This edition first published 2018

2018 John Wiley & Sons, Ltd

First edition published 2007, second edition published 2009, third edition published 2011, fourth edition

published 2014, all by John Wiley & Sons, Ltd

Registered office

John Wiley & Sons Ltd, The Atrium, Southern Gate, Chichester, West Sussex, PO19 8SQ, United Kingdom

For details of our global editorial offices, for customer services and for information about how to apply for permission to reuse the copyright material in this book please see our website at www.wiley.com.

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, except as permitted by the UK Copyright, Designs and Patents Act 1988, without the prior permission of the publisher.

Wiley publishes in a variety of print and electronic formats and by print-on-demand. Some material included with standard print versions of this book may not be included in e-books or in print-on-demand. If this book refers to media such as a CD or DVD that is not included in the version you purchased, you may download this material at http://booksupport.wiley.com. For more information about Wiley products, visit www.wiley.com.

Designations used by companies to distinguish their products are often claimed as trademarks. All brand names and product names used in this book are trade names, service marks, trademarks or registered trademarks of their respective owners. The publisher is not associated with any product or vendor mentioned in this book.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. It is sold on the understanding that the publisher is not engaged in rendering professional services and neither the publisher nor the author shall be liable for damages arising herefrom. If professional advice or other expert assistance is required, the services of a competent professional should be sought.

Library of Congress Cataloging-in-Publication Data

Names: Vernimmen, Pierre, author.

Title: Corporate finance: theory and practice/Pierre Vernimmen, Pascal Quiry, Maurizio Dallocchio, Yann Le Fur, Antonio Salvi.

Description: Fifth edition. | Hoboken: Wiley, 2017. | Revised edition of Corporate finance, 2014. | Includes index. |

Identifiers: LCCN 2017030393 (print) | LCCN 2017033170 (ebook) | ISBN 9781119451808 (pdf) | ISBN 9781119424529 (epub) | ISBN 9781119424482 (paperback)

Subjects: LCSH: CorporationsFinance. | Business enterprisesFinance. |

BISAC: BUSINESS & ECONOMICS/Corporate Finance.

Classification: LCC HG4026 (ebook) | LCC HG4026 .V467 2017 (print) | DDC 658.15dc23

LC record available at https://lccn.loc.gov/2017030393

A catalogue record for this book is available from the British Library.

ISBN 978-1-119-42448-2 (paperback) ISBN 978-1-119-45180-8 (ebk)

ISBN 978-1-119-42452-9 (ebk) ISBN 978-1-119-42444-4 (ebk)

Cover design: Wiley

Cover Image: liravega/Shutterstock

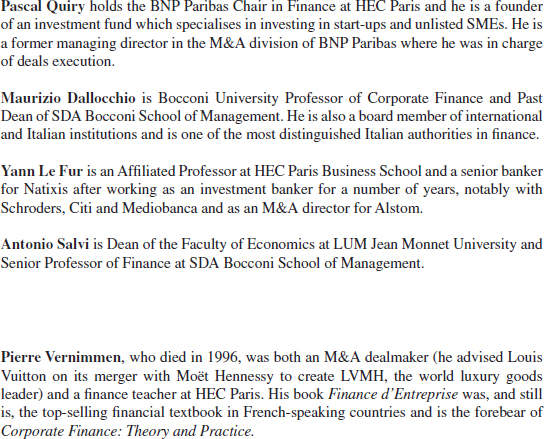

About the Authors

Preface

This book aims to cover the full scope of corporate finance as it is practised today worldwide.

A way of thinking about finance

We are very pleased with the success of the first three editions of the book. It has encouraged us to retain the approach in order to explain corporate finance to students and professionals. There are four key features that distinguish this book from the many other corporate finance textbooks available on the market today:

- Our strong belief that financial analysis is part of corporate finance. Pierre Vernimmen, who was mentor and partner to some of us in the practice of corporate finance, understood very early on that a good financial manager must first be able to analyse a companys economic, financial and strategic situation, and then value it, while at the same time mastering the conceptual underpinnings of all financial decisions.

- Corporate Finance is neither a theoretical textbook nor a practical workbook. It is a book in which theory and practice are constantly set off against each other, in the same way as in our daily practice as investors at Monestier Capital, DGPA and Natixis, as board members of several listed and unlisted companies, and as teachers at HEC Paris and Bocconi business schools.

- Emphasis is placed on concepts intended to give you an understanding of situations, rather than on techniques, which tend to shift and change over time. We confess to believing that the former will still be valid in 20 years time, whereas the latter will, for the most part, be long forgotten!

- Financial concepts are international, but they are much easier to grasp when they are set in a familiar context. We have tried to give examples and statistics from all around the world to illustrate the concepts.

The five sections

This book starts with an introductory chapter reiterating the idea that corporate financiers are the bridge between the economy and the realm of finance. Increasingly, they must play the role of marketing managers and negotiators. Their products are financial securities that represent rights to the firms cash flows. Their customers are bankers and investors. A good financial manager listens to customers and sells them good products at high prices. A good financial manager always thinks in terms of value rather than costs or earnings.

Section I goes over the basics of financial analysis, i.e. understanding the company based on a detailed analysis of its financial statements. We are amazed at the extent to which large numbers of investors neglected this approach during the latest stock-market euphoria. When share prices everywhere are rising, why stick to a rigorous approach? For one thing, to avoid being caught in the crash that inevitably follows.

The return to reason has also returned financial analysis to its rightful place as a cornerstone of economic decision-making. To perform financial analysis, you must first understand the firms basic financial mechanics (Chapters 25). Next you must master the basic techniques of accounting, including accounting principles, consolidation techniques and certain complexities (Chapters 6 and 7), based on international (IFRS) standards now mandatory in over 80 countries, including the EU (for listed companies), Australia, South Africa and accepted by the SEC for US listing. In order to make things easier for the newcomer to finance, we have structured the presentation of financial analysis itself around its guiding principle: in the long run, a company can survive only if it is solvent and creates value for its shareholders. To do so, it must generate wealth (Chapters 9 and 10), invest (Chapter 11), finance its investments (Chapter 12) and generate a sufficient return (Chapter 13). The illustrative financial analysis of the Italian appliance manufacturer Indesit will guide you throughout this section of the book.

Section II

Next page