Augen - Trading Options at Expiration : Strategies and Models for Winning the Endgame

Here you can read online Augen - Trading Options at Expiration : Strategies and Models for Winning the Endgame full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2009, publisher: Prentice Hall, genre: Business. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

Trading Options at Expiration : Strategies and Models for Winning the Endgame: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Trading Options at Expiration : Strategies and Models for Winning the Endgame" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Augen: author's other books

Who wrote Trading Options at Expiration : Strategies and Models for Winning the Endgame? Find out the surname, the name of the author of the book and a list of all author's works by series.

Trading Options at Expiration : Strategies and Models for Winning the Endgame — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Trading Options at Expiration : Strategies and Models for Winning the Endgame" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Strategies and Models for Winning the Endgame

Vice President, Publisher: Tim Moore

Associate Publisher and Director of Marketing: Amy Neidlinger

Executive Editor: Jim Boyd

Editorial Assistants: Myesha Graham, Pamela Boland

Operations Manager: Gina Kanouse

Digital Marketing Manager: Julie Phifer

Publicity Manager: Laura Czaja

Assistant Marketing Manager: Megan Colvin

Cover Designer: Chuti Prasertsith

Managing Editor: Kristy Hart

Project Editor: Betsy Harris

Copy Editor: Keith Cline

Proofreader: Kathy Ruiz

Indexer: Erika Millen

Compositor: TnT Design

Manufacturing Buyer: Dan Uhrig

2009 by Pearson Education, Inc.

Publishing as FT Press

Upper Saddle River, New Jersey 07458

This book is sold with the understanding that neither the author nor the publisher is engaged in rendering legal, accounting or other professional services or advice by publishing this book. Each individual situation is unique. Thus, if legal or financial advice or other expert assistance is required in a specific situation, the services of a competent professional should be sought to ensure that the situation has been evaluated carefully and appropriately. The author and the publisher disclaim any liability, loss, or risk resulting directly or indirectly, from the use or application of any of the contents of this book.

FT Press offers excellent discounts on this book when ordered in quantity for bulk purchases or special sales. For more information, please contact U.S. Corporate and Government Sales, 1-800-382-3419, .

Company and product names mentioned herein are the trademarks or registered trademarks of their respective owners.

All rights reserved. No part of this book may be reproduced, in any form or by any means, without permission in writing from the publisher.

Printed in the United States of America

First Printing March 2009

ISBN-10: 0-13-505872-4

ISBN-13: 978-0-13-505872-5

Pearson Education LTD.

Pearson Education Australia PTY, Limited.

Pearson Education Singapore, Pte. Ltd.

Pearson Education North Asia, Ltd.

Pearson Education Canada, Ltd.

Pearson Educatin de Mexico, S.A. de C.V.

Pearson EducationJapan

Pearson Education Malaysia, Pte. Ltd.

Library of Congress Cataloging-in-Publication Data

Augen, Jeffrey.

Trading options at expiration : strategies and models for winning the endgame / Jeff

Augen.

p. cm.

ISBN 0-13-505872-4 (hardback : alk. paper) 1. Options (Finance) 2. Investment

analysis. 3. SecuritiesPrices. 4. Stock price forecasting. I. Title.

HG6024.A3A9226 2009

332.63'2283dc22

2008051445

To Lisathe most independent person I knowwho taught me never to rely on anyone for anything. I only made it this far because of you.

Id like to thank everyone who helped turn some good ideas and a few words on paper into a complete book. Foremost is Jim Boyd who first had the idea of a single-topic options trading book. The work would never have taken form without Jims input.

Authors write words and make charts, but finished books are created by project editors. Once again it has been my pleasure to work with Betsy Harris who created a publication-quality document from a rough draft. In that regard I would also like to thank Keith Cline who patiently edited the original text.

Authors rarely step back and take an objective look at their own work. That task fell to Robert Balon and Michael Thomsett, who read every word and contributed valuable ideas. Their comments and enthusiasm for the material gave me confidence that helped shape the presentation.

Finally, I would like to acknowledge the excellent work of the Pearson marketing team and especially Julie Phifer, who always seems willing to put real thought behind new book concepts.

Writing this book and working with a team of focused professionals has been a real privilege. Our goal has been to produce a true source of value creation for the investment community in these turbulent times.

Jeff Augen, currently a private investor and writer, has spent over a decade building a unique intellectual property portfolio of databases, algorithms, and associated software for technical analysis of derivatives prices. His work, which includes more than a million lines of computer code, is particularly focused on the identification of subtle anomalies and price distortions.

Augen has a 25-year history in information technology. As a cofounding executive of IBMs Life Sciences Computing business, he defined a growth strategy that resulted in $1.2 billion of new revenue and managed a large portfolio of venture capital investments. From 2002 to 2005, Augen was President and CEO of TurboWorx Inc., a technical computing software company founded by the chairman of the Department of Computer Science at Yale University. He is the author of three previous books: The Option Traders Workbook (FT Press 2008), The Volatility Edge in Options Trading (FT Press 2008) and Bioinformatics in the Post-Genomic Era (Addison-Wesley 2005).

Much of his current work on option pricing is built around algorithms for predicting molecular structures that he developed many years ago as a graduate student in biochemistry.

This book was written during one of the most turbulent times in stock market historythe second half of 2008. During this time frame, trillions of dollars were lost by both bulls and bears as the worlds financial markets melted down. Investors who have never experienced a crashing market often believe that it is easy to generate profits in this environment with short positions. Unfortunately, nothing is ever that simple. The 2008 collapse included single-day bear market rallies as large as 11%large enough to destroy nearly any short position. The answer lies in reducing market exposure and trading only when it makes sense.

Far too many investors have taken the opposite approach by remaining in the market with a portfolio of investments whether they were winning or losing. This approach has its own familiar vocabulary built around terms such as value investing and diversification. It hasnt worked well for most investors. At the time of this writing, U.S. equity markets had just plunged to their 1997 levels, erasing 11 years of gains. Subtracting an additional 30% for inflation and dollar devaluation paints an even darker, but more realistic picture. As a group, long-term stock investors collectively lost an enormous amount of moneytrillions of dollars.

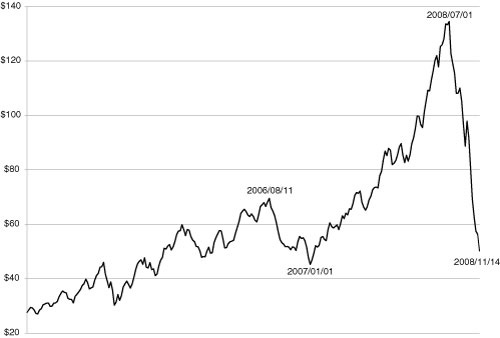

Commodity traders faced similar problems. Oil prices climbed steeply from $27 in January 2004 to $134 in July 2008 before falling back to $50 in November. Long-term bulls actually suffered two significant setbacks during this time frame because the price fluctuated from an interim high of $70 in August 2006 to a low of $45 just five months later. traces the price from January 2004 through the November 2008 decline.

Figure I.1 Weekly U.S. spot price for crude oil 2004/01/02 to 2008/11/14. Price is displayed on the y-axis, key dates are noted on the chart. Source: U.S. Department of Energy, Energy Information Agency, www.eia.doe.gov.

As always, timing is everything. But the more important lesson is that blindly hanging on with a bullish or bearish view is a flawed strategy. Every investment has a window of opportunity; unless that window can be identified, leaving the money invested is somewhat like gambling. That said, the window can be relatively longsometimes spanning months or years.

Font size:

Interval:

Bookmark:

Similar books «Trading Options at Expiration : Strategies and Models for Winning the Endgame»

Look at similar books to Trading Options at Expiration : Strategies and Models for Winning the Endgame. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Trading Options at Expiration : Strategies and Models for Winning the Endgame and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.