Uncle Bob Williams - Uncle Bobs Money: Generating Income with Conservative Options Trades

Here you can read online Uncle Bob Williams - Uncle Bobs Money: Generating Income with Conservative Options Trades full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2011, publisher: CreateSpace Independent Publishing Platform, genre: Business. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Uncle Bobs Money: Generating Income with Conservative Options Trades

- Author:

- Publisher:CreateSpace Independent Publishing Platform

- Genre:

- Year:2011

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

Uncle Bobs Money: Generating Income with Conservative Options Trades: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Uncle Bobs Money: Generating Income with Conservative Options Trades" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Proven money-making secrets should not belong to the privileged few.

Every investor should know how to generate income using conservative options trades so the risk of loss is low.

Its important to shatter the mystery and secrecy to end the status quo, where options pit traders and large investment firms with math geniuses onboard are able to earn consistently using options trades while the rest struggle to find the same strategies they use.

TO THIS END:

This book provides all the learning materials you need to understand how to make income-generating options trades.

You can learn what you need to know, then walk away to start trading options profitably without ever coming back to us.

But we do hope youll join our community of successful options investors, where youll access super-easy tools to take the processes of successfully finding, trading and monitoring your options trades to maximum profitability.

- - - - - -

With UNCLE BOBS MONEY you get:

(1) PORTFOLIO STABILITY

At last -- heres your chance to make serious money year after year despite wild market volatility.

(2) PORTFOLIO GROWTH IN ALL MARKET CONDITIONS

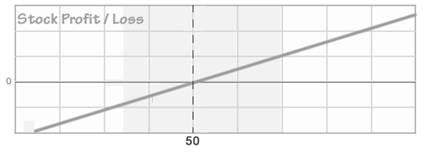

Ignite your portfolio with our special method of non-directional trading. Now youll make money whether the market goes up or down.

(3) CONTROL OF YOUR OWN FINANCIAL DESTINY

When you make the decision to work with Uncle Bobs Money, you stay in control. We dont have access to your account.

(4) A WEALTH-BUILDING PLAN THAT LEAVES THE HERD IN THE DUST

Market roulette anyone?

Uncle Bobs Money takes nothing for granted. Instead, we subject the movements of the Indexes we trade to the continual test of statistical probabilities - the same kinds of risk analysis an Insurance company uses to make an investment or even to evaluate a prospective policy holder.

(5) A SYSTEM WHICH FOCUSES ON YOUR FINANCIAL SUCCESS

We take the anxiety and guesswork out of structuring your portfolio.

Uncle Bob Williams: author's other books

Who wrote Uncle Bobs Money: Generating Income with Conservative Options Trades? Find out the surname, the name of the author of the book and a list of all author's works by series.