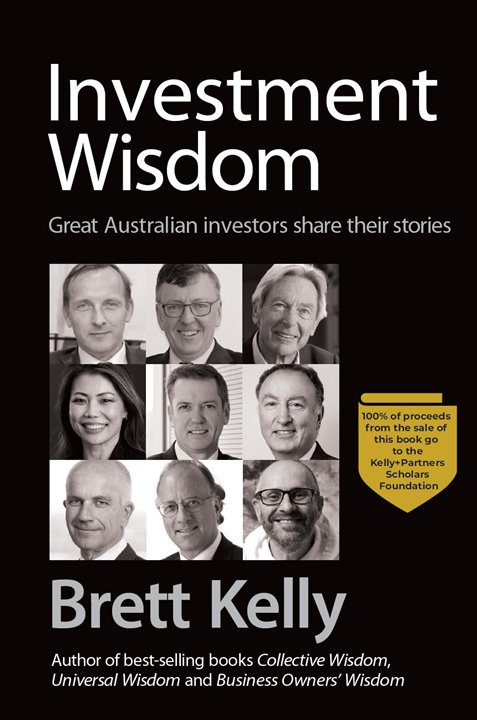

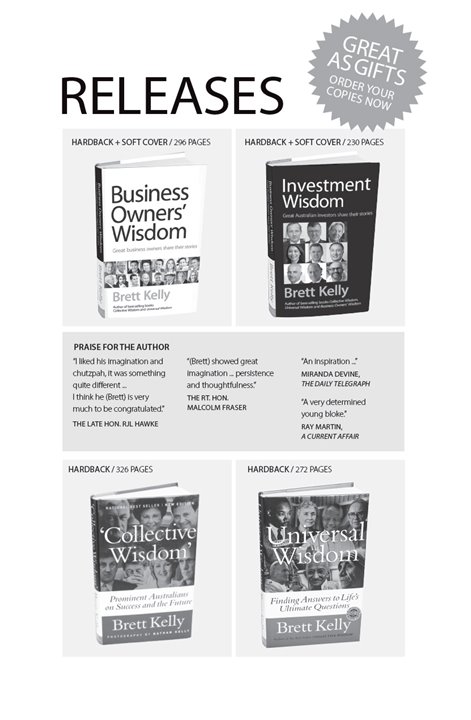

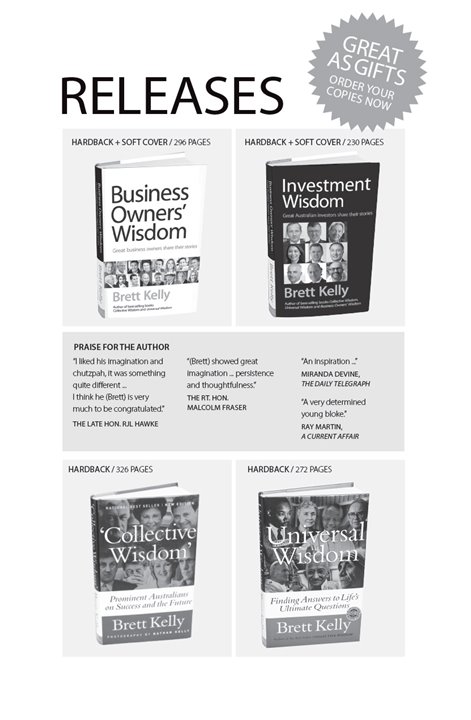

Title Investment Wisdom: Great Australian investors share their stories / Brett Kelly.

ISBN 978-0-9807765-4-6 (hbk.)

ISBN 978-0-9807765-5-3 (pbk.)

ISBN 978-0-9807765-9-1 (eBook)

Series: Investment Wisdom ; No. 1.

Subjects: EntrepreneurshipAustralia.

BusinesspeopleAustralia.

EntrepreneurshipAustraliaAnecdotes.

BusinesspeopleAustraliaAnecdotes.

Dewey Number: 338.04

Editorial Management Primary Ideas

Editor Katarina Kroslakova

Copy-Edito r / Proofreader Ella Martin

Design Aleksandra Beare

Illustrations Aleksandra Beare

Pre-Media Ovato

Printing Toppan Security Printing Pty Ltd, Singapore

10 9 8 7 6 5 4 3 2 1

General Advice Warning

This book may contain general advice. Any general advice provided has been commented without taking into account your objectives, financial situation or needs. Before acting on any advice, you should consider the appropriateness of the advice with regard to your objectives, financial situation and needs.

This book is dedicated to my wife, Rebecca.

Her partnership with me has been focused, patient, long-term and has resulted in life's ultimate investment returns: our love, and our family with three precious children, Thomas, Nicholas and Audrey.

Contents

Kelly+Partners Scholars Foundation

The Mission of the Kelly+Partners Scholars Foundation is to inspire business leadership for the 21st century.

Kelly+Partners Scholars provides scholarships to Year 11 students for a study trip to Israel to understand how innovation and technology can be drivers of positive social impact through business.

The full 100 per cent of proceeds from the sale of Investment Wisdom will be donated to the Kelly+Partners Scholars Foundation with the goal to sell 40,000 copies to raise $2million that will allow 30 students per year for the next 100 years to be provided a scholarship.

Acknowledgements

This book, and the now four books that form a part of a series I commenced in 1998 ( Collective Wisdom, Universal Wisdom, Business Owners' Wisdom and now Investment Wisdom ) has been inspired by the long-running BBC documentary series, Seven Up .

In 2003, determined to remember to always be alive to life and not to be one of those people who wanders unconsciously through life until death grabs them, I decided to emulate the Seven Up series and write a book every seven years. Each book would encompass what had been my focus over the previous seven years, and to an extent, set me up to continue that focus for the next seven years.

I believed this reflection would help me decide actively if I liked where I was and what I was doing.

Here is the current instalment.

I want to thank all the people who have helped with this book. These key people include Gary Chestney, Josh Thomas, Claudia Pan and Katarina Kroslakova and her publishing team.

In particular, my wife Rebecca and our children Thomas, Nicholas and Audrey are the often-unnoticed inspiration for all I do. I love you and want to thank you.

To my mum and dad, teachers and all who have inspired in me my relentless love of learning, thank you.

To my partners, colleagues and clients at Kelly+Partners, we love how we help others. Thank you for believing in our mission of how we can make a difference through our work.

And of course, my thanks also go to the great investment leaders for their generosity of time, spirit and energy when conducting these interviews with me. Without you and your teams, this book wouldnt exist.

Introduction

In my 2005 book, Universal Wisdom , I profiled seven people who had changed the world. One of those people, Warren Buffett, was to have a significant impact on my career. I have been reading about Buffett since 1991, when I was 17 years old. He struck me as not just a man of brilliant ideas but also one who had implemented those ideas with real commitment.

In 1991, Buffett wrote:

John Maynard Keynes, whose brilliance as a practicing investor matched his brilliance in thought, wrote a letter to a business associate, F. C. Scott, on August 15, 1934, that says it all: As time goes on, I get more and more convinced that the right method in investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes. It is a mistake to think that one limits ones risk by spreading too much between enterprises about which one knows little and has no reason for special confidenceOnes knowledge and experience are definitely limited and there are seldom more than two or three enterprises at any given time in which I personally feel myself entitled to put full confidence.