| Trading Sardines - Lessons in the Markets from a Lifelong Trader |

| Linda Bradford Raschke |

| Riddler (Feb 2022) |

|

| Tags: | Trading, Stocks, Financial Markets |

| Tradingttt Stocksttt Financial Marketsttt |

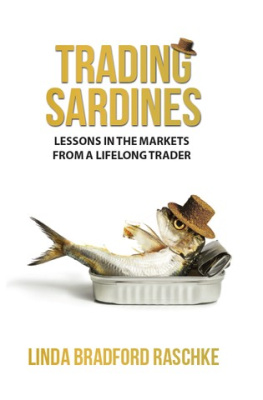

Trading Sardines celebrates grit and resilience in the financial markets.

It is a hilarious, honest, and poignant account of the evolution of a professional trader over nearly four decades. From the raucous trading floors of the early eighties to the days of giant server racks thirty years later, the reader takes a chronological trip through the markets, trading strategies, and unimaginable events, watching how one woman responds with unblinking honesty.

Linda Raschke shares a lifetime of market lessons while highlighting the tension between luck, risk, and passion. Along the way, she shows that perseverance can overcome the most inconceivable challenges, both in life and in trading. Her stories, documented with charts and photos, will keep you captivated and prove that humor may just be the key ingredient for survival. You wont hear these types of tales anywhere elsethis is the REAL world of trading.

This book will motivate every trader, no matter the level of proficiency and experience. Lindas success is testimony that you dont have to be perfect, you just have to stay in the game.

About the Author

Linda Bradford Raschke (born 1959) is an American trader, investor and hedge fund manager. She held memberships on the Pacific Stock Exchange and the Philadelphia Stock Exchange in the early eighties before founding LBRGRoup, a CTA (Commodity Trading Advisor).

She started several successful hedge funds, both onshore and offshore, and rose to the top of the ranks in hedge fund performance. She is mentioned in many trading books, including Jack Schwagers New Market Wizards. She lives in Florida and Illinois with her husband Damon, and her horses, where she continues to actively trade and invest.

She holds a BA in Economics and in Music Composition from Occidental College (1980).

Title Page

Trading

Sardines

LESSONS IN THE MARKETS

FROM A LIFELONG TRADER

LINDA BRADFORD RASCHKE

Inner Flap

Trading Sardines celebrates grit and resilience In financial markets. It is a hilarious, honest, and poignant account of the evolution of a professional trader over decades. From the raucous trading floors of the early eighties to the days of server racks thirty years later, the reader takes chronological trip through the markets, trading strategies and unimaginable events, watching how one woman responds with unblinking honesty.

Linda Raschke shares a lifetime of market lessons while highlighting the tension between luck, risk, and passionand the dangers and joys that it brings. Along the way, she shows that perseverance can overcome any challenges, both in life and In trading. Her stories, documented with charts and photos, will keep you laughing and prove that humor may Just be the key Ingredient for survival. You wont hear these types of tales anywhere elsethis Is the REAL world of trading.

This book will motivate every trader, no matter the level of proficiency and experience. Lindas success is testimony that you dont have to be perfect, you just have to stay in the game.

Readers of this book have a fantastic chance to gain Invaluable insights and lessons from Lindas own trading journeynot just in terms of her trading methodology, but more interestingly the specific behaviors and habits that she has built around her trading and, perhaps most valuable of all her mindset and how she developed her mental approach to trading the markets. This is a fascinating, enjoyable, humorous, and essential read for anyone who is interested In knowing both how to achieve trading success, and even more Importantly how to sustain it

Steve Ward, Performance Coach

CONTENTS

ADVANCE REVIEWS

The more you actually know, the less confident you become. I advise you not to read any books. Including this one.

Charles Dow

I did not learn how to trade the markets from reading this book. It is a rip-off.

Jesse Livermore

The author should not have gotten back up on her horse when she fell off.

Richard Wyckoff

I did not understand the angle this book was taking. Clearly, the author is making this up.

William Gann

The sequence of stories in this book is confusing, it just doesnt add up. Retrace your steps directly out of the bookshop.

Leonardo Fibonacci

How dare this author write about a woman trader! Her credentials make her unqualified to write on this subject. Besides, I made more money than she ever did.

Hetty Green

This chick is ballsyshes cornering the market in books about women traders. It wont end well.

The Hunt Brothers

The only market women belong in is the supermarket, and this book belongs firmly in the discount bin.

Bernard Baruch

I experienced only waves of nausea reading this book. It has no forecasting value.

Ralph Elliott

This author needs to learn how to write. She sure cant trade. Cut your losses immediately.

George Douglass Taylor

This book is

compiled and gifted to book-lovers by

The Rddler

Epigraph

The Edge there is no honest way to explain it because the only people who really know where it is are the ones who have gone over.

Hunter S. Thompson

INTRODUCTION

I wrote this book because nobody could believe all the crazy things which have happened to me in the financial trading industry. When I was a market maker on the Philadelphia Stock Exchange, the specialist in the pit where I stood said, Truth is stranger than fiction. It is impossible to make these events up. I started out trading in San Francisco on the Pacific Coast Exchange where there was one of the best business libraries in the country. The first book I checked out was about catastrophe theory. This is a concept used to show how gradual changes to a system can produce sudden drastic results. A stock market crash is an obvious example. It never caught on as a legitimate model of price behavior because it had no predictive value. But it opened my eyes to the fact that there is so much that we cant model. We live in an abstract nonlinear world that is in conflict with our human biases.

Despite the increased awareness over the past two decades of black swans, fat tails, and chaotic events, otherwise known as outliers, people tend to be more comfortable engaging in straight lined thinking. Fuzzy variables are messy. The unknown is uncomfortable.

Yet trading is about decision making under uncertainty. This is my journey as a trader where my knack for being on the wrong side of outliers and unforeseen events is well beyond random. Some of the challenges and obstacles along the way were self-created. Some were plain old bad luck. But part of this story is about how to pull yourself up by the bootstraps yet one more time and keep a positive attitude. How to persevere, the work and single-mindedness required to succeed, and above all, how to maintain a healthy sense of humor to keep ones sanity.

It was not my intent to write an autobiography but to share some of the more interesting and useful lessons I learned on my journey. Hopefully, an astute trader will get some ideas to further their own research or see different ways of looking at things. For those who are newer to the financial trading industry, it might be an eye-opener as to how many potholes can pepper the road to success.

![Ryan Mallory [Ryan Mallory] - The Part-Time Trader: Trading Stock as a Part-Time Venture, + Website](/uploads/posts/book/124134/thumbs/ryan-mallory-ryan-mallory-the-part-time-trader.jpg)