CONTENTS

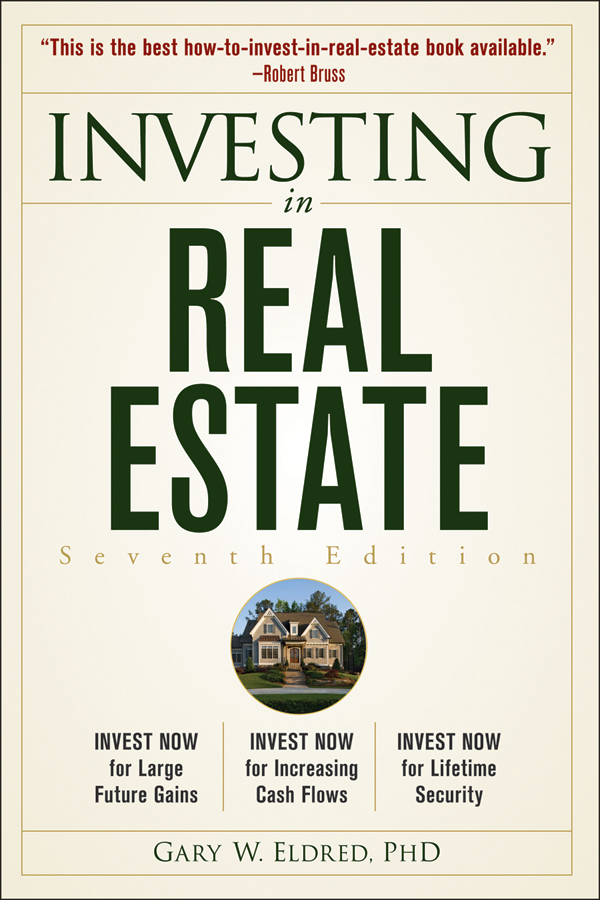

Praise for Gary Eldred

Donald Trump and I have created Trump University to offer the highest quality, success-driven education available. Our one goal is to help professionals build their careers, businesses, and wealth. Thats why we selected Gary Eldred to help us develop our first courses in real estate investing. His books stand out for their knowledge-packed content and success-driven advice.

Michael W. Sexton, CEO Trump University

Gary has established himself as a wise and insightful real estate author. His teachings educate and inspire.

Mark Victor Hansen, Coauthor, Chicken Soup for the Soul

I just finished reading your book, Investing in Real Estate . This is the best real estate investment book that I have read so far. Thanks for sharing your knowledge about real estate investment.

Gwan Kang

I really enjoyed your book, Investing in Real Estate . I believe its one of the most well-written books on real estate investing currently on the market.

Josh Lowry Bellevue, WA President of Lowry Properties

I just purchased about $140 worth of books on real estate and yours is the first one I finished reading because of the high reviews it got. I certainly wasnt let down. Your book has shed light on so many things that I didnt even consider. Your writing style is excellent. Thanks again.

Rick Reumann

I am currently enjoying and learning a lot from your book, Investing in Real Estate . Indeed its a powerful book.

Douglas M. Mutavi

Thanks so much for your valuable book. I read it cover to cover. Im a tough audience, but youve made a fan here. Your writing is coherent, simple, and clean. You are generous to offer the benefits of your years of experience to those starting out in this venture.

Lara Ewing

Copyright 2012 by Gary W. Eldred, PhD. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the web at www.copyright.com . Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions .

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.

Wiley publishes in a variety of print and electronic formats and by print-on-demand. Some material included with standard print versions of this book may not be included in e-books or in print-on-demand. If this book refers to media such as a CD or DVD that is not included in the version you purchased, you may download this material at http://booksupport.wiley.com . For more information about Wiley products, visit www.wiley.com .

Library of Congress Cataloging-in-Publication Data:

Eldred, Gary W.

Investing in real estate / Gary W. Eldred. 7th edition.

pages cm

ISBN 978-1-118-17297-1 (pbk.); ISBN 978-1-118-22696-4 (ebk); ISBN 978-1-118-24002-1 (ebk); ISBN 978-1-118-26460-7 (ebk)

1. Real estate investmentUnited States. I. Title.

HD255.M374 2012

332.6324dc23

2011046343

ACKNOWLEDGMENTS

Many people have contributed directly and indirectly to this 7th edition of Investing in Real Estate . Because of their efforts, this popular classic text on property investing will continue to provide beginning and experienced investors the timely, no-nonsense, practical know-how that has kept this book a bestseller for the past 25 years.

Accordingly, I thank Donald Trump and Michael Sexton for inviting me to work with them to help create some of the best real estate educational products and services available (especially Trump University booksall published by John Wiley & Sons). Working with the Trump team has provided me new perspectives on property investing.

I also express my appreciation to Dr. Malcolm Richards, dean of the School of Business and Management at the American University of Sharjah (AUS). In recognizing the critical need for real estate education in the Middle Eastand the hypergrowth Sharjah/Dubai metroplexDean Richards designed a rewarding position for me from which I have added substantively to my knowledge and analytical abilities as they apply to international property markets. Under Dean Richards, the School of Business and Management of AUS has established itself as the premier school for business education in the Middle Eastand I am pleased to have been able to participate in its development. Also, I thank Dennis Olsen, chair of the Department of Finance at AUS, for the counsel, insights, and collegial support that he has offered to facilitate my work and working environment at AUS.

My valued assistants at AUS, Mohsen Mofid, Faiza Farooq, Omer Shabbir, and Sadaf Ahmad Fasihnia, too, deserve recognition for their cheerful and competent assistance in my writing and teaching. (Alas, all have now graduated and I miss them greatly.)

My best-selling real estate titlesincluding Investing in Real Estate have been translated into foreign languages such as Russian, Indonesian, Vietnamese, and Chinese. Thanks go to the skillful translators of these volumes and to my Asian property advisor Sit Ming (Laura) Lee.

Last, but far from least, I thank my supervising editor Shannon Vargo, senior production editor Deborah Schindlar, and the entire staff at John Wiley & Sons with whom I always enjoy working. This edition of Investing in Real Estate marks the 24th book manuscript that I have written for this 200-year-old company that represents the finest of publishing traditions. I look forward to completing many more.

Gary W. Eldred

Prologue

INVEST IN PROPERTY NOW

Invest in property now. Or forever live with your regrets.

Listen to the wealth-building wisdom of Warren Buffett: Invest when fear, doubt, and uncertainty grip the mind of the crowd; sell when wild hopes and speculative fever burn away reason.

The emotional herding of the crowd allows you and me to buy cheap and sell dear. Think through that wise advice offered by the Sage of Omaha. What type of markets offer the best opportunities for future profits? What type of market alleviates risk? To answer these questions, contrast those boom market conditions of yesteryear with the potential-filled market we experience today: