Yang Chyes Simply Invest is a succinct guide for investors to help them understand the key principles of long-term investing and the value of working with an adviser and goals-based investing.

DAVID BOOTH, executive chairman and founder, Dimensional Fund Advisors

Essential knowledge for investors. Armed with his many years of experience, Yang Chye has written a very interesting and well researched book. It has lots of gems on investments and the financial markets. This is a must read for anyone investing in the market, a good resource of fundamentals for beginners and an equally important reminder for seasoned investors.

NG KENG HOOI, group chief executive and president, AIA Group

An insightful view of investing from an industry veteran, expounded in a refreshing way. Well written and engaging, with wise insights... this is a good primer to investing. Technical concepts are presented clearly and simply, with astute advice for beginners to investing and even seasoned professionals. Yang Chye wisely takes the emotion out of investing and focuses on the facts and fundamentals that matter.

THIO BOON KIAT, chief executive, UOB Asset Management

Simply Invest imparts discerning knowledge to succeed in achieving ones financial goals, in a market clouded by excessive noise and information overload. It is written in simple language, making it an easy read for all types of investors.

SUSAN SOH, managing director and country head, Schroders Singapore

This book is a pleasant read and draws precious lessons of past crises. Being a fund manager for the past thirty years, I couldnt agree more with the author that at the end of the day, three simple principles govern the success to investing: discipline, commitment and ability to wait.

HOU WEY FOOK, chief investment officer, DBS Bank

A highly readable book for anyone interested in investment, whether you are a novice investor or seasoned financial adviser. Yang Chye has the gift of making complex ideas simple. I am sure you will find useful tips and practical insights.

GILBERT TAN, associate professor, Lee Kong Chian

School of Business, Singapore Management University

Finally, a well-researched, insightful and relevant contemporary investment bible. A must read for investors. A wake-up call for financial industry practitioners. A persuasive and enlightening testament to all on the importance of goals-based investing.

GOH KEAT JIN, CFA, chief executive,

Maybank Asset Management Singapore

Simple to read and easy to relate to. I hope through reading this, investors will come to appreciate that investing can be as simple as you want it to be, as long as you are disciplined, committed and patient.

MADELINE HO, head of Wholesale Fund Distribution,

Asia-Pacific executive managing director, Natixis Investment Managers

From helping investors understand how difficult it is to outsmart the market to the value of advice Simply Invest by Yang Chye is an insightful guide that lays out the challenges and opportunities investors face on their journey to a successful investment experience.

MARK GOCHNOUR, CFA, head of Global Client Services,

Dimensional Fund Advisors

Simply

Invest

Copyright 2019 by GYC Financial Advisory Pte Ltd

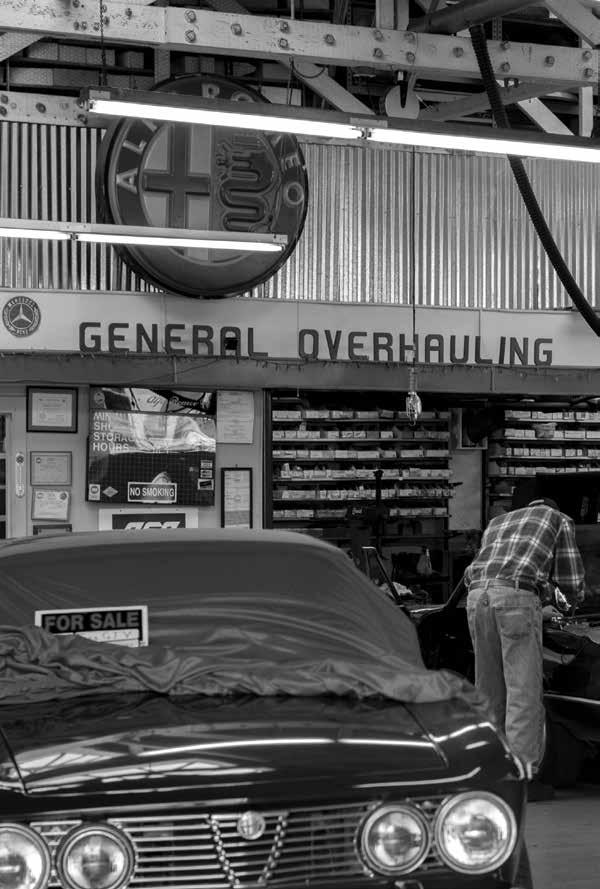

Photography by Joseph Goh. Used with permission.

Cover design by Qin Yi.

Cover images pngtree.com, xb100 / Freepik

All rights reserved

Published in Singapore by Epigram Books

www.epigrambooks.sg

NATIONAL LIBRARY BOARD, SINGAPORE

CATALOGUING-IN-PUBLICATION DATA

NAME

Goh, Yang Chye.

TITLE

Simply invest : naked truths to grow your money / Goh Yang Chye.

DESCRIPTION

Singapore : Epigram Books, [2019]

Includes bibliographical references and index.

IDENTIFIER

OCN 1086363823

ISBN 978-981-47-8560-0 (paperback)

ISBN 978-981-47-8561-7 (ebook)

SUBJECT

LCSH: Finance, PersonalSingapore.

InvestmentsSingapore.

CLASSIFICATION

DDC 332.02401095957dc23

First edition, April 2019.

INTRODUCTION A BETTER

WAY TO INVEST

H ave you ever wondered if there was a simpler way to invest? Investing is often presented as deeply complicated, risky, and accessible only to the sort of crazy-rich people who can afford to gamble away millions on the wildest ventures.

Buy this stock! Sell everything now! Follow this hot tip! Investment advice is endless, yet endlessly contradictory. From financial gurus proclaiming the secrets to ultimate wealth to salesmen pushing a baffling array of investment products, how can one possibly know what to do?

Yet investing doesnt have to be this way. Over the two centuries of the financial markets, the combined power of data analysis and financial science has revealed several naked truths about investing. This book will bring you on a journey to discover those truths and how to use them to successfully and simply invest.

It will reveal why conventional investing methods fail and yet remain popular. It will explore some of the greatest theories of modern finance backed by decades of empirical researchwhich have also revealed the specific factors that drive investment returns. It will show how these can be optimised in a portfolio for the best possible return at a given level of risk. It will examine how to respond to market scenarios, the dangers of human instinct and the problems with alternative investments like cryptocurrencies and property. Finally, this book will discuss how to effectively integrate all these insights into a portfolio to realistically achieve your financial goals.

This book ultimately hopes to reveal that investingand succeeding at itis nowhere near as complicated or expensive as the financial industry may want you to believe. You dont need to be rich, fearlessly reckless or a seasoned investor with multiple degrees in finance.

All you need are three simple things: discipline, commitment and the ability to wait.

PART I REVEALING THE FOLLIES OF FORECASTING

ACKNOWLEDGEMENTS

This book would not be possible without my wife, Sok Lee, and my two sons, Joseph and Barnabas, who have been my pillars of support, joy and inspiration; and the following people and their respective contributions:

Aw Choon Hui, contributing author who helped with content, and conceptual and narrative design; Carl Chay, contributing author who assisted in content, and investment research and analysis; Davian Aw, co-writer, who contributed to writing, editing and structure optimisation; Barnabas Goh, co-writer, who aided in research and analysis, writing and editing; Joseph Goh, artist, whose photography and design concepts were used; and Eldes Tran, editor, and Qin Yi, designer, of Epigram Books.

W e all know that we cannot predict the future. Yet the world of investing, as we know it, is riddled with questions that seek to defy this universal truth. Will the market crash soon? Which stocks will do best this year? Is this a good time to start investing, or should you wait until next year?

Perhaps we can blame the media for convincing us that such questions can be answered (or at least guessed at, with a reasonable degree of accuracy) by men in expensive suits seated behind an array of screens.