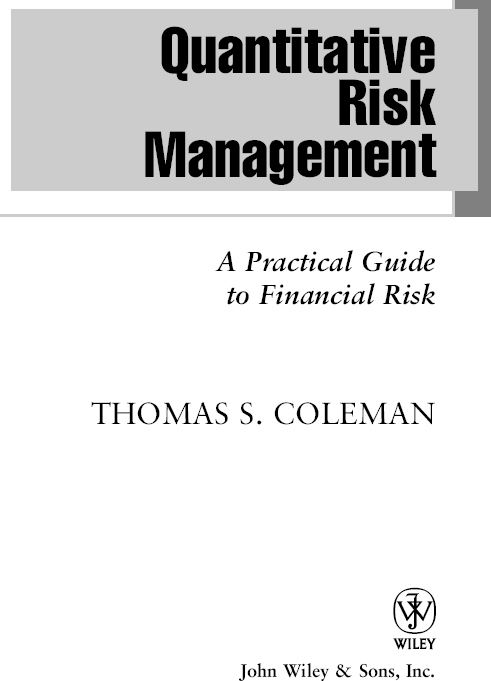

Founded in 1807, John Wiley & Sons is the oldest independent publishing company in the United States. With offices in North America, Europe, Australia, and Asia, Wiley is globally committed to developing and marketing print and electronic products and services for our customers' professional and personal knowledge and understanding.

The Wiley Finance series contains books written specifically for finance and investment professionals as well as sophisticated individual investors and their financial advisors. Book topics range from portfolio management to e-commerce, risk management, financial engineering, valuation, and financial instrument analysis, as well as much more.

For a list of available titles, please visit our website at www.WileyFinance.com .

Copyright 2012 by Thomas S. Coleman. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

Chapters 1, 2, 3, 4, and parts of 6 were originally published as A Practical Guide to Risk Management, 2011 by the Research Foundation of CFA Institute.

Chapters 5, 7, 8, 9, 10, and 11 include figures, tables, and short excerpts that have been modified or reprinted from A Practical Guide to Risk Management, 2011 by the Research Foundation of CFA Institute.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 7508400, fax (978) 6468600, or on the Web at www.copyright.com . Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 7486011, fax (201) 7486008, or online at www.wiley.com/go/permissions .

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 7622974, outside the United States at (317) 5723993 or fax (317) 5724002.

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may not be available in electronic books. For more information about Wiley products, visit our web site at www.wiley.com .

Library of Congress Cataloging-in-Publication Data:

Coleman, Thomas Sedgwick, 1955

Quantitative risk management: a practical guide to financial risk/Thomas S. Coleman.

pages cm.(Wiley finance series; 669)

Includes bibliographical references and index.

ISBN 9781118026588 (cloth); ISBN 978-1-118-26077-7 (ebk);

ISBN 978-1-118-22210-2 (ebk); ISBN 978-1-118-23593-5 (ebk)

1.Financial services industryRisk management.2.Financial risk management. 3. Capital market. I. Title.

HG173.C664 2012

332.10681dc23

2011048533

To Lu and Jim, for making me who I am today.

Foreword

Having been the head of the risk management department at Goldman Sachs for four years (which I sadly feel obligated to note was many years ago during a period when the firm was a highly respected private partnership), and having collaborated on a book called The Practice of Risk Management , I suppose it is not a surprise that I have a point of view about the topic of this book.

Thomas Coleman also brings a point of view to the topic of risk management, and it turns out for better or for worse, we agree. A central theme of this book is that in reality risk management is as much the art of managing people, processes, and institutions as it is the science of measuring and quantifying risk. I think he is absolutely correct.

This book's title also highlights an important distinction that is sometimes missed in large organizations. Risk measurement, per se, which is a task usually assigned to the risk management department, is in reality only one input to the risk management function. As Coleman elaborates, Risk measurement tools...help one to understand current and past exposures, a valuable and necessary undertaking but clearly not sufficient for actually managing risk. However, The art of risk management which he notes is squarely the responsibility of senior management, is not just in responding to anticipated events, but in building a culture and organization that can respond to risk and withstand unanticipated events. In other words, risk management is about building flexible and robust processes and organizations.

The recognition that risk management is fundamentally about communicating risk up and managing risk from the top leads to the next level of insight. In most financial firms different risks are managed by desks requiring very different metrics. Nonetheless, there must be a comprehensive and transparent aggregation of risks and an ability to disaggregate and drill down. And as Coleman points out, consistency and transparency in this process are key requirements. It is absolutely essential that all risk takers and risk managers speak the same language in describing and understanding their risks.

Finally, Coleman emphasizes throughout that the management of risk is not a function designed to minimize risk. Although risk is usually a reference to the downside of random outcomes, as Coleman puts it, risk management is about taking advantage of opportunities: controlling the downside and exploiting the upside.

In discussing the measurement of risk the key concept is, of course, the distribution of outcomes. But Coleman rightly emphasizes that this distribution is unknown, and cannot be summarized by a single number, such as a measure of dispersion. Behavioral finance has provided many illustrations of the fact that, as Coleman notes, human intuition is not very good at working with randomness and probabilities. In order to be successful at managing risk, he suggests, We must give up any illusion that there is certainty in this world and embrace the future as fluid, changeable, and contingent.

One of my favorite aspects of the book is its clever instruction on working with and developing intuition about probabilities. Consider, for example, a classic problem, that of interpreting medical test results. Coleman considers the case of testing for breast cancer, a disease that afflicts about one woman in twenty. The standard mammogram tests actually report false positives about five percent of the time. In other words, a woman without cancer will get a negative result 95 percent of the time and a positive result 5 percent of the time. Conditional on receiving a positive test result, a natural reaction is to assume the probability of having cancer is very high, close to 95 percent. In fact, that is not true. Consider that out of 1,000 women approximately 5 will have cancer. Approximately 55 will receive positive results. Thus, conditional on receiving a positive test result the probability of having cancer is only about 9 percent, not 95 percent. Using this example as an introduction, the author then develops the ideas of Bayesian updating of probabilities.

Next page