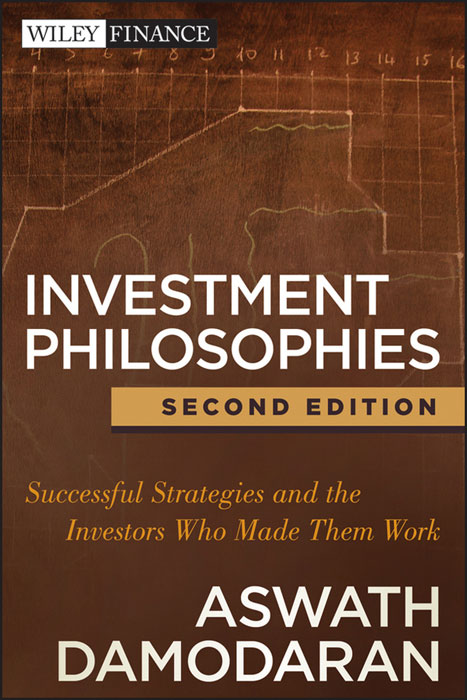

Founded in 1807, John Wiley & Sons is the oldest independent publishing company in the United States. With offices in North America, Europe, Australia, and Asia, Wiley is globally committed to developing and marketing print and electronic products and services for our customers professional and personal knowledge and understanding.

The Wiley Finance series contains books written specifically for finance and investment professionals as well as sophisticated individual investors and their financial advisors. Book topics range from portfolio management to e-commerce, risk management, financial engineering, valuation, and financial instrument analysis, as well as much more.

For a list of available titles, visit our Web site at www.WileyFinance.com .

Copyright 2012 by Aswath Damodaran. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

First Edition Copyright 2003 by John Wiley & Sons, Inc. All rights reserved.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com . Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions .

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may not be available in electronic books. For more information about Wiley products, visit our web site at www.wiley.com .

Library of Congress Cataloging-in-Publication Data:

Damodaran, Aswath.

Investment philosophies : successful strategies and the investors who made them

work / Aswath Damodaran.2nd ed. p. cm.(Wiley finance series)

Includes index.

ISBN 978-1-118-01151-5 (cloth); ISBN 978-1-118-22192-1 (ebk);

ISBN 978-1-118-23561-4 (ebk); ISBN 978-1-118-26049-4 (ebk)

1. Investment analysis. I. Title.

HG4529.D36 2012

332.6dc23

2012005823

CHAPTER 1

Introduction

Who wants to be an average investor? We all dream of beating the market and being super investors, and we spend an inordinate amount of time and resources in this endeavor. Consequently, we are easy prey for the magic bullets and the secret formulas offered by salespeople pushing their wares. In spite of our best efforts, though, most of us fail in our attempts to be more than average. Nonetheless, we keep trying, hoping that we can be more like the investing legendsanother Warren Buffett, George Soros, or Peter Lynch. We read the words written by and about successful investors, hoping to find in them the key to their stock-picking abilities, so that we can replicate them and become like them.

In our search, though, we are whipsawed by contradictions and anomalies. On one corner of the investment town square stands an adviser, yelling to us to buy businesses with solid cash flows and liquid assets because that's what worked for Buffett. On another corner, another investment expert cautions us that this approach worked only in the old world, and that in the new world of technology we have to bet on companies with great growth prospects. On yet another corner stands a silver-tongued salesperson with vivid charts who presents you with evidence of the charts' capacity to get you in and out of markets at exactly the right times. It is not surprising that facing this cacophony of claims and counterclaims we end up more confused than ever.

In this chapter, we present the argument that to be successful with any investment strategy, you have to begin with an investment philosophy that is consistent at its core and matches not only the markets you choose to invest in but your individual characteristics. In other words, the key to success in investing may lie not in knowing what makes others successful but in finding out more about yourself.

WHAT IS AN INVESTMENT PHILOSOPHY?

An investment philosophy is a coherent way of thinking about markets, how they work (and sometimes do not), and the types of mistakes that you believe consistently underlie investor behavior. Why do we need to make assumptions about investor mistakes? As we will argue, most investment strategies are designed to take advantage of errors made by some or all investors in pricing stocks. Those mistakes themselves are driven by far more basic assumptions about human behavior. To provide an illustration, the rational or irrational tendency of human beings to join crowds can result in price momentum: stocks that have gone up the most in the recent past are more likely to go up in the near future. Let us consider, therefore, the ingredients of an investment philosophy.

Human Frailty

Underlying every investment philosophy is a view about human behavior. In fact, one weakness of conventional finance and valuation has been the short shrift given to behavioral quirks. It is not that conventional financial theory assumes that all investors are rational, but that it assumes that irrationalities are random and cancel out. Thus, for every investor who tends to follow the crowd too much (a momentum investor), we assume there is an investor who goes in the opposite direction (a contrarian), and that their push and pull in prices will ultimately result in a rational price. While this may, in fact, be a reasonable assumption for the very long term, it may not be a realistic one for the short term.

Academics and practitioners in finance who have long viewed the rational investor assumption with skepticism have developed a branch of finance called behavioral finance that draws on psychology, sociology, and finance to try to explain both why investors behave the way they do and the consequences for investment strategies. As we go through this book, examining different investment philosophies, we will try at the outset of each philosophy to explore the assumptions about human behavior that represent its base.

Market Efficiency

A closely related second ingredient of an investment philosophy is the view of market efficiency or inefficiency that you need for the philosophy to be a successful one. While all active investment philosophies make the assumption that markets are inefficient, they differ in their views on what parts of the market the inefficiencies are most likely to show up in and how long they will last. Some investment philosophies assume that markets are correct most of the time but that they overreact when new and large pieces of information are released about individual firms: they go up too much on good news and down too much on bad news. Other investment strategies are founded on the belief that markets can make mistakes in the aggregatethe entire market can be undervalued or overvaluedand that some investors (mutual fund managers, for example) are more likely to make these mistakes than others. Still other investment strategies may be based on the assumption that while markets do a good job of pricing stocks where there is a substantial amount of informationfinancial statements, analyst reports, and financial press coveragethey systematically misprice stocks on which such information is not available.