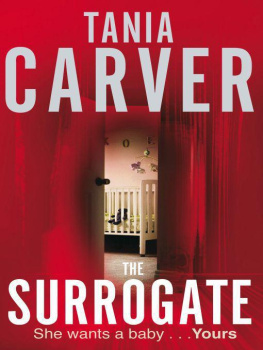

Tom Cain - Carver

Here you can read online Tom Cain - Carver full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2011, publisher: Transworld Publishers Limited, genre: Detective and thriller. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Carver

- Author:

- Publisher:Transworld Publishers Limited

- Genre:

- Year:2011

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

- 80

- 1

- 2

- 3

- 4

- 5

Carver: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Carver" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Carver — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Carver" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Sam Carver faces his most deadly challenge yet

The collapse of Lehman Brothers in September 2008 sent shockwaves around the world. Never before had such a large and prestigious bank been allowed to fail, and to fail so quickly. It began a domino effect, creating an international financial crisis that has affected us all. Theories abound as to the cause of the collapse the sub-prime bubble, bad management, even good old-fashioned greed.

But what if it was none of the above? What if Lehman Brothers was deliberately destroyed by a warped financial genius bent on a course of financial terrorism? What if that was only a dry run for an even bigger, bolder assault on the financial capital of the world: the City of London?

With the markets in meltdown and the life of the woman he loves at stake, Sam Carver has just five days to prevent an attack that could bring the global economy to its knees.

TOM CAIN

TRANSWORLD PUBLISHERS

6163 Uxbridge Road, London W5 5SA

A Random House Group Company

www.transworldbooks.co.uk

First published in Great Britain

in 2011 by Bantam Press

an imprint of Transworld Publishers

Copyright Tom Cain 2011

Tom Cain has asserted his right under the Copyright, Designs and Patents Act 1988 to be identified as the author of this work.

This book is a work of fiction and, except in the case of historical fact, any resemblance to actual persons, living or dead, is purely coincidental.

A CIP catalogue record for this book is available from the British Library.

Version 1.0 Epub ISBN 9781448110391

ISBNs 9780593067659 (cased)

9780593067666 (tpb)

This ebook is copyright material and must not be copied, reproduced, transferred, distributed, leased, licensed or publicly performed or used in any way except as specifically permitted in writing by the publishers, as allowed under the terms and conditions under which it was purchased or as strictly permitted by applicable copyright law. Any unauthorized distribution or use of this text may be a direct infringement of the authors and publishers rights and those responsible may be liable in law accordingly.

Addresses for Random House Group Ltd companies outside the UK can be found at:

www.randomhouse.co.uk

The Random House Group Ltd Reg. No. 954009

2 4 6 8 10 9 7 5 3 1

East Hampton, New York: 5 June 2007

MALACHI ZORN WALKED OUT of his house on Lily Pond Road and strolled across the grass to the path that led down to the beach. He was a man of medium height and slim build with tousled, dirty-blond hair, the year-round tan of a lifelong sportsman and a three-day growth of stubble that glowed golden in the bright early-summer sunshine. He wore an old Brooks Brothers button-down shirt whose pale-blue fabric had faded almost to white in places, and was frayed around the top of the collar. It hung loosely over a pair of khaki cargo shorts. His feet were bare.

He stopped for a moment and looked with disgust at the edifice rising on the plot next to his own. A hedge-fund manager had torn down the elegant, eighty-year-old house that had once stood there, and was now building a vast, white temple to tastelessness and excess. The new building dwarfed Zorns own traditional beach cottage, built in 1896 by a pupil of Stanford White, with its gabled roof, shingled walls and cosy veranda looking out towards the sea. His neighbours monstrosity summed up everything Zorn most despised about the amoral, self-enriching vulgarians who had turned Wall Street into a gigantic machine for extracting money from everyday Americans and pocketing the profit for themselves.

Fighting hard to contain the simmering rage that now threatened to ruin his day and, more importantly, distort his thinking, Zorn got moving again, relishing the warmth of the sand beneath his feet as he strolled to the waters edge and let the incoming waves ripple and eddy around his ankles. He stood for a while, looking out to sea, hardly taking in the view but using it as a backdrop to the inner workings of his mind. Finally, he gave a single decisive nod of his head, turned on his heels and walked back up to his property.

Five minutes later, having made a cup of strong, black coffee and picked a couple of home-baked cookies from a large glass jar, Zorn was back at his personal workstation. Racked in front of him were eight flat-panel screens, arranged in two rows of four. They showed a constant stream of real-time market data and global TV and internet news coverage. A yellow legal pad lay on his desk, next to an old Harvard University coffee cup filled with freshly sharpened HH pencils. Zorn picked up a Bluetooth telephone earpiece and put it on. He looked at the only other item on his desk: a twenty-year-old picture of his parents. This ones for you, he murmured, and punched a speed-dial number.

When the call was answered there were no hellos or small talk, just a simple instruction. I want to make a short call on Lehmans, Zorn said. Start with a hundred in three-month options. Be ready to write a lot more.

You sure, Mal? asked the voice on the other end of the line, with the carefully modulated tone of surprise that a broker reserves for a client about to embark on an insane course of action. Lehmans is trading at almost eighty, and its only moving up. Youve got a hundred million dollars says its gonna go the other way?

Yes.

OK. Well, its your money and youve always been right before, but

But nothing. Write the calls. And something else: whats the premium on Lehmans credit default swaps at the moment?

Less than a basis point, couple tenths, maybe but why do you want to know? You wanna bet that a one-hundred-and-fifty-year-old bank

Hundred-and-fifty-seven-year-old, to be precise.

Whatever youre saying that this great institution, the fourth biggest bank on the Street, is about to collapse?

Thats right. At some point over the next year or two, thats exactly what Im saying. Buy ten billion bucks of Lehmans CDSs. If people want to sell you more, buy it. Dont stop.

Youre risking millions, you know that?

Im risking a couple of tenths of one per cent of ten billion. Thats two mill a year downside, against ten billion up. Thats not a bad deal. So make it.

You got it

And my name is nowhere near this. Nowhere near it at all.

The Penthouse Executive Club, 45th St, New York City: 18 September 2008

How did you do it, Mal? I mean, you told me Lehmans would crash and burn. I thought you were totally fuckin nuts. And then it goes and does exactly what you said it would. So how come you were right and every other son of a bitch in this business was wrong?

Three days had passed since Lehman Brothers Bank filed for Chapter 11 bankruptcy, its share price evaporating from a high of eighty-two dollars to just three cents in a little over a year. After a weekend of desperate negotiations involving the heads of all the major Wall Street banks, US Treasury Secretary Hank Paulson, UK Chancellor Alistair Darling and senior executives from Bank of America (BoA) and Barclays, both of which had shown interest in buying the stricken bank, the Chief Executive Officer of Lehmans, Richard Fuld, and his board had been forced to admit defeat. Fulds reputation as one of the masters of the financial universe now lay in tatters, just like the institution for which he had been responsible. He was pleading poverty, too, but his critics werent convinced. They pointed to the estimated half a billion dollars Fuld had received from Lehmans between 2000 and 2007, none of which he was asked to return.

Font size:

Interval:

Bookmark:

Similar books «Carver»

Look at similar books to Carver. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Carver and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.