This book is intended to help professionals, especially from functional areas other than finance, such as sales, marketing, human resource, research and development, production, and procurement, to gain an extensive working knowledge of critical financial principles in an easy-to-follow manner, enabling them to make critical business decisions involving cost-savings, budgets, new projects decisions, growth strategies, and so on.

This book introduces you to the key concepts of finance so you can contribute to the success of your business. It will help you understand the language used by accountants and how financial statements fit together. Furthermore, you will understand how to use ratio analysis to get a sense of the companys performance. In addition, you will learn the concepts of management accounting and various kinds of decisions, including make-or-buy, shutdown, and so on. You will gain an understanding of how to implement Budgeting and Working Capital Management. The exciting part is also the chapter on Investment Appraisal, where you will learn how to evaluate business proposals from a return standpoint.

finance for non-finance executives; finance for dummies; financial statements; financial accounting; management accounting; investment appraisal; decision making; costing

Why Accounting Matters for Non-financial Professionals?

Ironically, while money drives us all, a lot of laymen are alienated from financial knowledge not because of intelligence but because of fear.

It is imperative to understand the subject and language of finance if managers are to communicate with authority within a business. After all, finance is the language used in the boardroom.

Accounting is best left to accountants, right? Actually, thats not true. All non-financial professionals stand to benefit from a firm grasp of basic accounting concepts. Being able to back up your business proposals, projects, and ideas with numbers puts you in a stronger position, as does being able to recognize the financial value of your workhow you contribute to the bottom line.

- Can we just do without looking at the financial portion?

- Only if the world operates without money!

Learning to Read Financial Statements

Suppose a friend came to you and asked you to invest in her new business. She has started a website design business and would like more money to buy a new computer. Before you decide if you should invest in her business or not, think about the questions you would want to ask her. What questions did you come up with? Here are a few you might have thought of:

- How much cash does the company already have?

- How much revenue has the company made since it was started? In the past year?

- How much revenue does the company expect to make in the future?

- What has the company spent its cash on in the past?

- Does the company have any debt?

In order to answer these questions, a good place to start would be to look at the companys financial statements. Learning to read financial statements is like learning a new language.

If you want to order a good dish in a French restaurant, you will need to speak French to read the menu. Similarly, with companies, if you want to find a good stock to invest in, you will need to speak the language of finance and read their financial statements. Just like learning any new language, it is difficult at first, but the more you practice, the more fluent you will become!

At the most basic level, financial statements give you information that is predominantly quantitative

- How much it sells and at what cost

- How much cash it generates

- How many assets it has and whether these are owned by banks or shareholders

However, they also provide insight into

- Who owns it and who are the major stakeholders

- How it is organized and who are the key decision makers

- Market share/growth targets

- Level of concern for its employees/community

- What the chairman looks like (!)

So some qualitative data is provided.

And if you look really hard and read between the lines, they may provide

- A window into the companys strategy

- Economics of the industry/competitors

Financial Statements Provide Information about Firms Economic Activities

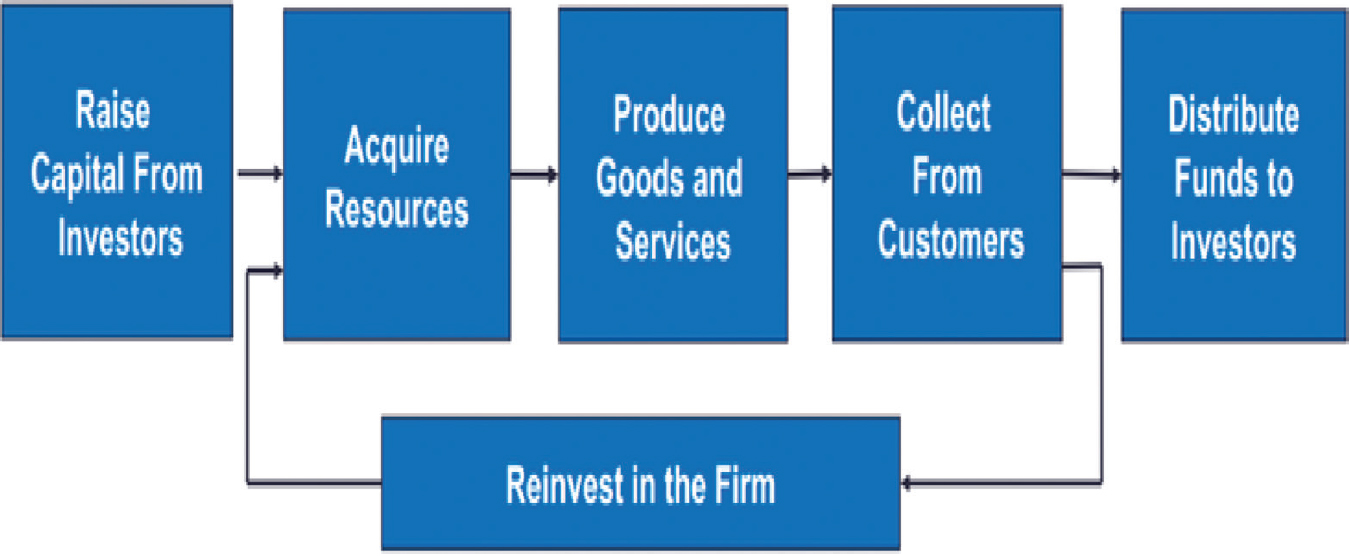

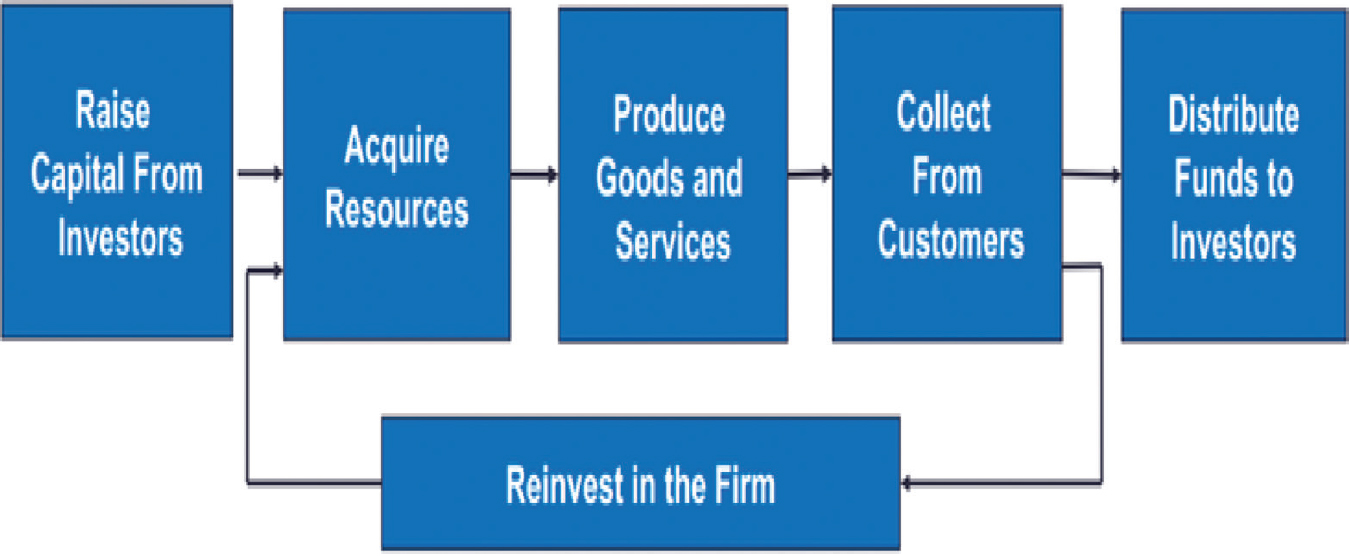

These range from raising funds from investors to running the business operations to generate profit, which is either reinvested in the business or distributed to the investors in the form of dividend ().

Figure 1

Definition of Accounting

- Accounting is a system for recording information about business transactions and events.

- Accounting systems slice the firms life into arbitrary periods (quarters and years). This allows for the generation of more timely information.

- To provide summary statements of a companys financial position and performance to users who require such information.

- There are three key components of financial statements.

- This helps get standardized reports for external stakeholders.

- A major motive is tax accounting in compliance with Internal Revenue Service (IRS) rules for computing taxes payable.

- Managerial accounting uses custom reports for internal decision making.

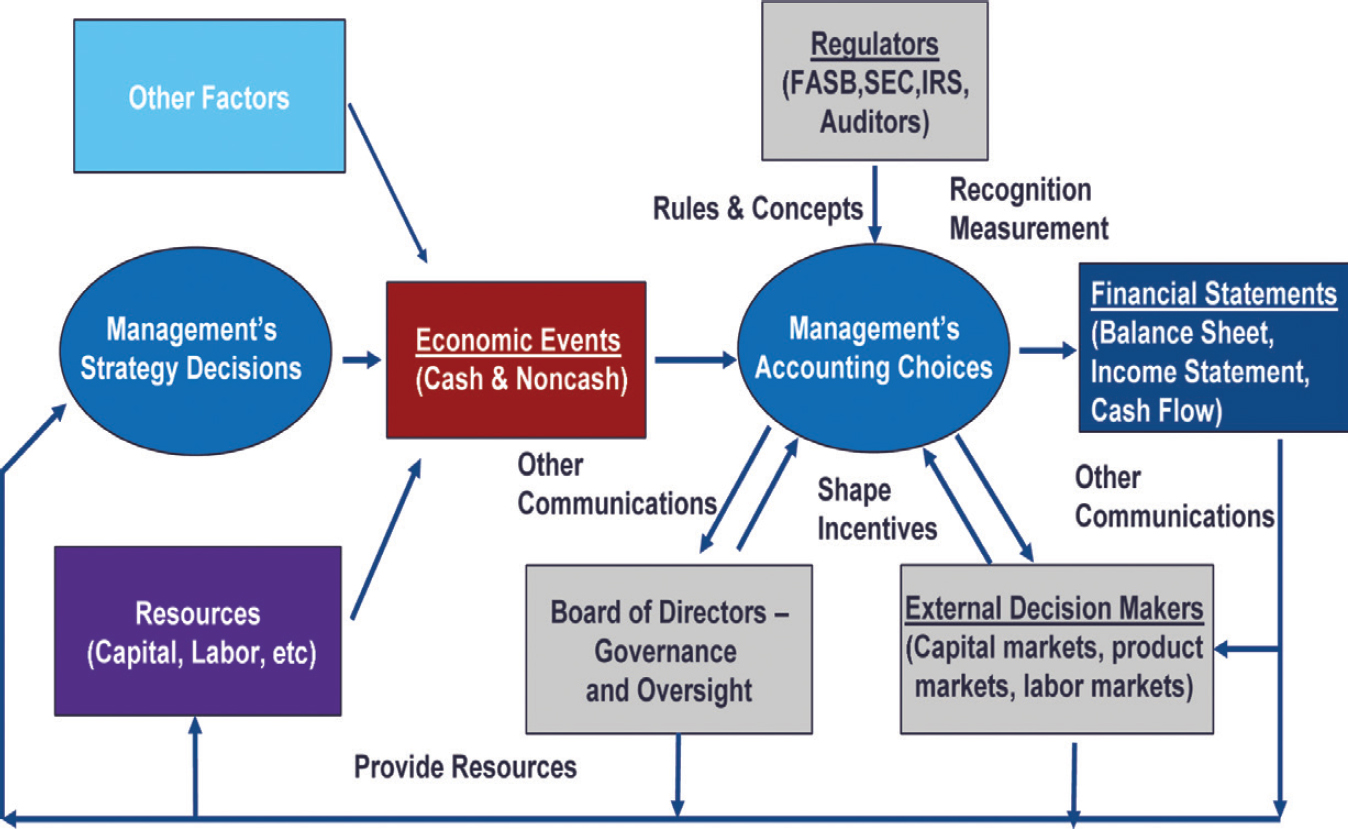

Role of Financial Reporting

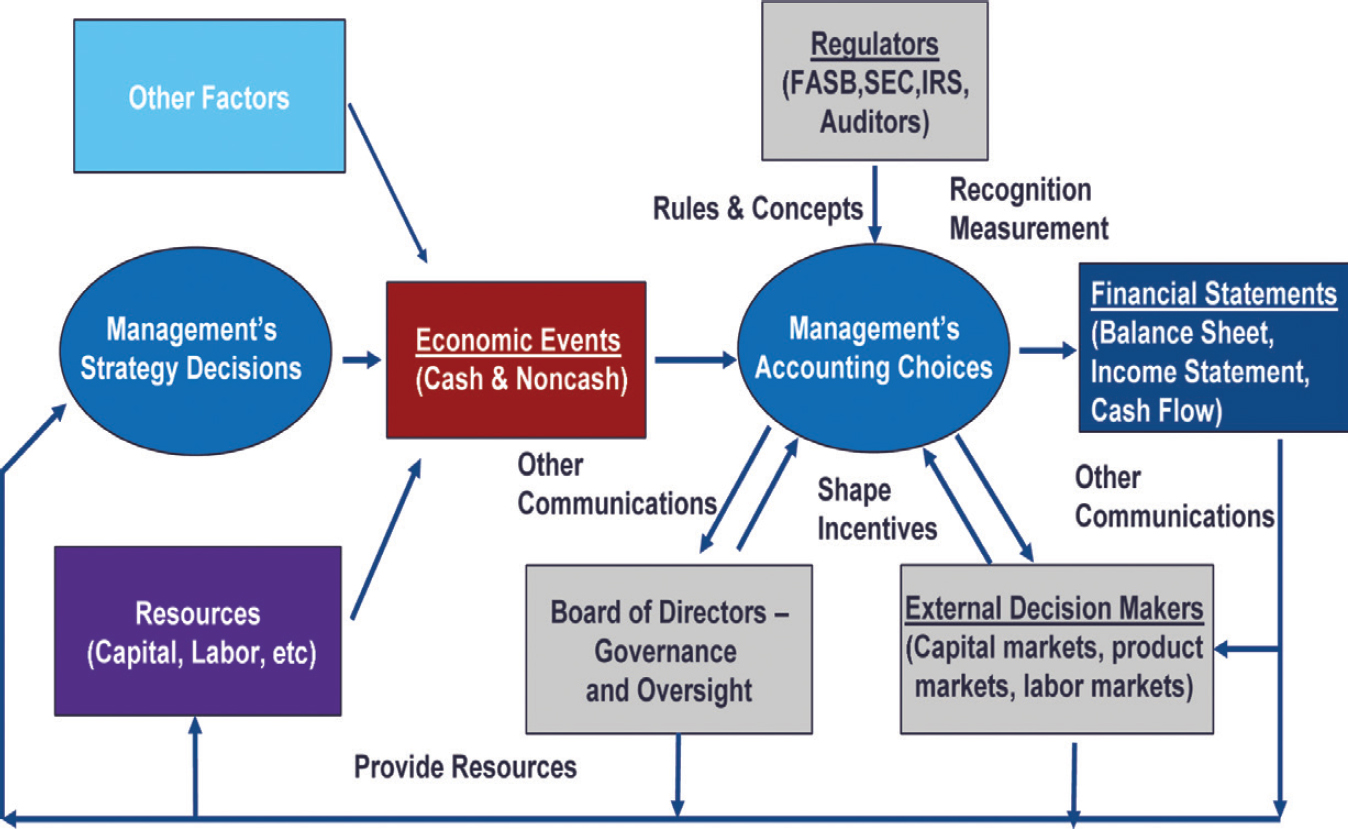

Figure 2

Financial Reporting Requirements

- Each country has its own financial reporting requirements

- In the U.S., The Securities and Exchange Commission (SEC) requires periodic financial statement filings:

- 10-K: Annual report (within 60 days for big firms)

- 10-Q: Quarterly report (within 40 days for big firms)

- 8-K: Current report (material events)

- Proxy, registration, and insider trading statements

- In other countries, firms file semiannual reports instead of quarterly reports