Publishing details

HARRIMAN HOUSE LTD

3A Penns Road

Petersfield

Hampshire

GU32 2EW

GREAT BRITAIN

Tel: +44 (0)1730 233870

Fax: +44 (0)1730 233880

Email: enquiries@harriman-house.com

Website: www.harriman-house.com

First published in Great Britain in 2011

Copyright John Cotter

The right of John Cotter to be identified as the Author has been asserted in accordance with the Copyright, Design and Patents Act 1988.

ISBN: 978-0-85719-162-5

British Library Cataloguing in Publication Data

A CIP catalogue record for this book can be obtained from the British Library.

All rights reserved; no part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise without the prior written permission of the Publisher. This book may not be lent, resold, hired out or otherwise disposed of by way of trade in any form of binding or cover other than that in which it is published, without the prior written consent of the Publisher.

No responsibility for loss occasioned to any person or corporate body acting or refraining to act as a result of reading material in this book can be accepted by the Publisher, by the Author, or by the employer(s) of the Author.

Disclaimer

Nothing in this book should be taken as specific advice or as a specific recommendation to buy or sell a particular stock. Hopefully, however, much of what I have said will act as a catalyst to your investment thought processes.

Always remember that the value of shares can fall as well as rise and you can get back less than you invested.

During bad times in the market it may be necessary to remind yourself that shares can rise as well as fall. During 2008 I used to say this to myself as a daily mantra!

In the book I have used specific examples and prices to help demonstrate and bring to life the different principles and concepts involved. Obviously, the prices, ratios and charts were taken at the time of writing and will no longer be accurate, but are used to illustrate the principes involved.

At the time of writing, I own long-term investments in Medusa Mining, Tullow Oil, Communisis, Axis-Shield, Xstrata, BHP Billiton, Straight, Cookson Group and ASOS. Shares are also held on my behalf inside an employees share scheme in Barclays Bank, but not in any other shares mentioned in this book.

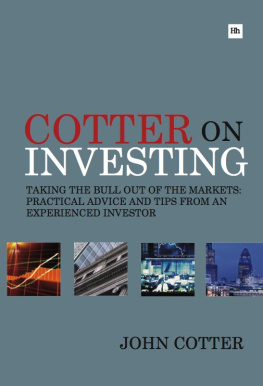

Biography

John has worked for the Barclays for 38 years, filling various senior management positions in the financial services industry. During the last 15 years he has worked for Barclays Stockbrokers, for whom he now fills the role of Vice President. He is a regular speaker on their behalf at client seminars and other professional gatherings and is renowned for his ability to demystify even the most complex of financial subjects.

John writes a regular column, Cotters Corner, which is consistently one of the most popular sections on the Barclays Stockbrokers website. The articles aim to educate, inform and inspire investors of all levels, helping them to understand the ins and outs of investing and hopefully trade more profitably.

John is married with five children and has now returned to his native Merseyside to live.

Preface

I have worked in the investment business for nearly 40 years and even now, after all this time, I often do not understand many of the investment reports and papers that are put in front of me written by experts. I am not questioning their knowledge or expertise, just their ability to communicate it in terms the average person can understand.

I was determined therefore to write a book on investing in shares that didnt confuse the average layman with technical jargon. A book that spoke about stock market investment the way I believe it is a relatively straightforward subject that is best kept simple.

To make sure I pass my own simplicity test, when I use a phrase or word that I think the average person may not fully understand, I have included a simple explanation of it in a glossary at the end of the book.

This book, therefore, is written for people who want to make their own investment decisions in the stock market a group of people well call self-directed investors.

The stock market of course can be a dangerous place and the risk involved can put people off the whole idea of investing in shares. It shouldnt. Successful investors are those who manage risk, not avoid it altogether. After all, a life without risk is a life without reward!

This book is not designed to be a comprehensive introduction to the topic of investing in shares. There are other books that do that already. Rather, I focus on a few key topics that Ive found investors are most interested in.

I give my own opinions, not only on some of the different investment vehicles you can use, but also on the ways in which you can improve your performance as a self-directed investor, by using different selection and timing techniques. For me to promote an idea in this context it has to pass what I refer to as the 3 Box Test: it has to be simple, it has to make sense and it has to work most of the time. If such an idea in my opinion ticks all three of these boxes, I have used it in this book. If it doesnt, I havent.

If you do decide to take control of your own share portfolio I think you will find it not only financially beneficial, but also an enjoyable learning experience.

Good luck with your investing!

Chapter 1: Why Buy Shares?

Your financial future

I dont think that being financially self-sufficient is just a preferred option anymore, I believe it is essential. Gone are the days when Mr Average would work 40 years of his life for one company and retire with a pension equal to two-thirds of his final salary. The prospects for the state pension are equally dismal. Not only will the amount payable come under immense pressure, but the existing plans to defer the qualifying date to 66 from 65 will only be the start of a slippery slope.

The institutions that used to look after us can no longer be relied on to do so; whether this is your employer, the government or the NHS. For Mr and Mrs Average, who have aspirations of a quality life both while working and in retirement, the message is clear: if you dont provide it for yourself then no-one else is likely to do it for you.

And this is the way the world is going we want to take control of our own lives in all sorts of ways. For instance, we are far less likely to buy a packaged holiday from a travel agent now than we used to be. Many more people not only want to take more control of their holidays but also their investments.

So, to get started, there are two big questions every potential investor should ask themselves:

- Should stock market investments play an important part in my life?

- Should I take responsibility for my own investment decisions?

I strongly believe that the answer to both questions is yes. Let me explain by addressing each point in turn. First, should you buy shares?

Are shares a good investment?

The long-term

Hows this for a fact:

If you invested 1000 in 1945 in the broad UK stock market, by the end of 2009 it would be worth almost 1.2million!

A problem is that not many people are patient enough to take a 65-year view! However, I make no apologies for quoting such a long-term figure. Most peoples financial lives are divided into different stages. Very often they start life as a borrower, then become a saver, then an investor and end up in retirement as a

![Cotter - Kettlebell training: [95 exercises for strength, toning, stamina, and weight loss]](/uploads/posts/book/196732/thumbs/cotter-kettlebell-training-95-exercises-for.jpg)