Grateful acknowledgement is made to the following for permission to quote excerpts:

From the Herbert B. Swope Collection, Howard Gotlieb Archival Research Center at Boston University.

Bernard M. Baruch Papers. Mudd Manuscript Library. Department of Rare Books and Special Collections. Princeton University Library.

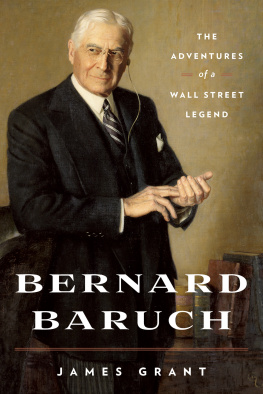

Bernard Baruch: The Adventures of a Wall Street Legend 2012 by James Grant. All rights reserved. Printed in the United States of America. No part of this book may be used or reproduced in any manner whatsoever without written permission except in the case of brief quotations used in critical articles and reviews.

Preface

B ernard M. Baruch and I were at each others sides for four years, he in posthumous, archival form. We had our ups and downs together. I began work on his biography with the hypothesis that there was less to the legendary investor and mythical Adviser to Presidents than met the eye. Bringing out the truth, I hoped to put a famous American life in the context of almost a century of American financial history.

I was successful in one thing, at least. I was able to show conclusively that Baruch, as a moneymaker, was only human. Thus, he did not sell out at the top in 1929he was, indeed, bullisha fact that may prove to be of more than academic interest in the highly speculative market environment of 1996. However, what I quickly came to understand was that this fallibility was worthy and appealing. Certainly, the success that the mortal Baruch enjoyed through trial and error was harder won than any that the legendary Baruch might have achieved through pure clairvoyance. My skepticism turned to admiration.

And presently, admiration was mingled with affection. As I read Baruchs correspondence and talked to some of his surviving friends, I began to like him. (I nearly laughed myself sick at the idea of your looking dignified at the time the degree was conferred upon you, Baruch wrote to his old friend Frank Kent, star political columnist of the Baltimore Sun , on the occasion of Kents receiving an honorary degree for which Baruch had nominated him. Your poor wife! Your poor wife!) I, too, became his friend. And then, as the years passed and as my research moved into the public phase of his career, all previous feelings gave way to an overwhelming sense of exasperation. By the time the first book was published, in 1983, I was glad to see the back of him. Then, again, I have no doubt, Baruch would have been delighted to be done with me.

The differences in our lifestyles were unbridgeable. Baruch, who was born in 1870 and died in 1965, lived in a Fifth Avenue mansion, a South Carolina plantation, and a Scottish castle, among other splendid addresses. He loved hunting, racing, boxing, motoring, speculating, and passing the time of day with his boon companions. He would travel to Saratoga for the racing season and to Europe to take the waters. He was a mans man and a ladies man all at the same time. The circle of his friends naturally tended to exclude biographers, harmless, bookish people who are always writing (or preparing to write or pretending to write) and who tend to talk about little except their subjects. Baruch loved to talk about himself, but even for him there were limits.

The paucity of sex in this book (with which I was taxed by some readers after its first publication in 1983) can be put down to my determination to hold to the same high evidentiary standards in romance and adultery as in speculation. The unintended consequence of this scruple is the impression conveyed through omission that Baruch was not very interested in the opposite sex, that his marriage was a success, or both. Neither was true, in fact. The evidence on this score, although circumstantial, is strong and convincing. Baruchs marriage having become a formality, he ardently sought female companionship outside of it. He loved women and they him.

As for the financial side of things, previously untapped primary sources helped to shed new light on Baruchs speculative and investment methods. These sources included the documents in which Baruch carried out some stock market-related litigation, the minutes of the New York Stock Exchange deliberations in which he participated anda particular gold minethe correspondence that traced his venture-capital investment in what was to become the Texas Gulf Sulfur Company. I studied his brokerage house records from the late 1920s and early 1930s and old documents, interesting and otherwise, from the State Department and the Federal Bureau of Investigation. None of these, I think, had been cited before.

Rereading my record of Baruchs life, I thought that the speculator particularly distinguished himself at the Versailles Peace Conference. In service of his hero Woodrow Wilson, Baruch brought a rare and valuable common sense to the economic negotiations, in the process crossing swords with John Maynard Keynes. As a rule, Baruchs pronouncements on public issues were oracular or platitudinous, and he was a tireless defender of the institution of the garrison state, from which the end of the Cold War has delivered us. At Versailles, however, his special Wall Street intelligenceintuitive, incisive, down-to-earth, impatient for results, focused on future outcomeswas just what the historical moment seemed to need.

My politics are libertarian, whereas Baruchs were not. Or, more correctly, his were usually not. Sometimes, he was the epitome of the Grover Cleveland Democrat, a proponent of limited government, hard money, and individual liberty. More often, he seemed to profess something else. In the political arena, he seemed to have no clear purpose, except patriotically to advance the interests of the United States as he understood them. Once he condensed his ideological contradictions into a single sentence of moderate length: I have unlimited faith in the American people taking care of themselvesif they are told what to do and why.

In finance, in clear distinction, his life was purposeful, artful, and even inspirational. In the stock market, he realized harrowing losses as well as fabulous gains. In venture capital, he sometimes miscalculated (as with his attempted rehabilitation of the Wabash Pittsburgh Terminal Railway Company); or, calculating correctly, he sometimes committed himself too timidly (as in Texas Gulf). He did not buy the market at the 1932 bottom any more than he sold it at the 1929 top. Still, he made his millions, and, more impressively, he kept them. If he bought too little, sold too soon, or seemed on occasion to be otherwise risk-averse, it was perhaps because he was mainly risking his own money. He was a freelance capitalist, a type rarely seen in the institutionalized financial markets of the late twentieth century.

At this writing, the stock market is higher and more popular than it has ever been before, and the idea that a mutual fund is little riskier than an insured savings account has gained credence. Baruch would have disagreed, I suspect, although there can be no telling how he might have been positioned in this, the greatest bull market ever. Possibly, he would be even more bullish than the next fellow, as, indeed, he was in the terminal phase of the Coolidge boom. Baruchs speculative genius was his traders flexibility. What he said (or was quoted as saying) was less important than how he acted. That he was able to regain his bearings and salvage the greater part of his fortune during the long bear market of the early 1930s was a feat of discipline that every investor must admire.

Baruch was an old-fashioned millionaire who had less money than the public imagined but more than enough to live as the public imagined that every millionaire should live. Was his a happy life? He was a poor father, he presided over no railroad (a lifelong ambition), and he spent the last several decades of his political career on the outside looking in. However, he was exceptionally happy in his own skin. His vanity was pure and innocent. What a fine figure of a man I am, he would say, meaning every word of it. Walking down Madison Avenue in New York, he would beam at passersby, trusting that they would beam back at him, which they often did.