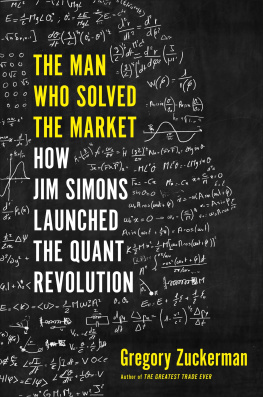

ALSO BY GREGORY ZUCKERMAN

For Adult Readers:

The Frackers

The Greatest Trade Ever

For Young Readers:

Rising Above

Rising Above: Inspiring Women in Sports

Portfolio / Penguin

An imprint of Penguin Random House LLC

penguinrandomhouse.com

Copyright 2019 by Gregory Zuckerman

Penguin supports copyright. Copyright fuels creativity, encourages diverse voices, promotes free speech, and creates a vibrant culture. Thank you for buying an authorized edition of this book and for complying with copyright laws by not reproducing, scanning, or distributing any part of it in any form without permission. You are supporting writers and allowing Penguin to continue to publish books for every reader.

Grateful acknowledgment is made for permission to reprint the following photographs:

: Courtesy of Lee Neuwirth Lee Neuwirth

: Courtesy of Seth Rumshinsky

: Photo by Rick Mott, taken at the NJ Open Go Tournament, provided with permission, courtesy of Stefi Baum

: Courtesy of Brian Keating

: Courtesy of David Eisenbud

: Courtesy of Wall Street Journal and Jenny Strasburg

: Patrick McMullan/Getty Images

ISBN 9780735217980 (hardcover)

ISBN 9780735217997 (ebook)

ISBN 9780593086315 (international edition)

Jacket design: Karl Spurzem

Jacket image: (equations) Virtualphoto / Getty Images

Version_2

CONTENTS

To Gabriel and Elijah

My signals in the noise

CAST OF CHARACTERS

James Simons

Mathematician, code breaker, and founder of Renaissance Technologies

Lenny Baum

Simonss first investing partner and author of algorithms that impacted the lives of millions

James Ax

Ran the Medallion fund and developed its first trading models

Sandor Straus

Data guru who played key early role at Renaissance

Elwyn Berlekamp

Game theorist who managed the Medallion fund at a key turning point

Henry Laufer

Mathematician who moved Simonss fund toward short-term trades

Peter Brown

Computer scientist who helped engineer Renaissances key breakthroughs

Robert Mercer

Renaissances co-CEO, helped put Donald Trump in the White House

Rebekah Mercer

Teamed up with Steve Bannon to upend American politics

David Magerman

Computer specialist who tried to stop the Mercers political activities

A TIMELINE OF KEY EVENTS

1938

Jim Simons born

1958

Simons graduates MIT

1964

Simons becomes code breaker at the IDA

1968

Simons leads math department at Stony Brook University

1974

Simons and Chern publish groundbreaking paper

1978

Simons leaves academia to start Monemetrics, a currency trading firm, and a hedge fund called Limroy

1979

Lenny Baum and James Ax join

1982

Firms name changes to Renaissance Technologies Corporation

1984

Baum quits

1985

Ax and Straus move the company to California

1988

Simons shuts down Limroy, launches the Medallion fund

1989

Ax leaves, Elwyn Berlekamp leads Medallion

1990

Berlekamp departs, Simons assumes control of the firm and fund

1992

Henry Laufer becomes full-time employee

1993

Peter Brown and Robert Mercer join

1995

Brown, Mercer achieve key breakthrough

2000

Medallion soars 98.5 percent

2005

Renaissance Institutional Equities Fund launches

2007

Renaissance and other quant firms suffer sudden losses

2010

Brown and Mercer take over firm

2017

Mercer steps down as co-CEO

INTRODUCTION

You do knowno one will speak with you, right?

I was picking at a salad at a fish restaurant in Cambridge, Massachusetts, in early September 2017, trying my best to get a British mathematician named Nick Patterson to open up about his former company, Renaissance Technologies. I wasnt having much luck.

I told Patterson that I wanted to write a book about how James Simons, Renaissances founder, had created the greatest moneymaking machine in financial history. Renaissance generated so much wealth that Simons and his colleagues had begun to wield enormous influence in the worlds of politics, science, education, and philanthropy. Anticipating dramatic societal shifts, Simons harnessed algorithms, computer models, and big data before Mark Zuckerberg and his peers had a chance to finish nursery school.

Patterson wasnt very encouraging. By then, Simons and his representatives had told me they werent going to provide much help, either. Renaissance executives and others close to Simonseven those I once considered friendswouldnt return my calls or emails. Even archrivals begged out of meetings at Simonss request, as if he was a Mafia boss they dared not offend.

Over and over, I was reminded of the iron-clad, thirty-page nondisclosure agreements the firm forced employees to sign, preventing even retirees from divulging much. I got it, guys. But come on. Id been at the Wall Street Journal for a couple of decades; I knew how the game was played. Subjects, even recalcitrant ones, usually come around. After all, who doesnt want a book written about them? Jim Simons and Renaissance Technologies, apparently.

I wasnt entirely shocked. Simons and his team are among the most secretive traders Wall Street has encountered, loath to drop even a hint of how theyd conquered financial markets, lest a competitor seize on any clue. Employees avoid media appearances and steer clear of industry conferences and most public gatherings. Simons once quoted Benjamin, the donkey in Animal Farm, to explain his attitude: God gave me a tail to keep off the flies. But Id rather have had no tail and no flies. Thats kind of the way I feel about publicity.

I looked up from my meal and forced a smile.

This is going to be a battle.

I kept at it, probing defenses, looking for openings. Writing about Simons and learning his secrets became my fixation. The obstacles he put up only added allure to the chase.

There were compelling reasons I was determined to tell Simonss story. A former math professor, Simons is arguably the most successful trader in the history of modern finance. Since 1988, Renaissances flagship Medallion hedge fund has generated average annual returns of 66 percent, racking up trading profits of more than $100 billion (see Appendix 1 for how I arrive at these numbers). No one in the investment world comes close. Warren Buffett, George Soros, Peter Lynch, Steve Cohen, and Ray Dalio all fall short (see Appendix 2).

In recent years, Renaissance has been scoring over $7 billion annually in trading gains. Thats more than the annual revenues of brand-name corporations including Under Armour, Levi Strauss, Hasbro, and Hyatt Hotels. Heres the absurd thingwhile those other companies have tens of thousands of employees, there are just three hundred or so at Renaissance.