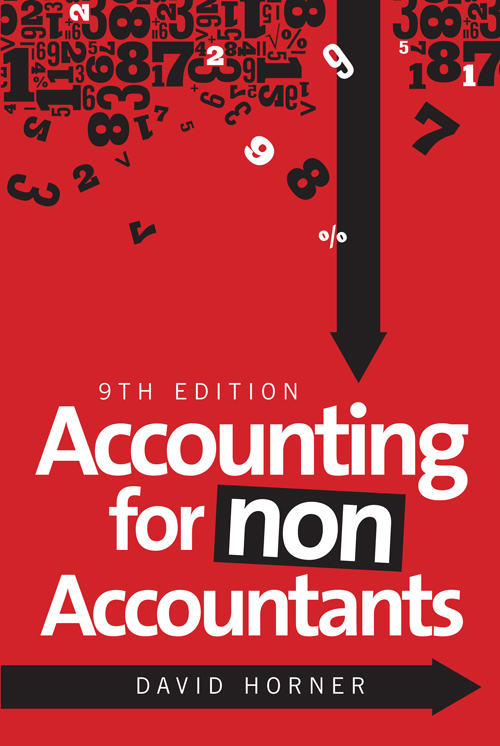

Note on the Ebook Edition For an optimal reading experience, please view large

tables and figures in landscape mode. |

This ebook published in 2013 by

Kogan Page Limited

120 Pentonville Road

London N1 9JN

UK

www.koganpage.com

Kogan Page, 2013

E-ISBN 9780749465988

CONTENTS

For Nancy Henwood

Thanks to Matthew Smith and Ian Hallsworth at

Kogan Page for their enthusiasm and support .

All businesses and many other types of organization will need to keep records of any financial transactions that take place. However, it makes sense to introduce some accounting terminology before we look at any system of recording financial transactions. We will begin by explaining some of the frequently used terms whose meaning may not be immediately obvious. These terms are assets , liabilities and capital :

A ssets are resources that are used within the business. These can take the form of physical resources used to facilitate production, such as premises and equipment. Assets can also include resources which are used as a part of the production process, such as materials that are going to be converted into goods, the cash used to purchase more assets and the outstanding amounts owed to the business by its customers.

L iabilities are debts of the business that are outstanding. These are any borrowings which the business will repay at some point in the future. These can be short-term debts which are to be repaid in the next few days, such as an expense which has yet to be paid, but can also be long-term debts not to be repaid until many years in the future, such as a mortgage.

C apital refers to the value of the owners resources placed within the business. This can take the form of money invested in the business but can also take the form of owners assets brought into business use, such as the owners vehicle. The withdrawal of capital from the business by the owner is known as drawings.

The capital, along with the liabilities of the business, enables the business to acquire assets which can be used as part of the business operations. This leads us to the accounting equation, which can be simply stated as follows:

Assets = Capital + Liabilities

This equation must always hold true. To explain why the equation always holds, we must consider what the equation is telling us that the resources in use within the business must have been financed either from the owners resources or by borrowing resources. Once the business has become established and if the business is profitable, we can modify the equation to allow assets to be financed out of the profits of the business in addition to the capital and liabilities.

The process of recording and maintaining records of financial transactions is known as bookkeeping. However, there are two types of bookkeeping that are commonly practised by business organizations single-entry and double-entry bookkeeping.

Very small businesses (usually one-person organizations known as sole traders) and other types of organization such as charities, clubs and other small not-for-profit organizations may keep their financial records through a process of single-entry bookkeeping where each transaction is recorded as one single entry.

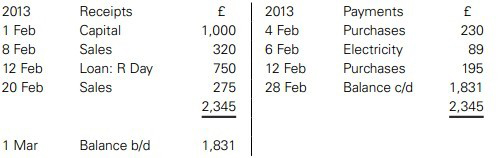

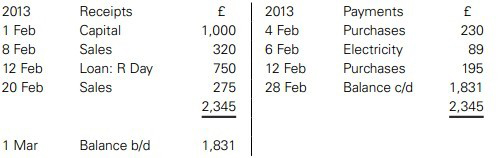

This is bookkeeping at it simplest and often can be as basic as the maintenance of only a receipts and payments account. An example of a receipts and payments account is shown in .

FIGURE 1.1 Receipts and payments account

This account shows all the monies received by the business and all the monies paid out by the business. The balance left over at the end of the month represents the current amount of money still left in the business bank account.

The receipts and payments account is more commonly known as a cashbook. The cashbook will record all transactions involving money either being received or being spent either in the form of cash or as money taken from or paid into the firms bank account.

If a firm maintains a receipts and payments account as its main financial record it will still need to keep records and details of the types of payment and types of receipt in each transaction. This will enable a firm to calculate the level of profit or loss generated. However, these extra details will often be kept in a memorandum form meaning that they are not part of the firms accounting system, but are there as financial records to provide information only.

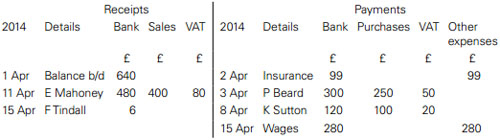

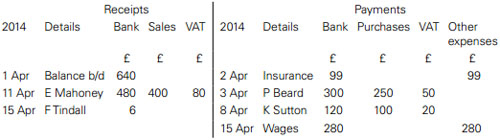

A more detailed variation on the cashbook can be used if managers want to monitor and control the type of expenses paid out by the firm more closely. A multi-column approach to the cashbook would be well suited to a business that wanted to keep records that show the effect of VAT (Value Added Tax) separately from its overall purchases and sales. An example of a multi-column cashbook appears in .

FIGURE 1.2 Multi-column cashbook

In the analysed columns enable a firm to keep records for VAT, which is necessary once firms reach a certain size (as measured by their sales turnover).

Problems with single-entry bookkeeping

Although popular with very small organizations, there are a number of limitations in relying on single-entry bookkeeping as a method of keeping financial records.

In the receipts and payments account, expenditure will appear but this does not allow the separation of expenditure on day-to-day running expenses and expenditure on assets. This is an important distinction for when a firm wants to calculate the level of profit for the period, assets would not normally be deducted as expenses.

Double-entry bookkeeping has a number of built-in checks, which means it is easier to spot mistakes with double-entry accounting (though mistakes still occur). Single-entry bookkeeping has no self-checking mechanism.

Attempting to control expenditure will require detailed records of where a business spends money. This is not easy unless there are separate records (ie individual accounts) maintained for each type of expense. This limitation can be minimized through the use of a multi-column cashbook.

Lack of full accounting records will make theft from the business by business employees more likely. Obviously a one-person organization will not face this problem.

Once a business begins to grow beyond a certain size and certainly once the maintenance of financial records moves beyond the very straightforward, it will make sense for the financial transactions of the business to be recorded using the double-entry system of bookkeeping. It is widely believed that the system of double-entry bookkeeping was developed and formally set out by Luca Pacioli in the late 15th century.

The term double-entry arises out of the fact that each and every financial transaction will require two entries. These are known as a debit entry and a credit entry and each will be recorded in a separate account. The account in which the transaction is recorded will depend on the nature of the transaction.

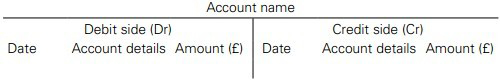

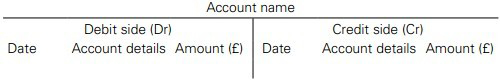

An example of how a double-entry account would appear is shown in .

FIGURE 1.3 Example of double-entry account presentation