Jeffrey Archer

Not a Penny More, Not a Penny Less

I acknowledge all the help I received from so many people in writing this book and wish to thank them: David Niven, Jr., who made me do it, Sir Noel and Lady Hall who made it possible, Adrian Metcalfe, Anthony Rentoul, Colin Emson, Ted Francis, Godfrey Barker, Willy West, Madame Tellegen, David Stein, Christian Neffe, Dr John Vance, Dr David Weeden, the Rev. Leslie Styler, Robert Gasser, Professor Jim Bolton, and Jamie Clark; Gail and Jo for putting it together; and my wife, Mary, for the hours spent correcting and editing.

Jrg, expect $7 million from Crdit Parisien in the No. 2 account by 6 pm tonight, Central European time, and place it with first-class banks and triple A commercial names. Otherwise, invest it in the overnight Euro-dollar market. Understood?

Yes, Harvey.

Place $1 million in the Banco do Minas Gerais, Rio de Janeiro, in the names of Silverman and Elliott and cancel the call loan at Barclays Bank, Lombard Street. Understood?

Yes, Harvey.

Buy gold on my commodity account until it reaches $10 million and then hold until you receive further instructions. Try and buy in the troughs and dont rush be patient. Understood?

Yes, Harvey.

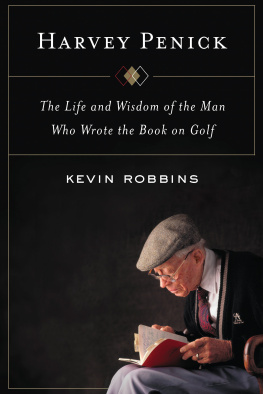

Harvey Metcalfe realized that the last instruction was unnecessary. Jrg Birrer was one of the most conservative bankers in Zrich and, more important to Harvey, had over the past twenty-five years proved to be one of the shrewdest.

Can you join me at Wimbledon on Tuesday, June 25th at 2 pm, Centre Court, my usual debenture seat?

Yes, Harvey.

The telephone clicked into place. Harvey never said good-bye. He had never understood the niceties of life and it was too late to start learning now. He picked up the phone, dialed the seven digits which would give him the Lincoln Trust in Boston, and asked for his secretary.

Miss Fish?

Yes, sir.

Remove the file on Prospecta Oil and destroy it. Destroy any correspondence connected with it and leave absolutely no trace. Understood?

Yes, sir.

The telephone clicked again. Harvey Metcalfe had given similar orders three times in the last twenty-five years and by now Miss Fish had learned not to question him.

Harvey breathed deeply, almost a sigh, a quiet exhalation of triumph. He was now worth at least $25 million, and nothing could stop him. He opened a bottle of Krug champagne 1964, imported from Hedges & Butler of London. He sipped it slowly and lit a Romeo y Julieta Churchill, which an Italian immigrant smuggled in for him in boxes of two hundred and fifty once a month from Cuba. He settled back for a mild celebration. In Boston, Massachusetts, it was 12.20 pm nearly time for lunch.

In Harley Street, Bond Street, the Kings Road and Magdalen College, Oxford, it was 6.20 pm. Four men, unknown to each other, checked the market price of Prospecta Oil in the final edition of the London Evening Standard. It was 3.70. All four of them were rich men, looking forward to consolidating their already successful careers.

Tomorrow they would be penniless.

Making a million legally has always been difficult. Making a million illegally has always been a little easier. Keeping a million when you have made it is perhaps the most difficult of all. Henryk Metelski was one of those rare men who had managed all three. Even if the million he had made legally came after the million he had made illegally, Metelski was still a yard ahead of the others: he had managed to keep it all.

Henryk Metelski was born on the Lower East Side of New York on May 17th, 1909, in a small room that already slept four children. He grew up through the Depression, believing in God and one meal a day. His parents were from Warsaw and had emigrated from Poland at the turn of the century. Henryks father was a baker by trade and had soon found a job in New York, where immigrant Poles specialized in baking black rye bread and running small restaurants for their country men. Both parents would have liked Henryk to be an academic success, but he was never destined to become an outstanding pupil at his high school. His natural gifts lay elsewhere. A cunning, smart little boy, he was far more interested in the control of the underground school market in cigarettes and liquor than in stirring tales of the American Revolution and the Liberty Bell. Little Henryk never believed for one moment that the best things in life were free, and the pursuit of money and power came as naturally to him as the pursuit of a mouse to a cat.

When Henryk was a pimply and flourishing fourteen-year-old, his father died of what we now know to be cancer. His mother outlived her husband by no more than a few months, leaving the five children to fend for themselves. Henryk, like the other four, should have gone into the district orphanage for destitute children, but in the mid-1920s it was not hard for a boy to disappear in New York though it was harder to survive. Henryk became a master of survival, a schooling which was to prove very useful to him in later life.

He knocked around the Lower East Side with his belt tightened and his eyes open, shining shoes here, washing dishes there, always looking for an entrance to the maze at the heart of which lay wealth and prestige. His first chance came when his roommate Jan Pelnik, a messenger boy on the New York Stock Exchange, put himself temporarily out of action with a sausage garnished with salmonella. Henryk, deputed to report his friends mishap to the Chief Messenger, upgraded food poisoning to tuberculosis, and talked himself into the ensuing vacancy. He then changed his room, donned a new uniform, lost a friend, and gained a job.

Most of the messages Henryk delivered during the early twenties read Buy. Many of them were quickly acted upon, for this was a boom era. He watched men of little ability make fortunes while he remained nothing more than an observer. His instincts directed him toward those individuals who made more money in a week on the Stock Exchange than he could hope to make in a lifetime on his salary.

He set about learning how to master the way the Stock Exchange operated, he listened to private conversations, opened sealed messages and found out which closed company reports to study. By the age of eighteen he had four years experience of Wall Street: four years which most messenger boys would have spent simply walking across crowded floors, delivering little pink pieces of paper; four years which to Henryk Metelski were the equivalent of a Masters Degree from the Harvard Business School. He was not to know that one day he would lecture to that august body.

One morning in July 1927 he was delivering a message from Halgarten & Co., a well-established brokerage house, making his usual detour via the washroom. He had perfected a system whereby he could lock himself into a cubicle, study the message he was carrying, decide whether the information was of any value to him and if it was, immediately telephone Witold Gronowich, an old Pole who managed a small insurance firm for his fellow countrymen. Henryk reckoned to pick up an extra $20 to $25 a week for the inside knowledge he supplied. Gronowich, in no position to place large sums on the market, never let any of the leaks lead back to his young informant.

Sitting on the lavatory seat, Henryk began to realize that this time he was reading a message of considerable importance. The Governor of Texas was about to grant the Standard Oil Company permission to complete a pipeline from Chicago to Mexico, all other public bodies involved having already agreed to the proposal. The market was aware that the company had been trying to obtain this final permission for nearly a year, but the general view was that the Governor would turn it down. The message was to be passed direct to John D. Rockefellers broker, Tucker Anthony, immediately. The granting of this permission to build a pipeline would open up the entire North to a ready supply of oil, and that could only mean increased profits. It was obvious to Henryk that Standard Oil stock must rise steadily on the market once the news had broken, especially as Standard Oil already controlled 90 per cent of the oil refineries in America.