the things

we have learned

in sales

Copyright 2018 by Jacco van der Kooij and Fernando Pizarro

All rights reserved. This book or any portion thereof may not be reproduced or used in any manner whatsoever without the express written permission of the publisher, except for the use of brief quotations in a book review.

Published in the United States of America

First Printing, June 2015

Second Edition, June 2017

ISBN: 978-1-387-02732-3

Winning By Design

San Francisco, California

United States of America

www.WinningByDesign.com

The third edition of Blueprints for a SaaS Sales Organization puts the work of building a high functioning, efficient sales organization into the context of The SaaS Sales Method.

The lessons contained in this book are the aggregated learning from years spent building sales teams for high-growth SaaS start-ups. As sales leaders and consultants in this constantly changing space, we have seen firsthand the effects of building sales teams correctly, which leads to explosive growth, and incorrectly, which almost always leads to an existential crisis.

What we noticed is that the companies that do it right are doing a few things consistently. We have reduced those best practices to a system which we believe sales leaders can implement. The blueprints presented in this book form the basis for that system and for all the work we do to scalably grow revenue. We hope they can do the same for you.

That said, this book is more relevant to some businesses than others. In particular, our blueprints cannot be applied to help you find out your business model, or align it with a recurring revenue business The lessons contained in this book can only be applied when you are ready to scale your SaaS business. How do you know if you are ready to scale? Read on.

As consultants, our prototypical client meets all of the above criteria. In the shorthand of capital raises, this book is most pertinent to your company if you are post-A round. That is because it is normal for you to still be tinkering with your sales model at A.

In this context, this book lays out step-by-step instructions to build a scalable, customer-centric sales organization based on The SaaS Sales Method that will help you develop the revenue stream needed to achieve your hopes and dreams.

To be notified of new books on technology and business by Fernando Pizarro please visit www.fernandopizarro.com

Jacco Van Der Kooij

Fernando Pizarro

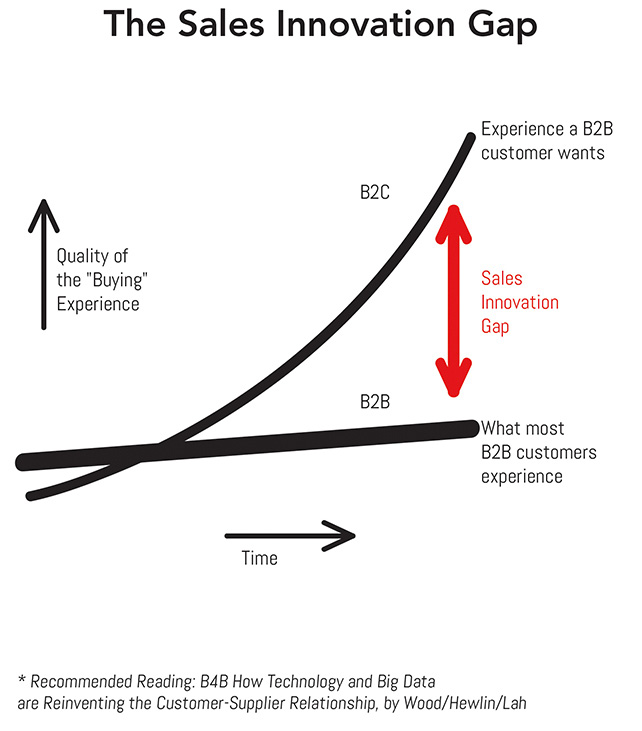

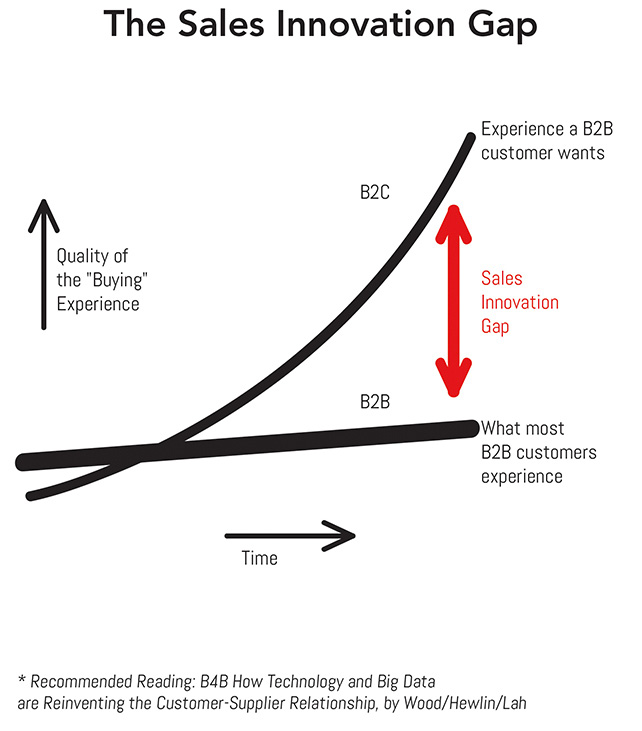

In TSSM we identified changing buyer characteristics as a major driver for a changed sales environment. One of the biggest changes was in customer expectations, which we call the innovation gap.

The problem is that the way we sell in B2B has made little progress since the early 1900s. As outlined in the book B4B*, there may have been several changes in activities from the days of solution selling, and many new tools, but no significant change in the approach and the methodology.

All of us are B2C customers, and today we use that as the point of reference for a great sales experience. This B2C experience provides instant pricing, peer references, access to online support, and the ability to make a purchase decision without talking to anyone. Try CustomInk.com or Amazon.com and youll see what we mean.

Fast-moving markets force B2B customers to look for the same experience, only to find that most B2B providers have a very poor sales experience. There is a big gap between the buyers expectations and what they actually experience. This gap is not only big it seems to be growing.

Do not misunderstand us; great tools are entering the market, from email tracking to work-flow management tools and more, all in an attempt to close the gap.

But you cant close that gap by building a 10-story apartment complex on a foundation designed for a single car garage. You need a blueprint that you can work from. A blueprint based on best practices from others that went before you. Because, in a business environment that is moving ever faster, you are most likely to only get one shot at it.

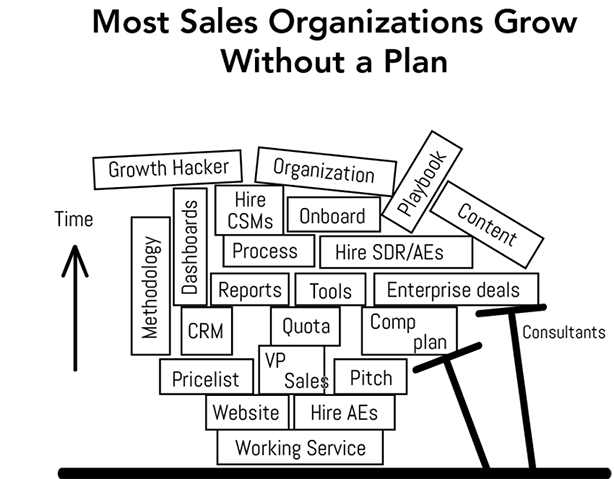

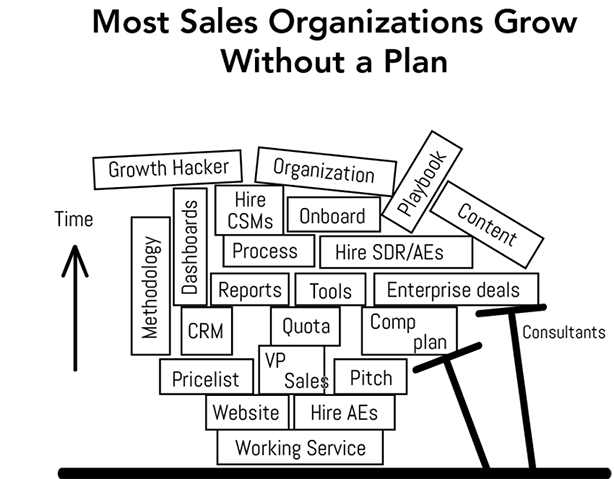

TSSM is based on applying fundamental skills across all the Moments That Matter (MTMs) to customers. Doing that is not possible when done in an ad how way. Almost all our clients face this issue: they do not build their teams with process to scale. Instead, they follow a predictable pattern which has been summarized into an industry truism that it takes at least two if not three Sales VPs to get things right.

The first VP takes three to six months to hire. He buys tools on an ad hoc basis to fit the budget. He establishes a once-a-year training program that includes lead development, closing, and negotiation skills. Staff turnover begins because quotas go unmet. Belatedly, he attempts to deploy processes too late.

The second VP is hired from a process-heavy larger company in order to build scalability. A former Oracle, IBM or Salesforce executive, this executive implements tools and systems that were popular four years ago, but she at least begins to refocus the company on inbound sales. Revenue still lags.

The third VP gets rid of most of the process and focuses on sales performance. At this point the service has matured, and he is able to overspend on top sales people. Revenue starts to flow but in a non-scalable way because it relies on individuals. It takes 2-3 rounds of funding or more to find the right balance between a sales focus and a process focus.

In January/February of every year there is a tsunami of Sales VPs working for SaaS companies who change jobs due to this common turn of events.

This rotation of sales leadership takes anywhere from 2-5 years per company and as a result, many companies miss their window for explosive growth. They are simply not fast or responsive enough. Lack of design at the outset requires that they constantly build, test, and rebuild until they get it right. Our blueprints are the solution to getting things right from the start.

At the same time, the old guard of the sales profession have a consultative skill set aimed at selling solutions. Many of these skills no longer apply to the SaaS paradigm in which volumes are up, transaction sizes are down, and revenue is earned long after the close.