Thank you for downloading this Simon & Schuster eBook.

Join our mailing list and get updates on new releases, deals, bonus content and other great books from Simon & Schuster.

C LICK H ERE T O S IGN U P

or visit us online to sign up at

eBookNews.SimonandSchuster.com

We hope you enjoyed reading this Simon & Schuster eBook.

Join our mailing list and get updates on new releases, deals, bonus content and other great books from Simon & Schuster.

C LICK H ERE T O S IGN U P

or visit us online to sign up at

eBookNews.SimonandSchuster.com

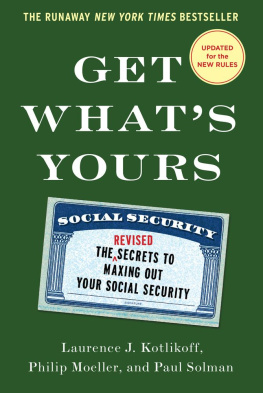

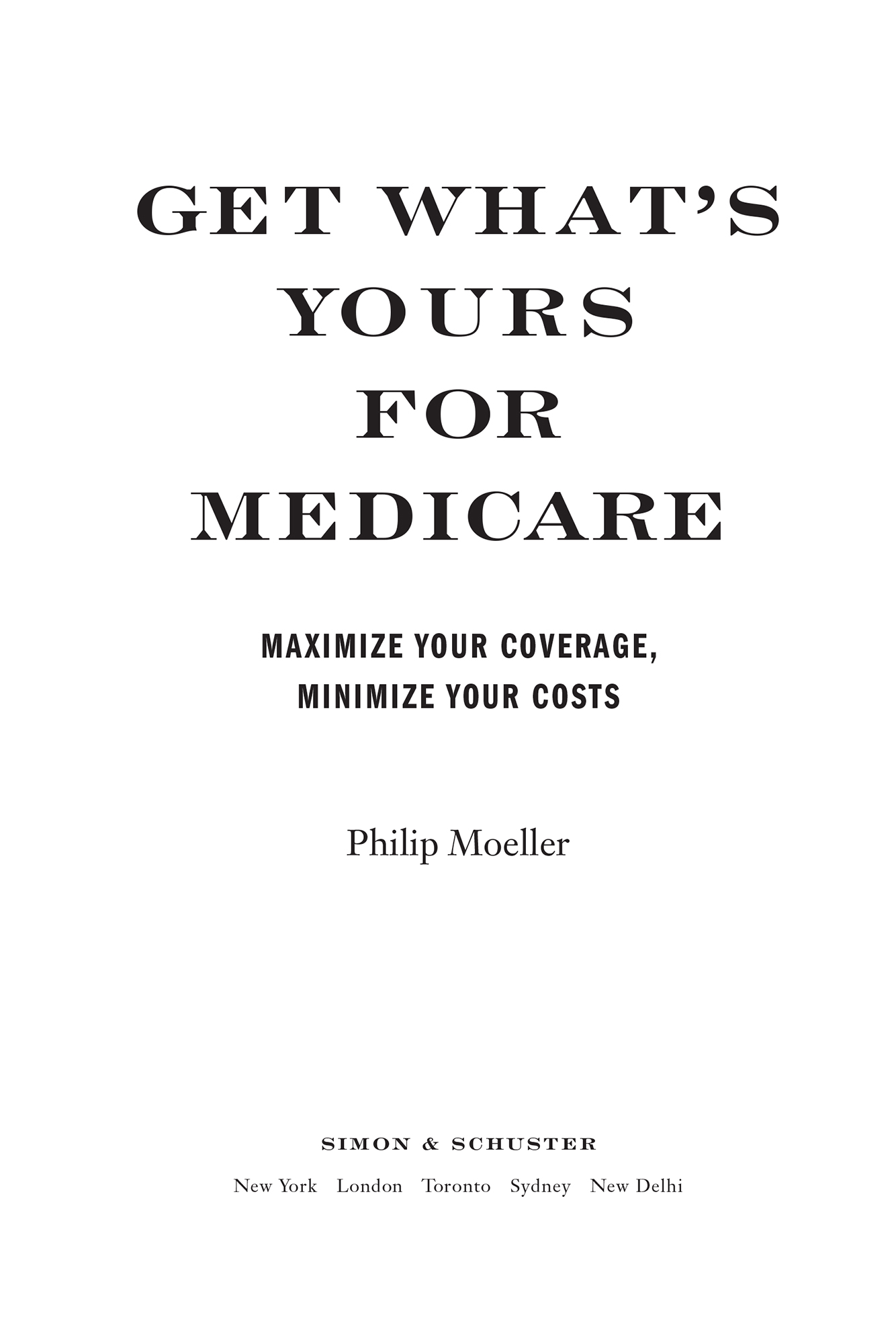

ALSO BY PHILIP MOELLER

Get Whats Yours: The Secrets to Maxing Out Your Social Security (with Laurence J. Kotlikoff and Paul Solman)

How to Live to 100: Be Healthy, Be Happy, and Afford It (with Lindsay Lyon and Kimberly Palmer)

Simon & Schuster

1230 Avenue of the Americas

New York, NY 10020

www.SimonandSchuster.com

Copyright 2016 by Philip Moeller

All rights reserved, including the right to reproduce this book or portions thereof in any form whatsoever. For information address Simon & Schuster Subsidiary Rights Department, 1230 Avenue of the Americas, New York, NY 10020.

First Simon & Schuster hardcover edition October 2016

SIMON & SCHUSTER and colophon are registered trademarks of Simon & Schuster, Inc.

For information about special discounts for bulk purchases, please contact Simon & Schuster Special Sales at 1-866-506-1949 or .

The Simon & Schuster Speakers Bureau can bring authors to your live event. For more information or to book an event contact the Simon & Schuster Speakers Bureau at 1-866-248-3049 or visit our website at www.simonspeakers.com.

Cover based on series designed by Christopher Lin

Cover photograph by Photo Researchers/Science Source Collection/Getty Images

Library of Congress Cataloging-in-Publication Data

Names: Moeller, Philip, author.

Title: Get whats yours for medicare : maximize your coverage, minimize your costs / Philip Moeller.

Description: First Simon & Schuster hardcover edition. | New York : Simon & Schuster, [2016] | Series: The get whats yours series | Includes bibliographical references and index.

Identifiers: LCCN 2016019251| ISBN 9781501124006 (hardback) | ISBN 1501124005 (hardback) | ISBN 9781501124013 (ebook) Subjects: LCSH: Medical care, Cost of--United States. | Health insurance--Economic aspects--United States.. | BISAC: BUSINESS & ECONOMICS / Personal Finance / Retirement Planning. | HEALTH & FITNESS / General. | SOCIAL SCIENCE / General.

Classification: LCC RA410.53 .M63 2016 | DDC 368.38/200973--dc23

LC record available at https://lccn.loc.gov/2016019251

ISBN 978-1-5011-2400-6

ISBN 978-1-5011-2401-3 (ebook)

To the day when good health care is a birthright

PHILIP MOELLER

CONTENTS

1

NO ONE TOLD ME

Glen didnt retire until he turned 70 in 2010. He and his wife, Margie, were covered until then by his employers health plan. Glen read the annual Medicare & You guide put out by the Centers for Medicare & Medicaid Services (CMS). His clear understanding from the guide was that he had been automatically enrolled in Medicare since he turned 65.

This was not true. Glen made a big Medicare mistake by not asking anyone to confirm his understanding. In fact, Glen had no Medicare coverage as of 2010. Neither did Margie. But they didnt know this.

No one told me is a scary cautionary Medicare tale that could be the subtitle of this book. It is repeated in countless calls for help from people like Glen and Margie (not their real names) to Medicare consumer counselors and call-center staffers around the country. And it is voiced even by people who consider themselves otherwise smart and well informed.

As it turns out, there can be little about Medicare that is automatic or clear or, especially in the midst of a medical emergency, logical or perhaps even fair. Despite widespread contrary beliefs, people are free never to get Medicare and can simply pay their own health bills without insurance. However, if you forgo Medicare and later change your mind, there can be steep late-enrollment penalties and many months may pass before Medicare insurance takes effect.

Even for people who want health insurance, Medicare usually isnt even required at age 65 or, indeed, at any later age, so long as a personor their spouseis still working and has group health insurance coverage from a current employer. Social Security is supposed to send out Medicare cards to some people when they turn 65. Maybe it did send out a card to Glen. Maybe he thought this meant he was covered. But this doesnt always happen, especially when a person has not yet started taking their Social Security retirement benefit.

There are three really big deals about getting Medicare right:

1. Enroll at the right time. Medicare has a bewildering mix of enrollment periods. You need to use the right one.

2. Choose the right mix of Medicare coverage. There are only two main paths here. One is Original Medicare (Parts A and B), perhaps with a Medigap supplemental policy, plus a Part D prescription drug plan. The other is a Medicare Advantage plan, usually including a Part D plan.

3. Understand what these various parts of Medicare cover and how to use them.

For nearly four years, Glen and Margie had no health problems serious enough to have caused them to file a claim with Medicare and learn about their earlier mistake. But then, in 2014, Margie got sick and was diagnosed with terminal cancer. They then began trying to file claims for what eventually would be enormous medical expenses. Thats when they found out that neither of them had Medicare coverage. Glen called the nonprofit Center for Medicare Advocacy seeking help.

Glen had missed his original window to sign up for Medicare after he retired in 2010. Margie may have assumed she was automatically covered by Medicare as well. The details arent clear, although it became clear in hindsight that they never really understood that there is no family coverage under Medicare, as is routinely the case with employer health insurance.

Glen and Margie needed to file individually for Medicare. When they realized their error in 2014, they had missed one of the many enrollment periods available during the year, and were told they had to wait until the beginning of 2015 to file for Medicare. Under its rules, their coverage would not become effective until July 2015.

Glen and Margie had to face her cancer with no insurance whatsoever. Instead of being able to focus on Margies care and spending as much quality time with her as possible, Glens life instead included the prospect of crushing medical bills and the need to worry about how he would pay for his wifes care. Medical expenses are, sadly, a leading cause of personal bankruptcy.

After the center said it had no immediate solution to their problem, Glen broke off contact. More than a year later, the center reached him again. He is a defeated man, a staffer recalled. Things had turned out terribly. He did, indeed, lose his wife.

And he still didnt know if he had Medicare.

CAROL

The Medicare rules say that private Medicare Advantage insurance plans must cover at least the same things that Original Medicare (Parts A and B) covers. Many people naturally assume this means the two approaches to Medicare are the same.

Big mistake.

Carols husband, Ernesto, had a Medicare Advantage plan in Texas, when he was diagnosed in June 2014 with pancreatic cancer. Little more than six months later, Ernesto would be dead following complications from surgery. During this time, when Carol wanted to spend as much time as possible with her partner, she instead had to fight insurance company rules and respond to unexpected surprises about what his Medicare Advantage plan did not cover.

Next page

![Moeller - Creative slow-cooker meals: [use two slow cookers for tasty & easy dinners]](/uploads/posts/book/220959/thumbs/moeller-creative-slow-cooker-meals-use-two-slow.jpg)