What this book covers

Who this book is for

This book is for investors who have some experience of stock market investing and who want to widen their horizons away from large companies offering little excitement and comparatively modest returns. It opens up a whole new world of great investment opportunities, where potential blockbusters lurk below the radar screens of most investors, including City professionals.

It is assumed that readers have a basic knowledge of what shares are and how the stock market works. You should know, for example, how shares are created, what rights the shareholders in a company have, why share prices rise and fall, and what happens when a takeover bid is launched.

However, you do not need a detailed understanding of a balance sheet or fundamental data to understand the information in this book.

Intermediate and advanced investors, as well as comparative beginners, will benefit from the wealth of information and advice. Similarly, it will appeal to long term investors seeking income and capital growth equally as much as to active traders alert to short term gains.

The book concentrates on stock market investing, although spread betters and traders of contracts for difference will widen their knowledge by reading this book. It should be noted that the new forms of trading tend to be available for only the more liquid, heavily traded stocks, and that usually means larger companies.

Finally, this book is for those investors willing to accept greater risk in exchange for the potential for greater returns and who want advice on how to select small companies that will perform while reducing the downside risk. They do not need to have a large sum to invest but they should have some solid investments in their portfolio and be able to stand any losses they may suffer in the pursuit of higher rewards.

Structure of the book

The book is divided into three parts:

- Part I defines what small companies are, discusses the various reasons why they are small, and considers the special characteristics that distinguish them from their larger counterparts. It looks at the ways in which small companies are traded on the London Stock Exchange.

- Part II gets down to the nitty gritty of analysing and assessing smaller companies, from where to find information to spotting the make or break signs.

- Part III has case studies showing how small companies made the grade or fell short of earlier hopes, with lessons for investors highlighted.

Supporting websites

The accompanying website for this book can be found at:

www.harriman-house.com/smallcompanies

Rodney Hobsons personal website is: www.rodneyhobson.co.uk

Introduction

Dominos Pizza isnt that a downmarket takeaway chain with accident-prone motorcyclists?

Speedy Hire a group of white van men supplying local builders who cant afford their own equipment?

Ten or 20 years ago those impressions might have been valid, but today there is a different side to these companies. Today these companies stand out as fantastic success stories as delighted shareholders will readily testify.

Dominos and Speedy are among many UK companies that started out small but ambitious. Those three dots on the Dominos logo? Thats the number of outlets it started with. Now the total is heading for 500. Speedy Hire was formed when a single outlet in Wigan took over another three in the North West. It now has national coverage with over 500 outlets and is much more than a humble tool hire company.

They are not alone. Two budget airlines that dared to challenge the world are now bigger than many of the entrenched flag carriers doomed to struggle to satisfy national pride. Ryanair and easyJet started small. Look at them now.

Stagecoach was a regional Scottish bus company inching its way forward in what had been a shrinking sector in the age of the motor car ICAP found a tiny niche acting as go-between among brokers in the esoteric world of specialist finance Bloomsbury Publishing put its faith in an unknown author called J. K. Rowling Hornby revived the dying UK toys industry Wolseley transformed itself from being a dying car manufacturer into an international building materials group specialising in plumbing equipment the list goes on and on.

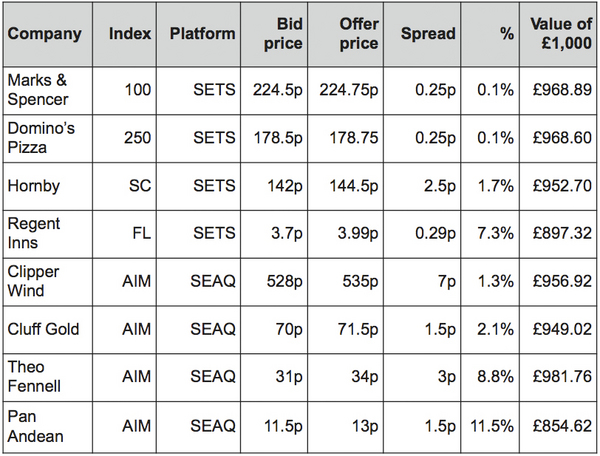

The following table shows the gains that were made investing 1,000 in five small companies on the first trading day of 2001 and selling on the final trading day of 2007. This period has not been selected to inflate the figures. It includes the final two-and-a-quarter years of the last long bear market and the slump in the second half of 2007. In other words, for 40% of the period the stockmarket generally was in freefall.

These are the kind of companies that investors dream of and there are plenty more out there waiting to be discovered if you know what to look for.

It is admittedly easy to look on the companies I have highlighted with the wisdom of hindsight but in each case there were signs along the way that these companies were destined for greater things. Some make excellent case studies in Part III and we shall see that, in broad terms, they had strong management; they focused on growing markets or spotted scope for new products or services; they secured a regular long term stream of income; they expanded steadily and purposefully without over extending themselves; in short, they had a clear strategy.