1. Begin with the End in Mind

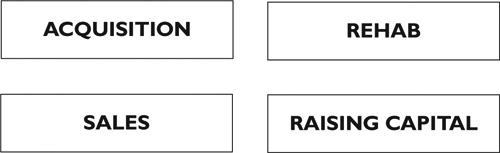

This is how our business works. Keith sat across from me at his desk and drew four boxes on a piece of white notebook paper. Inside each box he wrote:

Keith explained that in order for his fix-and-flip business to operate efficientlyand profitablyhe had to have someone dedicated to each box. In the beginning, it was just Keith and his business partner, so they split the four. However, as their company grew they hired staff to help out with all of the boxesit was the only way they could reach their goal of flipping 20 houses a month.

My church pastor introduced me to Keith in April 2009. I was broke and needed to find a way to survive in the post-boom era. Like a lot of real estate investors from 2004 to 2006, I rode the housing market wave like a drunken surfer. I owned 65 houses (lease-option deals and rental properties I acquired during this time), had a net worth of $8 million, and a bank account with an average daily balance of $175,000.

While I lived in a modest house in a middle-class suburb of Phoenix, I had a voracious appetite for shiny stuff. I bought a $100,000 Mercedes-Benz, a $65,000 ski boat, and a $10,000 Rolex watch. And because it gets a little toasty here in the summertime I purchased a $400,000 cabin in the mountains near Flagstaff.

Then the music stopped in 2007, and I didnt have a chair. Although my acquisition strategy was conservative (I never paid more than 70% of retail value for a house) there was no way I could know market values here would plummet by more than 60%. By 2009, I had lost my entire real estate investment portfolio. I sold the car, the boat, and the Rolex to help pay the bills. The bank foreclosed on my cabin. My wife went back to work after staying home with my daughters for 5 years, and I went looking for a job.

So needless to say, when Keith and I first met (at a Starbucks, because thats where all real estate meetings take place), I was a financial mess. Little did I know at the time that this would be the most fateful, and profitable, meeting of my life.

Keith did most of the talking. He explained how his commercial and land development businesses sufferedand collapsedin 2008. However, he and his partner were now doing something that was working.

I was surprised by how open and honest he was. Our three-hour meeting flew by without me having a chance to talk about my situation. We made plans to meet again in a few weeks. But just before Keith walked away he asked me about my background. I told him how I had bought and sold over 200 single-family homes from 20022006. When the market crashed, my wife and I lost everything.

The following morning Keith called and asked to meet again right away. It turns out that something he and his partner were working on was a fix-and-flip business. They were buying homes at foreclosure auctions (known as trustees sales in Arizona), fixing them up and flipping them for modest profits.

They wanted to expand into another part of town and needed help. Because of my real estate background, Keith brought me on board to help him manage their growing operation. A few months later he would hire me as his Realtor as well.

Of course, I was grateful for the opportunity. The housing market crash of 2008 had wiped me out, emotionally and financially. I needed the cash, and I needed someone to show me how to run a fix-and-flip business in the post-boom era.

It didnt take long for me to figure out how to leverage Keiths success and start raising capital to do my own flip deals. My business partner and friend, Manny Romero, already had cash lined up for us to get started. We flipped 8 houses the second half of 2009, 32 in 2010 and 20 in 2011 (we did fewer last year because we started focusing on higher price points).

Like Keith and his business partner when they first started, Manny and I split the four boxes. My focus is on the acquisition and sales side of the model, while Manny oversees our rehabs and raises new capital so we can do more deals. In 2012, well flip around 40 houses. By the end of 2012, our goal is to operate in just one box each, hire staff for the other two boxes, and flip six to eight houses a month.

We have the blueprint to do it. And after you read Fixing and Flipping Real Estate: Strategies for the Post-Boom Era , you will too.

Begin with the End in Mind

Make no mistakefixing and flipping is a business.

Treat this enterprise as anything other than that, and you will fail. Ive met a few so-called real estate investors in the past that operated their businesses like a hobby. They started out well enough. But eventually running things fast and loose cost them everything.

Dont run your business like a hobby, because hobbies are expensive. Youre not building model airplanes or scrapbooking family photo albums. This is a capital-intensive enterprise that requires attention to detail.

Now, with that little disclaimer out of the way lets get your fix and flip business started. To begin, youll need to determine what your income goal is and then decide what exit strategy best suits your personality.

GET YOUR BOOKS IN ORDER

Whether you plan to flip one house a year, or 20, its important to understand basic accounting principles. I recommend you take a bookkeeping class and use QuickBooks software, or its equivalent, to manage your assets and track expenses. This is especially important if you plan to raise private capital to do more deals (Ill cover this topic later in the book). Sophisticated investors will want to see a profit-and-loss statement and your balance sheet before they invest money.

Income Goal

I net about $10,000 in profit per flip. On higher end deals its more, but to keep it simple lets just say I net $10,000. If my income goal is to earn $120,000 per year I have to flip 12 houses, one per month.

Once I buy a house it takes four to seven days to complete the rehab and another two to three weeks to get it under contract. Most buyers need at least 30 days to close, usually a little more. So, to be on the safe side I estimate it will take 90 days to go from acquisition to rehab to payday.

The average acquisition price for a house that meets my buying criteria is $200,000. If I use a private lender to finance 75% of the purchase price (Ill explain the benefits of leverage in a later chapter) then $50,000 will be required for the down payment. Throw in another $15K$20K in rehab costs, plus $8K$10K in holding costs, and the grand total is $80,000 of working capital required.

But $80,000 in cash will only net me $40,000 annually (if it takes 90 days to go from acquisition to rehab to payday then I can only do 4 deals a year). I want to earn $120,000 a year flipping houses.

In order to close one deal a month Ill need $240,000 in cash.

This is where it gets tricky and why its so important for you to understand how the four boxes work and your role in each one. For example, you may have one house in the remodeling phase, another thats actively for sale and another under contract. While all of this is going on you may have meet with a prospective investor thats interested in giving you some cash to do more deals.