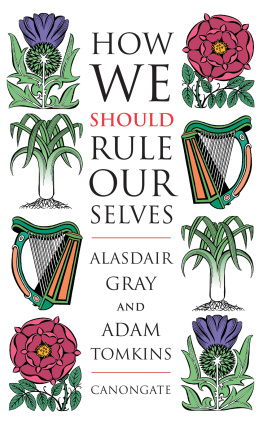

Alasdair Nairn - Engines That Move Markets

Here you can read online Alasdair Nairn - Engines That Move Markets full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. genre: Business. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Engines That Move Markets

- Author:

- Genre:

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

- 100

- 1

- 2

- 3

- 4

- 5

Engines That Move Markets: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Engines That Move Markets" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Engines That Move Markets — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Engines That Move Markets" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Technology Investing from Railroads to the Internet and Beyond

Second Edition

The four most expensive words in the English language are This time its different.

Sir John Templeton

For Siobhan, Hannah, Alexandra and Lochlann

Entering into a venture such as researching and writing this book while in full-time employment was not something that I did lightly. I took the decision at the height of the Internet bubble of 19992000. The driving force behind it was the frustration I felt in respect of what was happening in global stock markets at the time and the dangers this was likely to present for investors. In all likelihood the frustration I felt with stock market gyrations was soon matched by that of my family as I disappeared off to work on the book. For nearly 18 months I was posted missing and without doubt I owe a large debt of gratitude to my wife for putting up with me for this period. Nearly 20 years later, for this and many other reasons, the debt of gratitude has only grown.

The book itself could not have been written without the assistance of an individual with an ability to unearth information that is simply unrivalled. Murray Scott gave up much of his spare time to help me gather the historic financial information and put it in a useable form. It is difficult to give a flavour of just how much information had to be collected suffice to say that it reached the ceiling of the room in which it was stored. What Murray was able to find was incredible and testament to his tenacity in chasing down information. In this he was aided by an outside world of librarians and archivists who typically provided enthusiastic support in the search for lost or forgotten documents. You are a wonderful group of people thank you.

I would also to thank those who looked at various manuscripts, including Gordon Milne and in particular Jonathan Davis, who has edited, corrected and improved many versions of the text, including this second updated edition. The pair of us have since collaborated on a second book, Templetons Way With Money , and a third is now in preparation. The fact that we are still working together after all this effort is a wondrous thing and a testament to the pleasures of collaboration.

I would like to extend my heartfelt thanks finally to Myles Hunt and Christopher Parker of Harriman House who, together with other unheralded colleagues, have shepherded this new edition into print with consummate patience and skill.

Founder of the Templeton Investment mutual funds and of the Templeton charity foundations

There has never been a better time to be alive than today and we should count our blessings for this good fortune. I remain optimistic as to how the future will unfold but that does not mean that one should not be careful when making investments. The river of good fortune may be flowing in our direction but we must plot a careful course through the rapids that threaten to upturn our boat. We must remain patient, flexible in our outlook and always aware that eventually all securities and assets will be priced according to their future earnings.

The impact of expectations underpinned by emotion adds up to a trend on stock markets. Those who attest to the singular nature of our current bull market or, for that matter, any bull market really ought to know better. The lessons of history are very clear in this regard. All bull markets come to an end, typically when people are most optimistic about the future, and they are followed by bear markets which similarly reach their conclusion when sentiment is at its most negative.

As George Santayana said, those who do not remember the past are condemned to repeat it. In this important new book, Sandy Nairn, my friend and former colleague, looks at old technologies when they were new, in order to see how they were received at the time and how events unfolded as the technology was deployed. The aim is to try and set what is happening today in the context of previous technological breakthroughs. What is unique about this book is that he has extensively researched global archives to find out what the press actually said at the time and how share prices responded. Many new technologies changed the way we live. Whether it was the railroads which opened up the Great Plains of America and helped change an emerging nation into the worlds greatest economic power in 50 years by revolutionising the transportation of goods and people; whether it was the telephone which changed communication forever; or whether it was the computer that created whole new industries they all shared common characteristics. It is these common characteristics which Sandy has tried to highlight and place in the context of the time.

Like myself, Sandy is an investor who believes that investing in the stock market is an activity that calls for great patience and fortitude. To make superior returns the investor has to be prepared to act against the consensus and invest when sentiment is extremely negative, or, as I prefer to call it, at the point of maximum pessimism. Likewise, he must be prepared to sell when the levels of optimism are excessive.

In recent times it has become apparent that many prices for stocks have been pulled along by the increasing optimism of the longest bull market in post-war history, to the extent that their market prices are far in excess of their intrinsic worth. Hopefully the reader will understand this better by reading through the examples in this book.

Three years ago, Sandy cast around for research on the duration and magnitude of global bull and bear markets. He was surprised to find that in spite of the huge volume of investment literature, such research was not readily available. Undaunted, Sandy set about constructing his own study. The results confirmed what many value investors already knew. First, it is better to be in the market than out over the long-term, world stock markets rise. Secondly, although on average a bull market is four times greater than bear markets, there is no set pattern that allows simple prediction of when a bull market will end.

The genesis of the book lay in Sandys desire to see what lessons could be learned from history not just the statistics, but also the prevailing social attitudes. He has sifted through the archives in a bid to capture the atmosphere surrounding each new stock market boom. What were the common aspirations in early 19th-century England, or late 19th-century America? What investment opportunities generated enthusiasm?

Placing these historical market movements in context is important. It is helpful to remember that a market index is no more than the aggregate changes in prices of shares that comprise it. In order to come to an understanding of the intrinsic value of a security, the value investors main areas of focus should be estimated future earnings and the environment in which these companies are operating.

Hence, this book an examination of the technological change in the context of the time. Sandy focuses on a number of economic milestones electric light, the railroad, oil, the automobile, the telephone, the radio, the semiconductor, all of which have changed our world. In itself, the text would be engrossing enough. Sandy examines the ingenuity of the entrepreneurs of bygone years how they struggled to develop their products and markets.

Font size:

Interval:

Bookmark:

Similar books «Engines That Move Markets»

Look at similar books to Engines That Move Markets. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Engines That Move Markets and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.