1. Introduction to Blockchain

Blockchain is the new wave of disruption that has already started to redesign business, social and political interactions, and any other way of value exchange. Again, it is not just a change, but a rapid phenomenon that is already in motion. As of this writing, more than 40 top financial institutions and many different firms across industries have started to explore blockchain to lower transaction cost, speed up transaction time, reduce the risk of fraud, and eliminate the middleman or intermediary services. Some are trying to reimagine legacy systems and services to take them to a new level and also come up with new kinds of service offerings.

We will cover blockchain in greater detail throughout the book. You can follow through the chapters in the order presented if you are new to blockchain or pick only the ones relevant to you. This chapter explains what blockchain is all about, how it has evolved, and its importance in todays world with some uses and use cases. It gives an outside-in perspective to you to be able to delve deeper into blockchain.

Backstory of Blockchain

One of the first known digital disruptions that laid the foundation of the Internet was TCP/IP (Transmission Control Protocol/Internet Protocol ) back in the 1970s. Prior to TCP/IP, it was the era of circuit switching, which required dedicated connection between two parties for communication to happen. TCP/IP came up with its packet switching design, which was more open and peer-to-peer with no need to preestablish a dedicated line between parties.

When the Internet was made accessible to the public through the World Wide Web (WWW) in the early 1990s, it was supposed to be more open and peer-to- peer. This is because it was built atop the open and decentralized TCP/IP. When any new technology, especially the revolutionary ones, hits the market, either they fade away on their own, or they create such an impact that they become the accepted norm. People adapted to the WWW revolution and leveraged the benefits it had to offer in every possible way. As a result, the World Wide Web started shaping up in a way that might not have been the exact way it was imagined. It could have been more open, more accessible, and more peer-to-peer. Many new technologies and businesses started to build on top of it and it became what it is todaymore centralized. Slowly and gradually, people get used to what technology offers. People are just fine if an international transaction takes days to settle, or it is too expensive, or it is less reliable.

Let us take a closer look at the banking system and its evolution. Starting from the olden days of barter system till fiat currencies, there was no real difference between a transaction and its settlement because they were not two separate entities. As an example, if Alice had to pay $10 to Bob, she would just hand over a $10 note to Bob and the transaction would just get settled there. No bank was needed to debit $10 from Alices account and credit the same to Bobs account or to serve as a system of trust to ensure Alice does not cheat Bob. However, transacting directly with someone who is physically not present close by was difficult. So, banking systems evolved with many more service offerings and enabled transactions from every corner of the world. With the help of the Internet, geography was no more a limitation and banking became easier than ever. Not just banking for that matter: the Internet facilitated many different kinds of value exchange over the web.

Technology enabled someone from India to make a monetary transaction with someone in the United Kingdom, but with some cost. It takes days to settle such transactions and is expensive as well. A bank was always needed to impose trust and ensure security for such transactions between two or more parties. What if technology could enable trust and security without these intermediary and centralized systems? Somehow, this part (of technology imposing trust) was missing all through, which resulted in development of centralized systems such as banks, escrow services, clearing houses, registrars and many other such institutions. Blockchain proves to be that missing piece of the Internet revolution puzzle that facilitates a trustless system in a cryptographically secured way.

Satoshi Nakamoto, the pseudonymous name by which the world knows him, must have felt that the monetary systems were not touched by the technological revolution since the 1980s. Banks formed the centralized institutions that maintained the transaction records, governed interactions, enforced trust and security, and regulated the whole system. The whole of commerce relies on these financial institutions, which serve as the trusted third parties to process payments. The mediation of financial institutions increases cost and time to settle a transaction, and also limits the transaction sizes. The mediation was needed to settle disputes, but that meant that completely nonreversible transaction was never possible. This resulted in a situation where trust was needed for someone to transact with another. Certainly, this bureaucratic system had to change to keep up with the economys expected digital transformation. So, Satoshi invented a cryptocurrency called Bitcoin that was enabled by the underlying technology blockchain. Bitcoin is just one monetary use case of blockchain that addresses the inherent weakness of trust-based models. We will delve deeper into the fundamentals of both Bitcoins and blockchain in this book.

What is Blockchain?

The Internet has revolutionized many aspects of life, society, and business. However, we learned in the previous section that how people and organizations execute transactions with one another has not changed much in the past couple of decades. Blockchain is believed to be the component that completes the Internet puzzle and makes it more open, more accessible, and more reliable.

To understand blockchain, you have to understand it from both a business perspective and technical perspective. Let us first understand it in a business transaction context to get the what of it, and then look into the technicality to understand the how of it in the following chapters.

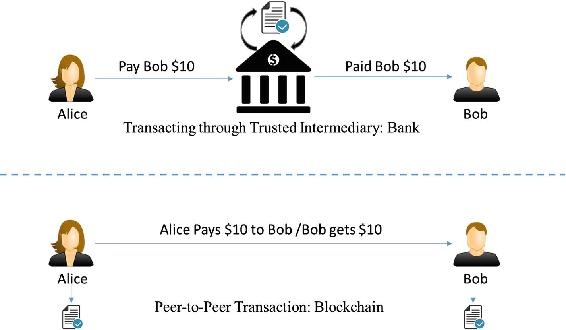

Blockchain is a system of records to transact value (not just money!) in a peer-to-peer fashion. What it means is that there is no need for a trusted intermediary such as banks , brokers, or other escrow services to serve as a trusted third party. For example, if Alice pays to Bob $10, why would it go through a bank? Take a look at Figure .

Figure 1-1

Transaction through an intermediary vs. peer-to-peer transaction

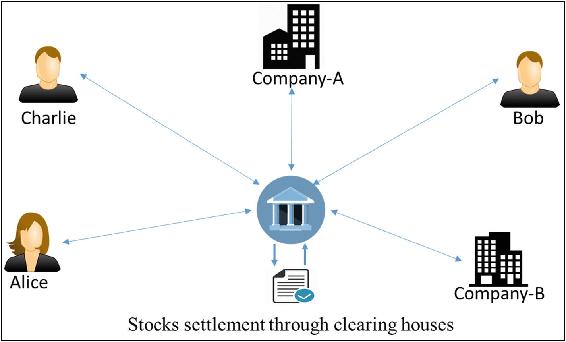

Let us look at a different example now. A typical stock transaction happens in seconds, but its settlement takes weeks. Is it desirable in this digital age? Certainly not! Figure demonstrates the current situation.

Figure 1-2

Stocks trading through an intermediary clearing house

If someone wants to buy some stocks from a company or a person, they can just directly buy it from them with instant settlement, with no need for brokers, clearing houses , or other financial institutions in between. A decentralized and peer-to-peer solution to such a situation can be represented as in Figure .

![Kirankalyan Kulkarni [Kirankalyan Kulkarni] - Learn Bitcoin and Blockchain](/uploads/posts/book/119684/thumbs/kirankalyan-kulkarni-kirankalyan-kulkarni-learn.jpg)