Visit the URL below to access your free Digital Asset files that are included with the purchase of this book.

Why This Book Was Written

Hunting for a good beginner-level book on options trading can be a very frustrating endeavor. Many of the books that are labeled introduction to... or ...for beginners are written by high-level brokers or academics who have an annoying habit of talking over their readers heads and diving headfirst into Wall Street jargon without taking the time to properly explain the basics.

On the flip side, since options trading is such a fertile niche for new ideas, every John Doe and his brother has written a book on options trading, and, unfortunately, an enthusiastic options trader doesnt necessarily make a good writer. Advice from these writers can be not only confusing but also misleading and the results of following said advice can be alarming if not disastrous.

This book, however, was written with the goal of maximizing clarity and readability, all while providing an extensive look at the fundamentals of options trading. You should be more than ready to make your first few trades after reading this book.

| 1 | Option Basics

Throughout this book, well be talking about stock options . However, there are other types of options which you may delve into at a later time. Heres a definition of each from the folks at optionstrading.org .

- S tock Options : The underlying asset for these contracts is shares in a specific publicly listed company.

- I ndex Options : These are very similar to stock options, but rather than the underlying security being stocks in a specific company it is an index such as the S&P 500.

- F orex/Currency Options : Contracts of this type grant the owner the right to buy or sell a specific currency at an agreed rate.

- F utures Options : The underlying security for this type is a specified futures contract. A futures option essentially gives the owner the right to enter into that specified futures contract.

- C ommodity Options : The underlying asset for a contract of this type can be either a physical commodity or a commodity futures contract.

- B asket Options : A basket contract is based on the underlying asset of a group of securities which could be made up of stocks, currencies, commodities or other financial instruments.

But lets keep it simple for now. Consider this scenario as a way to understand the basic premise of stock options trading.

I know a fashion designer who is an eccentric genius. She makes incredible dresses that you just cant find anywhere else. Theres nothing like them! She makes them all by hand, and she does all the work herself. The only drawback is that she only makes these dresses in the summer, and she only makes about 10 of them each year.

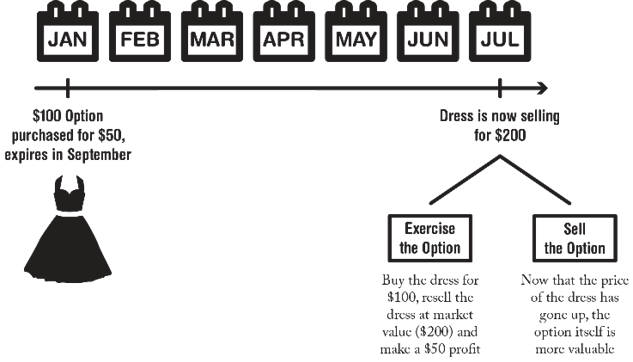

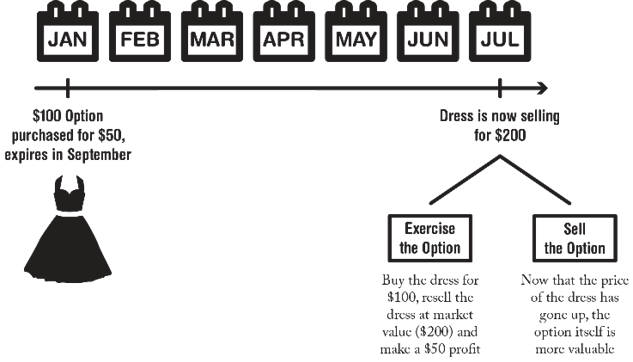

Its the middle of winter, and Ive made a deal to buy one of this designers summer dresses for a price of $100. Ive guaranteed the purchase using a contract. The contract states that I have the right to purchase a dress at $100 at any time before the third Friday of September. To secure my option to buy the dress, I paid a fee, or premium , of $50.

Note : This $50 is not a deposit or down payment. It will not be deducted from the $100 I will eventually pay to own a dress. The $50 premium is merely the price of my right to buy the dress for $100 before the third Friday in September.

In July, I decide to exercise my option to buy a dress. Per my contract, I pay $100 for the dress. On the same day I decide to go to the designers Etsy page and take a look at the other dresses shes selling. They are all priced at $200. I decide, rather than keeping the dress, to sell it to another party for $200. Since I paid only $100 plus the premium payment of $50, I profited $50 from my purchase of an option.

What are Options?

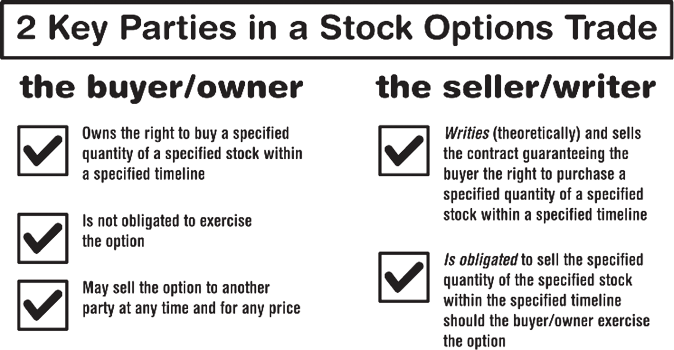

Options are contracts. They entitle a party to purchase or sell a specific asset (stock, real estate, merchandise) for a specific price within a certain window of time. They also oblige a separate party to sell or purchase the specific asset. For instance, in the example above, just as my option contract guaranteed me the right to buy the dress for $100, the dress maker was obliged to sell the dress for $100. In every option contract there is a buyer and a seller. One party, either the buyer or the seller , has an obligation to participate in a particular transaction per the dictates of the options contract. The other party, either the buyer or the seller , has the option to participate in a particular transaction per the dictates of the options contract. In the example above, I paid $50 for the option to buy a dress for $100 before the third Friday in September. Just because I owned this option does not mean that I was obliged to execute it. I was the owner or buyer of the option. The dressmaker, who was obligated to sell me the dress, was the writer or seller of the option.

What are Stocks?

If youre thinking about delving into the world of options, youre probably already familiar with stocks. But, just as a refresher a stock is a piece of a company. When a company decides to be a public company, it issues shares of stock for purchase by the general public. The more stocks or pieces you purchase, the more of the company you own, though, in most cases, unless you own thousands of shares, your piece is pretty small.

Now that you are technically a co-owner of this company, you are awarded a portion of the profits. If the company is performing at its best, your stock goes up in price and you see a profit, usually paid to you in the form of dividends, which are sums of money paid out to investors on a regular basis (usually quarterly). But if the company isnt performing well for one reason or another, you assume a loss. In this case, the dividends you receive are lower or, in some cases, you dont receive any at all.

In order to trade options, you DO NOT need to own stock in the company with which you are trading. However, if youre the writer/seller of the option, then owning the stock will lessen your risk. These are called covered options and well talk about them in a later chapter.

Options in the Stock Market

Though option contracts have been around in some form since the days of ancient Greece, it wasnt until 1973 that the trading of stock options became formally institutionalized in the Chicago Board Options Exchange (CBOE) . Prior to the CBOE, the general public was highly mistrustful of trading stock options. Contracts were difficult to enforce, and even brokers had a difficult time accurately pricing options. The CBOE saw to it that stock option contracts were all standardized and that a clearing corporation was formed (Options Clearing Corporation or OCC) that would be responsible for ensuring that contracts were enforced. There was still a lot of doubt about whether options trading would catch on with the general public, but after a few years in business, the CBOE was buzzing with trading activity. Since that time, options trading has become a persistent facet of major securities exchanges across the globe.