Make Money on Airbnb Without Owning Property

Discover How 1,000s of Savvy Real Estate Investors are becoming FINANCIALLY INDEPENDENT using Airbnb without owning a single property

ARX Reads

Copyright 2020 ARX Reads LLC

All rights reserved.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, photocopying, recording or otherwise, without the prior written permission of the publisher, or as expressly permitted by law, or under terms agreed with the appropriate reprographic rights organization.

Inquiries concerning reproduction outside the scope of the above should be sent to the Rights Department at the address below. You must not circulate this book in any other binding or cover and you must impose this same condition on any acquirer.

ARX Reads LLC

info@arxreads.com

www.arxreads.com

Table of Contents

INTRODUCTION

Have you ever found yourself wondering how you could make money on Airbnb without owning any property? Well, in this book, I'm going to cover for you a strategy that Ive been using, people have been using to great success.

In the past 10 years, Airbnb has completely changed the hospitality industry with over 500 million Airbnb stays all time. Most of us have tried the platform by now, but what you may not have realized is how much money people can make on Airbnb without even owning any property themselves.

I know it sounds kind of crazy. Like how can you run something out on Airbnb if you don't even own anything yourself? It's known as rental arbitrage. And it's something people have been doing since the beginning of Airbnb. So today we're going to look into the world of Airbnb rental arbitrage, how people are doing this, and what this means for the future of cities.

Chapter 1. Is it possible?

The question is, is it possible to run a short-term rental business without actually owning the property? Well, the short answer is yes. And that's why this book is here, but let me tell you a really quick story of how I got involved in short term rentals to help you understand how I figured it out.

So, I've had the privilege of teaching thousands upon thousands of investors all across the globe for several years. And what happened is that one of those investors came to me one day and said, Hey, all of that money that you taught us how to raise, we didn't do it as what you said to do. Now, normally I'm being honest. I got a little scared because it's usually at that point that I find out that something bad happened. But in this particular case, the investor had already had massive experience and a very profitable niche of real estate investing known as student housing. So, in my mind, I'm like, it couldn't be that bad. We got together because they had a question. Their question was very simple and it's something that a lot of business owners struggle with from time to time. And it was simply where the highest and best use of our time. So the reason this question came about is that inside their student housing business, they were making significant cash flow, but at the same time on the side, they had started leveraging other people's skills, using it to grow a short term rental business. And it got to the point where just a few short term rentals were starting to make just as much if not more money than this student housing thing. And they wanted to know which one that they should pursue. Now as normal as any other investors should, as you should, you should be looking at the numbers to make the decision. And a long story short. When I looked at the numbers, I was like, okay, those numbers look pretty good. And you've got to understand one very important thing. Having the privilege of speaking all across the globe I get offered all kinds of deals all the time, but this was one of those few times where I said, not only do you have such a great deal, I'm going to do it too. So when I came back home, I started doing what I normally do. I know how to go out there and creatively acquire real estate using none of our own money or credit or finding good deals for closures, all of that stuff. That's what we had done for decades. That's how we found our commercial buildings, cell phone towers, apartment buildings, they're single-family houses, mortgage notes, you name it. And then I started applying those same techniques. I was thinking, okay, cool. Let me go buy a house.

Chapter 2. Benefits of a House

Now in California, the average cost of a house is a little bit different than elsewhere. So bear with me as I give you some of the numbers. What we were looking at when we found the house right down the street, from where I live, we were looking at having to put in about a hundred thousand dollars. Now that included taking over the house, using a very advanced strategy. So we're making up the rear, we're doing some rehab to put the house together. Now that it was done, we still would have to furnish the house. And, right after closing, we would have a mortgage payment due.

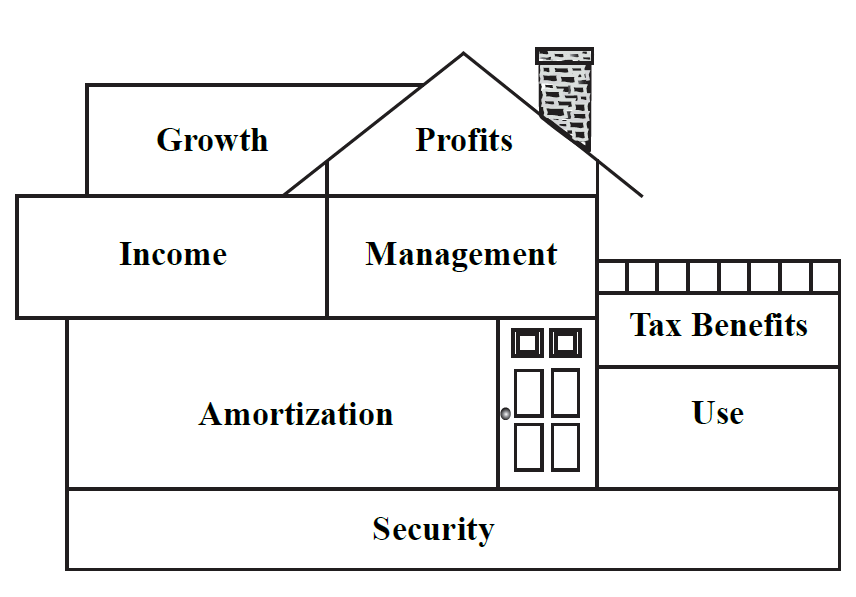

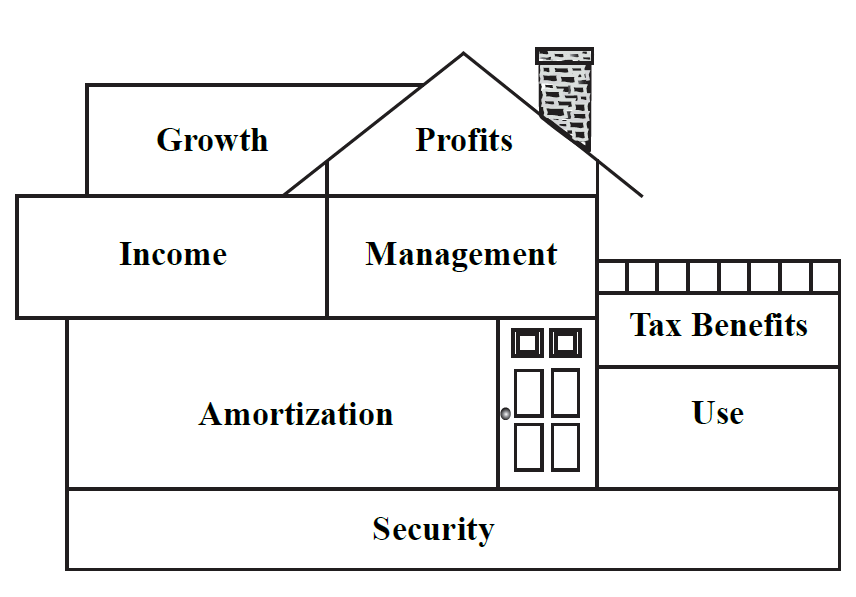

So I started totalling all of that up and not including the furnishings. As I said, it was going to cost us about a hundred thousand dollars. So I had to ask myself the same question. You should ask yourself when anytime you're looking to invest, does this make sense? You can never evaluate an investment in a vacuum. You need to have it compared to something. So here's what happened. I started asking myself, well, what do I need to make this short-term rental business work? Do I need to own the house? And that's when it hit me. Now, fortunately, as an educated investor, you spend a significant amount of time learning from all kinds of people all across the globe. And there is a very famous individual by the name of Peter Fortunato, who has a diagram of the benefits of a house.

Here it is.

So, it was at that time, I began to reference this diagram and I asked myself this question - Of these benefits, which one or ones do I need. And well, as it turns out, the only one that I needed to be controlled. I needed use. I needed to be able to use the space so that I could then offer the space to someone else. So I had the freedom and the flexibility to give up all of the other benefits if it made sense to me. Okay. Just to make sure that you understand before we get into the numbers. All we're looking to do is use a piece of real estate. Just control it. That's all we're after. We don't need all of the other benefits at the beginning of our business. Now, do you eventually want to grow to the point where all of those benefits become yours? Sure. But that's what we call phase three of the business. And right now, we're in phase one. So when we're in phase one, the only thing we care about is how can I get control to use the property for the specific purpose that I have in mind. So here are the numbers that roughly win. In the beginning, I'm looking at putting in a hundred thousand dollars, that a hundred thousand dollars are going to give me control of the property and put it in a condition in which I am now ready to put in the furnishing. Okay. And with that one property, I have one location. That's what it comes down to. The other side is what happens if instead of focusing on owning it, because yes if I'm owning it, I'm going to have the benefits of the equity and some depreciation and a whole bunch of other things. But I have to ask myself, what's this about?

So, it was at that time, I began to reference this diagram and I asked myself this question - Of these benefits, which one or ones do I need. And well, as it turns out, the only one that I needed to be controlled. I needed use. I needed to be able to use the space so that I could then offer the space to someone else. So I had the freedom and the flexibility to give up all of the other benefits if it made sense to me. Okay. Just to make sure that you understand before we get into the numbers. All we're looking to do is use a piece of real estate. Just control it. That's all we're after. We don't need all of the other benefits at the beginning of our business. Now, do you eventually want to grow to the point where all of those benefits become yours? Sure. But that's what we call phase three of the business. And right now, we're in phase one. So when we're in phase one, the only thing we care about is how can I get control to use the property for the specific purpose that I have in mind. So here are the numbers that roughly win. In the beginning, I'm looking at putting in a hundred thousand dollars, that a hundred thousand dollars are going to give me control of the property and put it in a condition in which I am now ready to put in the furnishing. Okay. And with that one property, I have one location. That's what it comes down to. The other side is what happens if instead of focusing on owning it, because yes if I'm owning it, I'm going to have the benefits of the equity and some depreciation and a whole bunch of other things. But I have to ask myself, what's this about?

Chapter 3. Cash flow

Next page

So, it was at that time, I began to reference this diagram and I asked myself this question - Of these benefits, which one or ones do I need. And well, as it turns out, the only one that I needed to be controlled. I needed use. I needed to be able to use the space so that I could then offer the space to someone else. So I had the freedom and the flexibility to give up all of the other benefits if it made sense to me. Okay. Just to make sure that you understand before we get into the numbers. All we're looking to do is use a piece of real estate. Just control it. That's all we're after. We don't need all of the other benefits at the beginning of our business. Now, do you eventually want to grow to the point where all of those benefits become yours? Sure. But that's what we call phase three of the business. And right now, we're in phase one. So when we're in phase one, the only thing we care about is how can I get control to use the property for the specific purpose that I have in mind. So here are the numbers that roughly win. In the beginning, I'm looking at putting in a hundred thousand dollars, that a hundred thousand dollars are going to give me control of the property and put it in a condition in which I am now ready to put in the furnishing. Okay. And with that one property, I have one location. That's what it comes down to. The other side is what happens if instead of focusing on owning it, because yes if I'm owning it, I'm going to have the benefits of the equity and some depreciation and a whole bunch of other things. But I have to ask myself, what's this about?

So, it was at that time, I began to reference this diagram and I asked myself this question - Of these benefits, which one or ones do I need. And well, as it turns out, the only one that I needed to be controlled. I needed use. I needed to be able to use the space so that I could then offer the space to someone else. So I had the freedom and the flexibility to give up all of the other benefits if it made sense to me. Okay. Just to make sure that you understand before we get into the numbers. All we're looking to do is use a piece of real estate. Just control it. That's all we're after. We don't need all of the other benefits at the beginning of our business. Now, do you eventually want to grow to the point where all of those benefits become yours? Sure. But that's what we call phase three of the business. And right now, we're in phase one. So when we're in phase one, the only thing we care about is how can I get control to use the property for the specific purpose that I have in mind. So here are the numbers that roughly win. In the beginning, I'm looking at putting in a hundred thousand dollars, that a hundred thousand dollars are going to give me control of the property and put it in a condition in which I am now ready to put in the furnishing. Okay. And with that one property, I have one location. That's what it comes down to. The other side is what happens if instead of focusing on owning it, because yes if I'm owning it, I'm going to have the benefits of the equity and some depreciation and a whole bunch of other things. But I have to ask myself, what's this about?