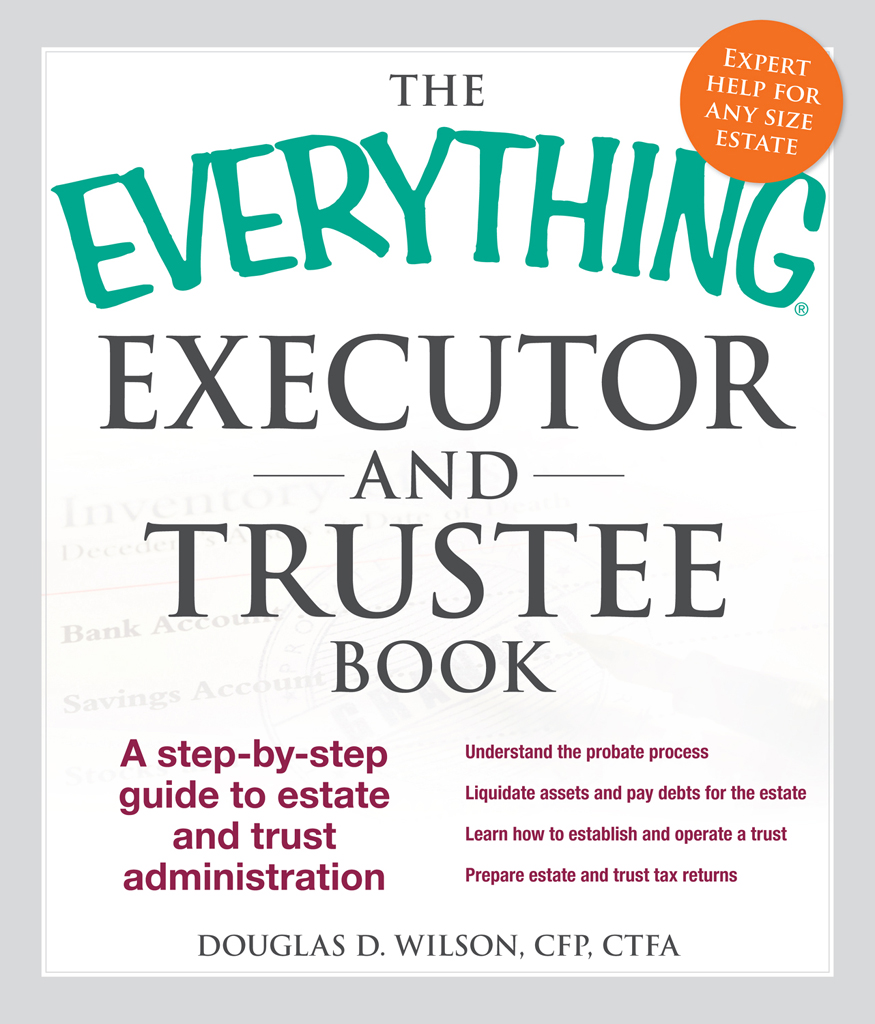

THE

EXECUTOR AND TRUSTEE

BOOK

A step-by-step guide to estate

and trust administration

Douglas D. Wilson, CFP, CTFA

Avon, Massachusetts

Contents

Top 10 Things Every Executor and Trustee Should Know

- Read the document, read the document, read the document!

- You are not required to accept the job of executor or trustee even if you are named under a will or trust.

- You, and no one else, are in charge of and responsible for how the estate or trust is handled.

- Understanding the basics of the process and what your responsibilities are will help you administer the estate or trust correctly.

- You dont have to, and in most cases should not, do it alone. Dont hesitate to hire professionals when needed.

- Keeping open and frequent communications with beneficiaries is the best way to avoid criticism.

- You must treat all beneficiaries the same, especially if you are one of them.

- Your job is to carry out the decedents specific directives and protect the interests of all beneficiaries.

- You are entitled to get paid for the job you do.

- Read the document, read the document, read the document!

Introduction

This guide is intended to give individuals a working knowledge of what is involved in settling an estate and managing a trust. Its purpose is to assist executors and trustees who find themselves in these roles and those who simply want to oversee the process. The chapters in this book will take you through the entire estate settlement process and describe in some detail what your responsibilities will be when managing a trust. Both the estate settlement and trust administration processes follow a logical order and that is how this guide has been formatted. You should not skip any of the chapters or sections as you go through the text. To do so might cause you to leave out an important step or responsibility that relates to another part of the process.

The first two chapters deal with basic definitions and the standards of care that apply to all executors and trustees. These are important topics and you should cover them thoroughly before proceeding to the other chapters. Most of the chapters have checklists, which can be used as a quick review of the material covered in the chapter and to assist you with your administration. As you go through this guide it might also be helpful to refer to the Estate Administration Checklist and/or the Trust Administration Checklist located in Appendix A & B respectively to make sure you have covered all of the items that come into play when you administer an estate or trust.

CHAPTER 1

Serving as an Executor and/or Trustee

Most of us are familiar with the two certainties of life: death and taxes. Once we pass on, most of us will leave things behind that need to be attended to, whether we plan properly during our lifetimes or not. A legal representative must be put in charge to handle these matters. Thats where an executor or trustee steps in. An executor (personal representative) is appointed to manage the decedents estate and a trustee is named to handle the trust, if the decedent had one. To clarify, executors are nominated under a will and appointed by the probate court. A trustee is named in the decedents trust.

Someone Must Be in Charge of a Decedents Affairs after Death

Before the settlement process begins, there is usually a lot of anxiety among the decedents heirs. As the grieving process is running its course, family members often perceive a financial crisis. How are we going to pay the bills? How much will the taxes be? When will they have to be paid? Will there be anything left? Who will be in charge? Concerns such as these commonly surround someones death, and usually with a great deal of emotion. A decedents legal representative (executor or trustee) will be responsible for addressing these concerns and managing the decedents estate.

Family members are typically confused about the settlement process. They will usually want matters settled in an unrealistically short time. The representative (this might be you!) should understand that settling the estate or managing the trust must be done methodically, with great care given to managing the process and avoiding mistakes that could be detrimental to the estate and the decedents heirs.

An executor or trustee is the one in charge of a decedents affairs after death. The term executor is the same as the term personal representative. This book will use executor to describe the person in charge of a decedents estate.

Executors and trustees generally feel honored to have been chosen but seldom ask themselves if they are up to the task. Settling an estate has many time-sensitive steps; missing a deadline can be costly. It can also require a significant time commitment. Managing a trust can require an even greater time commitment that can extend over a very long period. Before deciding whether to accept the assignment, you should understand the unique characteristics of the estate or trust and what responsibilities are involved.

Serving as an executor or trustee can be a perplexing and often daunting responsibility, but it does not have to be. If you take the time to understand the basics of the process and seek professional assistance when needed, the responsibility is manageable for most people. And, by the way, just because you have been named (nominated) in a will or trust doesnt mean you have to accept the responsibility. This is why a properly drafted document includes a provision for alternates and successors.

Every estate and trust is unique. No two are alike.

The Job of Being an Executor (Personal Representative)

When someone dies, a legal representative takes charge of the property that was titled in the decedents own (individual) name and oversees the legal transfer of that property to the decedents legal heirs. This process is called probate. The representative is also responsible for paying the decedents obligations and distributing what is left to the heirs. This person (or institution, such as a bank or trust company) is commonly called an executor (or executrix if a female) and is usually named by an individual in his or her will. If no reference is made in the will, or if the individual dies without a will, a court that has jurisdiction over the decedents estate appoints an executor (in some states the court appoints an administrator). Under the Unified Probate Code, which most states have adopted, executors are now referred to as personal representatives.

Frankly, it can be a pain in the neck to be an executor. The job carries many responsibilities and can require a sizable time commitment. It might be akin to taking over a business without knowing much about the enterprise. The executor must determine what assets the decedent accumulated over an entire lifetime, what he owed, and manage the assets and liabilities on behalf of the decedents creditors and heirs until the estate has been closed. You need to be organized and have the ability to deal with an assortment of financial information.