CONTENTS

Copyright 2003 by John Wiley & Sons (Asia) Pte Ltd

Published in 2003 by John Wiley & Sons (Asia) Pte Ltd 2

Clementi Loop #02-01, Singapore 129809

All rights reserved.

No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning or otherwise, except as expressly permitted by law, without either the prior written permission of the Publisher, or authorization through payment of the appropriate photocopy fee to the Copyright Clearance Center. Requests for permission should be addressed to the Publisher, John Wiley & Sons (Asia) Pte Ltd, 2 Clementi Loop, #02-01, Singapore 129809, tel: 65-64632400, fax: 65-64634605, email: .

This publication is designed to provide general information in regard to the subject matter and it is sold with the understanding that neither the Publisher, Editor or Author are engaged in providing legal, accounting or other professional advice or services and do not in any way warranty the accuracy or appropriateness of any of the formulae or instructions discussed in the Publication nor provide any warranty that use of any of the same may not cause injury, illness or damage to the user. Readers should seek appropriate advice from suitable qualified professionals or obtain independent advice or verification of the relevance and appropriateness of the use of any formula or instructions prior to use of these in relation to any of their activities.

All charts created by MetaStock

Daryl Guppy 2002

Email

Internet www.guppytraders.com

Disclaimer

The material in this publication is of the nature of general comment only, and neither purports nor intends to be advice. Readers should not act on the basis of any matter in this publication without considering (and if appropriate, taking) professional advice with due regard to their own particular circumstances. The decision to trade and the method of trading is for the reader alone. The author and publisher expressly disclaim all and any liability to any person, whether a purchaser of this publication or not, in respect of anything and of the consequences of anything done or omitted to be done by any such person in reliance, whether whole or partial, upon the whole or any part of the contents of this publication.

Other Wiley Editorial Offices:

111 River Street, Hoboken, NJ, 07030, USA

The Atrium, Southern Gate, Chichester P019 8SQ, England

John Wiley & Sons (Canada) Ltd, 22 Worcester Road, Rexdale, Ontario M9W 1L1, Canada

John Wiley & Sons Australia Ltd, 33 Park Road (PO Box 1226), Milton, Queensland 4064, Australia

Wiley - VCH, Pappelallee 3, 69469 Weinheim, Germany

Library of Congress Cataloging in Publication Data

ISBN 0-470-82101-9

Foreword by Martin J. Pring

Author of Getting Started in Technical Analysis

There are many books available that make wild claims about the ease of making money in the financial markets. Others offer trading secrets revealed for the first time. The implication from all these texts is that it is a snap to trade your way to a financial nirvana. Just read the book and collect the profits. Unfortunately, as any professional will tell you, the reality of the marketplace is quite different. I wont deny that there are some situations where the neophyte will hit it rich with a lucky streakbut thats all it is: luck. It is surprising how good luck can unexpectedly reverse on a dime, as yesterdays financial genius is exposed for the inexperienced neophyte that he really is.

In Better Stock Trading, Daryl Guppy tells it the way it really is. No hype, no tripejust cold, hard facts from someone who has been there and done it. It is really summed up in the closing paragraph of the preface: How we manage risk determines how well we trade. I couldnt agree more. Those who give precedence to earning profits over managing risk are doomed to failure. In my seminars, I often make this point using the following example.

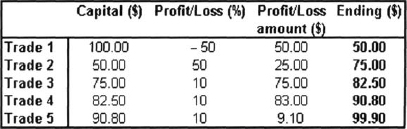

The importance of managing losses

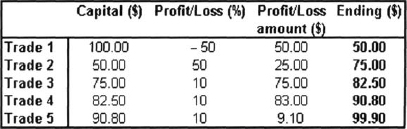

The starting amount of capital is $ 100. The first trade is a losing one that returns a loss of 50% and leaves an ending balance of $50 to begin the next trade. The next four trades are winners. The second trade increases by 50%, or $25, and leaves us with an ending balance of $75. The next three trades each make 10%. This gives us a total percentage gain in four trades of 80%. You would think that being down 50% and then up 80% would offer a great rate of return, yet when the calculation is made you are no further ahead. We are still a fraction under our starting capital. Concentrating on managing risk and cutting that initial loss would have returned a much higher rate of return.

This book is conveniently laid out in four parts. Part 1, Performance Profiling, introduces us to the concept of risk and examines how different categories of traders deal with it. Traders apply a variety of trading strategies. This part of the book describes three important ones: trend, breakout, and support/resistance. Daryl Guppy tells us that there is a distinction between timing the market and time in the market. Charles Dow, the father of technical analysis, once said words to the effect that pride of opinion has been responsible for more losses than all other opinions combined. What he meant was that many traders, when they enter a position that subsequently goes against them, become converts to the buy/hold approach as they quickly decide that they are now in it for the long term. Daryl Guppy explains that this is a cop-out and demonstrates that, in most situations, because of the time element, it leads to sub-par returns.

It is no coincidence that the subject of Part 2, protecting capital, precedes protecting profits, the subject of Part 3. That is because the number one objective of all professionals is to maintain principal. If you lose all your capital, you are out of business. By the same token, it is still necessary to protect profits as much as possible, because we are all subject to the temptations of greed and expect profitable positions to continue to grow. However, all trends eventually reverse, and unless profit protection strategies are put in place, its likely that black ink will quickly dissolve into red.

The final part of the book, titled Protect Portfolios, teaches us that portfolio risk overrides the risk management of individual trades. As a shopkeeper you can write off some of the inventory and survive, but you cannot write off the store and continue in business. The same is true for traders. Managing individual trades is fine, but you must also ensure that you keep an eye on the big picture by managing the portfolio. This part also explains the concept of diversification, along with how to judge performance against specific benchmarks.

Better Stock Trading wont make you rich overnight, or even over two or three nights! However, Daryl Guppy has laid out the rules, which, if faithfully followed, will enable you to achieve above-average returns, and that is all any serious market participant can ever hope to achieve.

Martin J. Pring

International Institute for Economic Research, Inc., Sarasota, Florida, United States

December 2002

Martin J. Pring ( www.pring.com ) is the author of Breaking the Black Box and Getting Started in Technical Analysis.