WEST ACADEMIC PUBLISHINGS

LAW SCHOOL ADVISORY BOARD

____________

JESSE H. CHOPER

Professor of Law and Dean Emeritus,

University of California, Berkeley

JOSHUA DRESSLER

Professor of Law, Michael E. Moritz College of Law,

The Ohio State University

YALE KAMISAR

Professor of Law Emeritus, University of San Diego

Professor of Law Emeritus, University of Michigan

MARY KAY KANE

Professor of Law, Chancellor and Dean Emeritus,

University of California,

Hastings College of the Law

LARRY D. KRAMER

President, William and Flora Hewlett Foundation

JONATHAN R. MACEY

Professor of Law, Yale Law School

ARTHUR R. MILLER

University Professor, New York University

Formerly Bruce Bromley Professor of Law, Harvard University

GRANT S. NELSON

Professor of Law, Pepperdine University

Professor of Law Emeritus, University of California, Los Angeles

A. BENJAMIN SPENCER

Earle K. Shawe Professor of Law,

University of Virginia School of Law

JAMES J. WHITE

Robert A. Sullivan Professor of Law Emeritus,

University of Michigan

I

CORPORATE FINANCE

IN A NUTSHELL

THIRD EDITION

JEFFREY J. HAAS

Professor of Law

New York Law School

II

The publisher is not engaged in rendering legal or other professional advice, and this publication is not a substitute for the advice of an attorney. If you require legal or other expert advice, you should seek the services of a competent attorney or other professional.

Nutshell Series, In a Nutshell and the Nutshell Logo are trademarks registered in the U.S. Patent and Trademark Office.

2004 West, a Thomson business

2011 Thomson Reuters

2015 LEG, Inc. d/b/a West Academic

444 Cedar Street, Suite 700

St. Paul, MN 55101

1-877-888-1330

West, West Academic Publishing, and West Academic are trademarks of West Publishing Corporation, used under license.

Printed in the United States of America

ISBN: 978-0-314-28963-6

III

To my father, Mike, who inspired my interest in business and finance.

V

PREFACE

_________

This book is designed for those interested in learning the fundamentals of corporate finance from both a business and legal point of view. In particular, it is targeted towards lawyers without a finance background who find themselves engaged in transactional work. It is also designed to assist law students who are taking a corporate finance, corporations or related course.

Corporate finance is unique in that it is an amalgam of substantive disciplines. Those with even a tangential familiarity with it are likely aware of the crucial role that mathematics and accounting play. Indeed, it is the math and accounting aspects of a corporate finance course that frequently frighten law students away from taking it. Accordingly, Part 1 makes a serious attempt to explain these concepts in a straight-forward, plain English manner.

Corporate finance, however, is much more than math and accounting, as Parts 2 through 3 make clear. Under the umbrella of corporate finance falls a whole host of other disciplines. Especially important is the subject of economics, particularly macroeconomics. Changes in fiscal and monetary policy at the national level directly impact economic growth and the interest rate environment, while indirectly affecting corporate growth and earnings. Corporations attempt to navigate the economic VI landscape and the concomitant risk it carries by engaging in various risk reduction strategies, especially the use of derivative instruments.

The law also plays a large role in corporate finance. Securities laws, both Federal and state, regulate, influence and guide companies raising capital through the sale of their common stock, preferred stock and debt securities. Corporate law, particularly Delaware corporate law, also affects the ability of companies to raise capital due to its strong influence on internal corporate governance and control.

While this book is entitled Corporate Finance, much of what it contains applies to business entities other than corporations. All businesses, regardless of their form, need capital to survive and grow. While the capital structure of these other entities may differ from that of the corporation, the ways in which they pursue and, ultimately, raise capital are similar.

For an expanded version of this book in a fully footnoted format, see CORPORATE FINANCE (HORNBOOK SERIES), ISBN 978-0-314-28964-3.

JEFFREY J. HAAS

New York, New York

September 1, 2015

E-mail: jeffrey.haas@nyls.edu

VII

ACKNOWLEDGMENTS

_________

Third Edition (2015)

I would like to thank the wonderful folks at West Academic Publishing, especially Louis Higgins, for their constant support and encouragement over the past 12 years.

Second Edition (2011)

I received a great deal of support and encouragement from my lovely wife, Alicja, my parents, Mike and Nancy, my brothers, Steve and Greg, and from my colleagues at New York Law School, particularly Rick Matasar, Grace Lee and Cathy Jenkins. Substantive assistance and support were given by Larry Mitchell, Larry Cunningham, Robert Campbell, Brent Friedman and Ron Sarubbi. Lastly, my research assistantsTrina Obi (11), Kristin Olsen (11), Jacklyn Swerz (11), Jon Nowakowski (10), Armen Khajetoorian (10), Nick Koumoulis (10) and Linda Hoffman (10)provided dedicated and much appreciated support.

First Edition (2004)

Many provided significant assistance in the preparation of this book. I would like to thank my colleagues at New York Law School, in general, and Rick Matasar and Grace Lee, in particular. In addition, a great deal of thanks go to Larry Cunningham, Ron Sarubbi, Brent Friedman, David Dami and Steve Howard for their substantive VIII comments and support. Lastly, I tip my hat to my cocky and funny research assistants, Stephen Ginsberg, Sagi Goldberg, Jon Macy, Danny Rehns, Heather Rutman, Rich Rybak, Mariam Sanni and Dimitra Tzortzatos, for their invaluable assistance and dedication.

IX

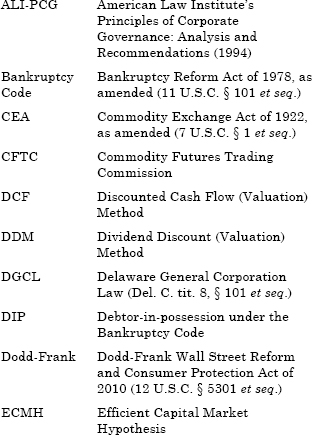

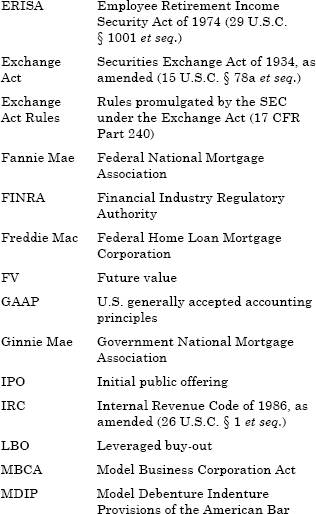

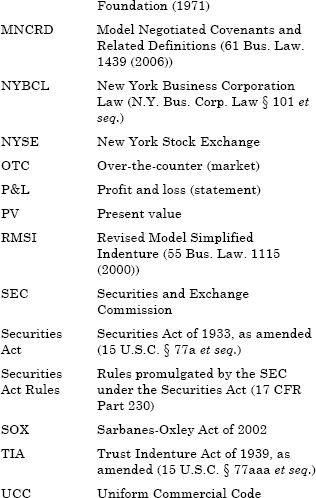

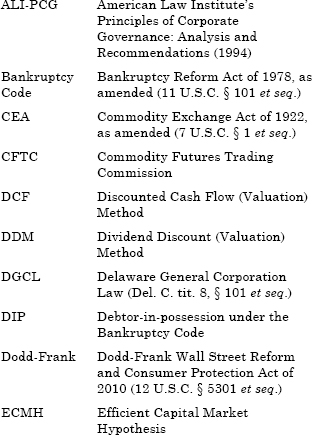

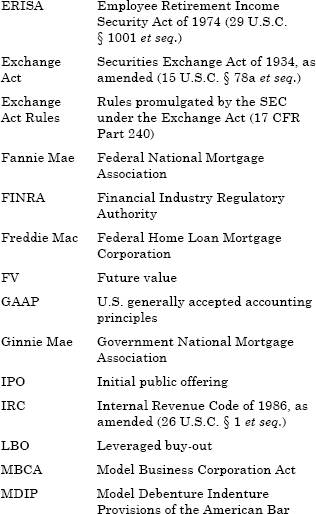

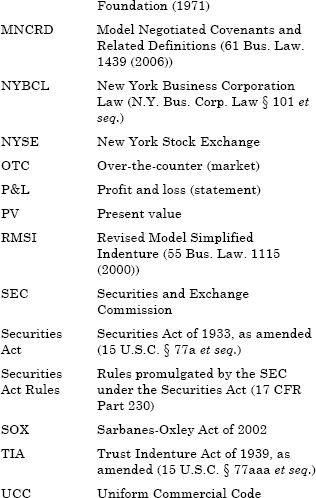

ABBREVIATIONS

_________

X

XI

XIII

OUTLINE

_________

XIV

c. Shareholders Equity

XV

Chapter 4. Future Value and Present Value

XVI

(4) Minority Discounts and Control Premiums

XVII

XVIII

(1) Overview

XIX

A. Types of Debt Instruments

XX

XXI

g. Transactions with Affiliates

XXII

(2) Preference

XXIII

XXIV

B. Investment Value and Conversion Value

XXV

(1) Overview

XXVI

XXVII

TABLE OF CASES

References are to Pages

_________

AG Capital Funding Partners, L.P. v. State St. Bank & Trust Co302

Air Products and Chemicals, Inc. v. Airgas, Inc495

Alaska Plastics v. Coppock 193

Allen v. Biltmore Tissue Corp184

Anadarko Petroleum Corp. v. Panhandle Eastern Corp336, 450, 511, 575

Applebaum v. Avaya 539

Arnolds v. Phillips 389