Acknowledgements

I would like to thank Lucy Fang, Vadim Graboys, Dan Gruttadaro, VikingCoder, and Sheldon Thomas for their assistance in the preparation of this book.

Chapter 1

Introduction

Bitcoin is the worlds first decentralized digital currency. Unlike most existing payment systems, it does not rely on trusted authorities such as governments and banks to mediate transactions or issue currency. With Bitcoin,

- Transaction costs can be reduced to pennies (in contrast to typical credit card fees of 2%).

- Electronic payments can be confirmed in about an hour without expensive wire transfer fees, even internationally.

- There is a low risk of monetary inflation since the production rate of bitcoins is algorithmically limited and there can never be more than 21 million bitcoins produced.

- Payments are irreversible (there are no chargebacks), so there is a reduced risk of payment fraud.

- Payments can be made without identification, though some extra effort is needed to ensure that ones identity cannot be exposed (See Section 2.1).

- Responsibility is shifted to the consumers, who can permanently lose all of their bitcoins if they lose their encryption keys.

The ledger records ownership without revealing any real identities by using digital addresses , which are like pseudonyms. Ownership depends on possession of a secret digital key that gives the owner the exclusive ability to transfer bitcoins to other addresses. The owner can spend bitcoins to purchase goods and services from any business that chooses to accept them.

Who operates Bitcoin? There is no company or organization that runs Bitcoin. It is run by a network of computers that anyone can join by installing the free open-source Bitcoin software. The system is designed such that malicious attackers can participate but will be effectively ignored as long as the majority of the network is still honest. If attackers ever acquired the majority of the computing power in the network, they could reverse their own transactions and block new transactions while they held the majority, but they still wouldnt be able to steal bitcoins directly. People have an incentive to join the Bitcoin network because those who process transactions are rewarded with newly created bitcoins.

] Nakamotos possible motivations for creating Bitcoin can be gleaned from some of his or her discussions on mailing lists:

"[Bitcoin is] very attractive to the libertarian viewpoint if we can explain it properly. Im better with code than with words though." - Satoshi Nakamoto []

It is estimated that Nakamoto now owns over $100 million worth of bitcoins, as of May 2013. []

Why do bitcoins have value? People consider bitcoins to be valuable for a variety of reasons.

- Utility: Bitcoins can be used to buy goods and services, most notably drugs on the Silk Road, where other currencies are not accepted.

- Exchange Value: Bitcoins can be traded for other currencies on exchanges such as Mt.Gox.

- Speculation: Bitcoins popularity has been surging, and its value has surged along with it. Speculators pay for bitcoins in the hopes of making quick profits.

- Scarcity: The supply of bitcoins is limited. Production is algorithmically limited and is capped at 21 million bitcoins.

Historically, most currencies have been backed by either commodities or legal tender laws. Bitcoin is backed by absolutely nothing, so one might question whether its value is sustainable. There is one case of a currency that continued to function after its legal tender status was revoked: the Iraqi Swiss dinar. [] After the Gulf War, the Iraqi government replaced Swiss dinars with Saddam dinars, but the Swiss dinars continued to circulate in the Kurdish regions of Iraq due to concerns about inflation of the new notes. This example demonstrates that its possible for a currency like Bitcoin to maintain its value.

Will Bitcoin succeed? There are two primary threats to Bitcoins success: government intervention and competition. Of the two, competition is probably the bigger concern, as discussed below.

Bitcoin is famous for being a facilitator of illegal activities such as drug dealing and gambling. The pseudonymous nature of Bitcoin makes it more difficult to use money-tracking methods to catch bitcoin-based drug dealers, gamblers, money launderers, and criminals. In the long run, if Bitcoin begins to replace the dollar, the feasibility of enforcing an income tax may become a major concern since bitcoin income can easily be hidden. Governments may decide that these concerns constitute grounds for banning Bitcoin.

There was a case in 2009 where the US Government successfully prosecuted a company that was producing a gold- and silver-backed private currency called "Liberty Dollars". The case was based on the charge that the liberty dollars resembled and competed with US dollars. Bitcoin, however, could not be dealt with in the same way since bitcoins dont resemble US dollars at all. Plus, there would be nobody to prosecute.

It would be quite difficult to enforce a ban on Bitcoin due to its distributed nature. Even if a ban worked, it would just push Bitcoin underground in the country that banned it. The system would still continue to operate normally in countries without a ban, and underground users would find ways to avoid being caught (by using the Tor service, for example).

A more likely threat to Bitcoins success is its competition. Since the introduction of Bitcoin, several alternative currencies have sprung up. These alternatives claim to have advantages over Bitcoin, though none yet rival Bitcoin in popularity. Bitcoin definitely has the first-mover advantage, but if a competitor manages to become noticeably superior, there could be an exodus from Bitcoin. Commentators have criticized Bitcoin in various ways, most notably on its inability to scale to larger transaction volumes. However, Bitcoin developers are actively improving the system and these criticisms could be addressed before competitors get off the ground.

]

Despite this extreme volatility, the price has trended upward and will likely continue in this direction if Bitcoin sees further adoption. So while holding bitcoins is by no means a safe investment, it has the potential to be a good investment.

Chapter 2

Using Bitcoin

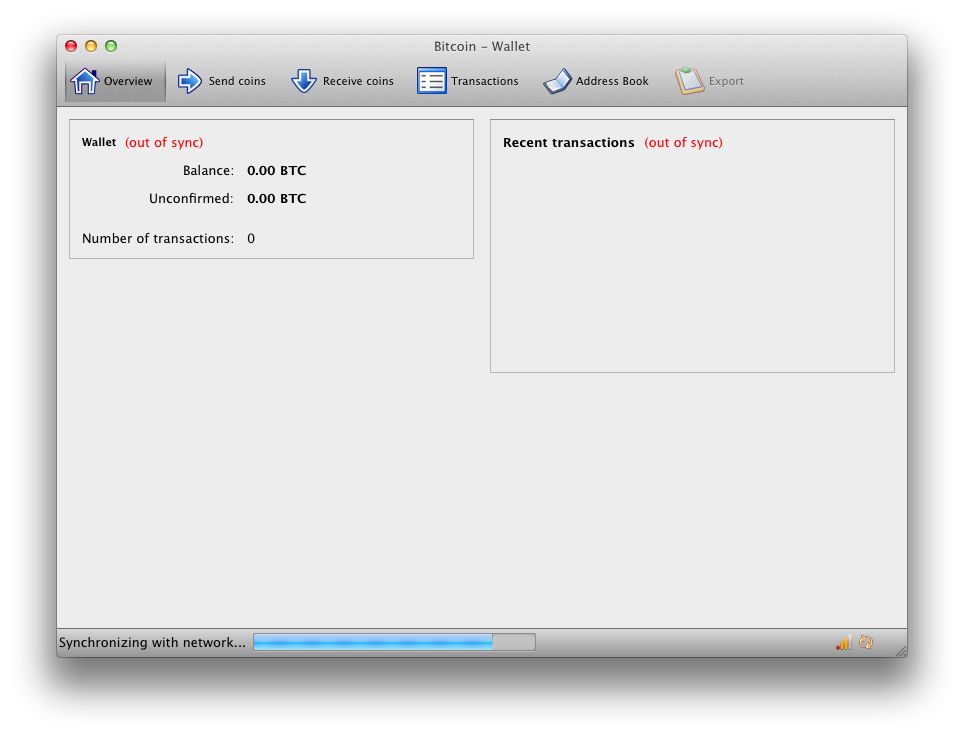

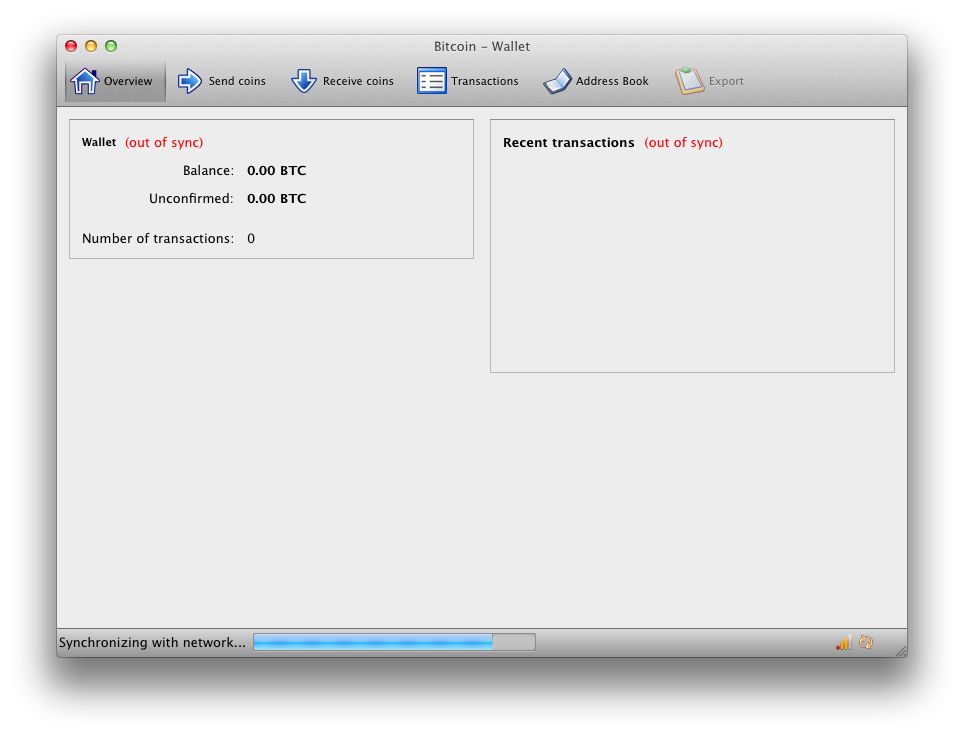

2.1 Wallets

To get started with Bitcoin, you need a wallet to hold your bitcoins. See

bitcoin.org/en/choose-your-wallet

for a list of options. The options for obtaining a wallet are:

- Running a bitcoin client on your computer or smartphone (clients come with wallets).

- Using a service that manages your wallet for you.

Using a service may be somewhat easier, but you really have to trust the service because they can potentially lose or steal your bitcoins. Since transactions are pseudonymous, they could even steal your bitcoins and tell you they lost them and you wouldnt know the difference! So it is recommended that you run a Bitcoin client. There are several clients available currently. The original Bitcoin client is called Bitcoin-Qt or the "Satoshi Client". The rest of this section will assume that you are using the Bitcoin-Qt client.

![Brian Kelly [Brian Kelly] - The Bitcoin Big Bang: How Alternative Currencies Are About to Change the World](/uploads/posts/book/119681/thumbs/brian-kelly-brian-kelly-the-bitcoin-big-bang.jpg)