All rights reserved.

Examples provided here are generic, hypothetical, and for informational purposes only, and do not constitute advice for investment or trading. Past performance is no guarantee of future results. Investing in equity funds involves potential loss of principal due to value fluctuations, which may not be reflected in examples given. Investing, particularly in small cap equities, involves potential loss of principal due to value fluctuations. Satovsky Asset Management, LLC makes no guarantee that the historic rates of return will persist, nor that any particular investing strategy will be successful or profitable.

Model portfolio results are based on simulated or hypothetical performance results that have certain inherent limitations. Unlike the results shown in an actual performance record, these results do not represent actual trading. Also, because these trades have not actually been executed, these results may have under - or over - compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated or hypothetical trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profits or losses similar to those being shown.

Please contact your financial advisor to understand your personal financial situation to appropriately receive individualized advice, taking into account all of the particular facts and circumstances of your own situation, before making any investment decisions.

Introduction

Your Own Worst Enemy

The investors chief problemand even his worst enemyis likely to be himself.

Benjamin Graham, The Intelligent Investor

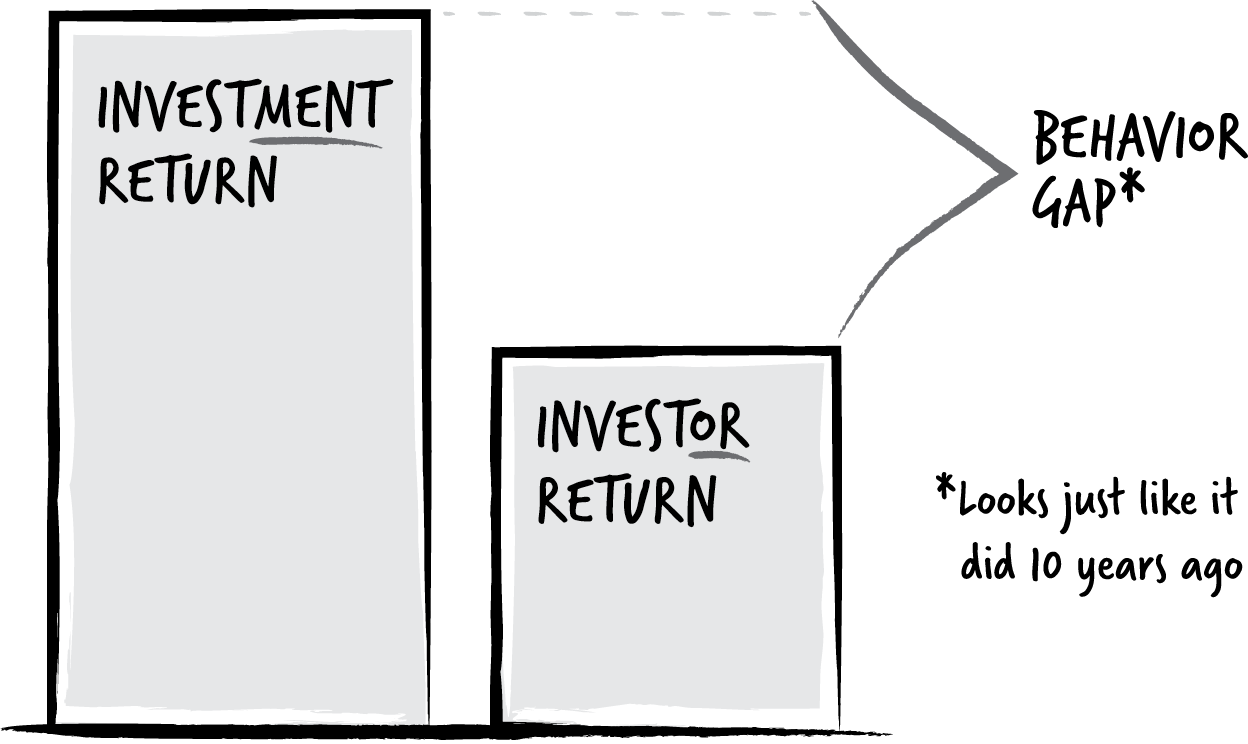

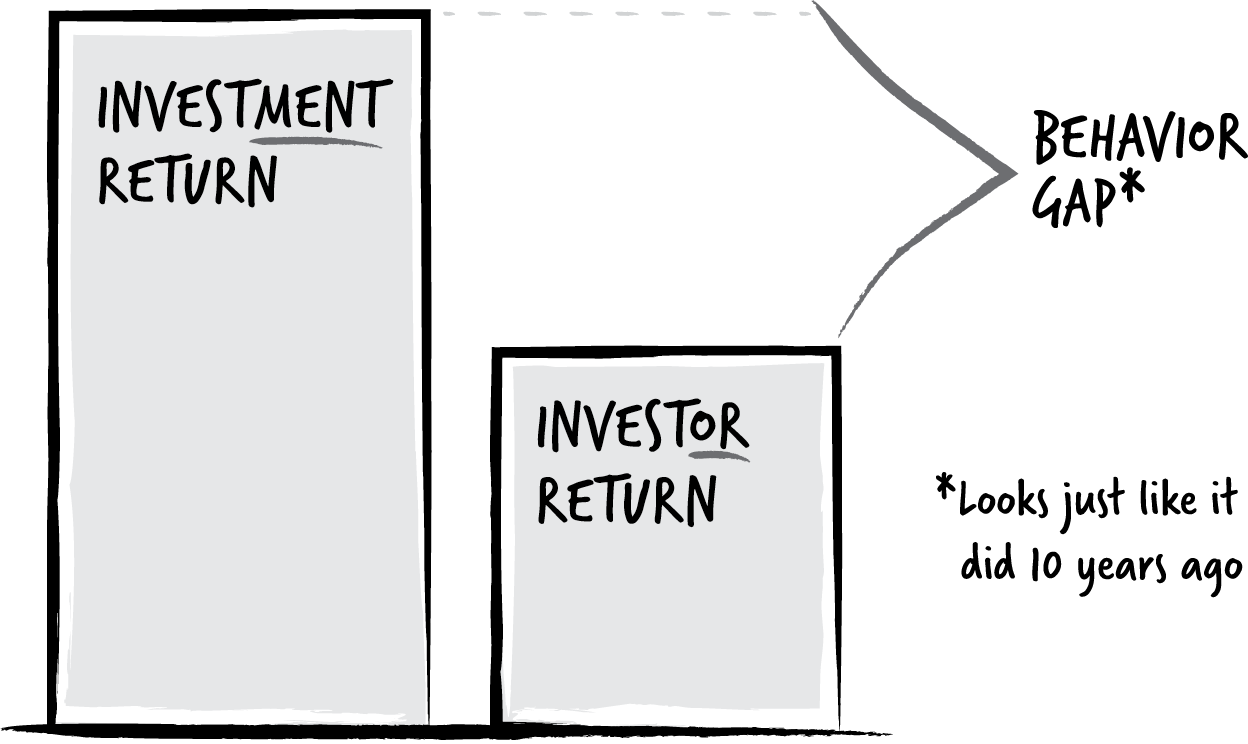

In the investing world, theres an intense amount of focus on market fluctuations that cost investors money. Less attention is paid to a far more pressing reason for widespread losses: the Behavior Gap , a term coined by the New York Times sketch artist and former financial planner Carl Richards. The Behavioral Gap is the difference between the earnings from holding our investments for ten-plus years, and the actual return investors receive. This generally occurs due to emotional reactions causing shorter holding periods, which often results in buying at highs (euphoric moments) and selling at lows (moments of despair or extreme pessimism about the future).

Below is Carls cocktail napkin sketch illustrating this point.

What do I mean by bad behavior? In a nutshell, the average holding period for investments in our society has been shrinking dramatically.

In his book Enough: True Measure of Money, Business, and Life , the investor and philanthropist John Bogle points out that in 1951, the average holding period for fund investors was about sixteen years. Today, however, that holding period averages about four years or less. And to make matters worse, oftentimes, fund investors dont trade very successfully.

Why is this? Its usually because they are chasing good performance and abandoning ship at the first sign of bad performance. Thus, the returns investors actually walked away with (the asset - weighted returns) have trailed the annualized, time - weighted returns reported by the funds themselves by a gap Bogle estimates at an astonishing 2.7 percent per year.

Today, having tracked data internally as well as externally for hundreds of individuals and institutional portfolios and investors, I can confirm that the Behavior Gap is realand its a problem that many who work outside of the financial industry arent even aware of. Candidly, Im not so sure those inside the industry are aware of it either and perhaps could be exacerbating it for their own perceived career survival.

Throw Out the Short-Term Money Mindset

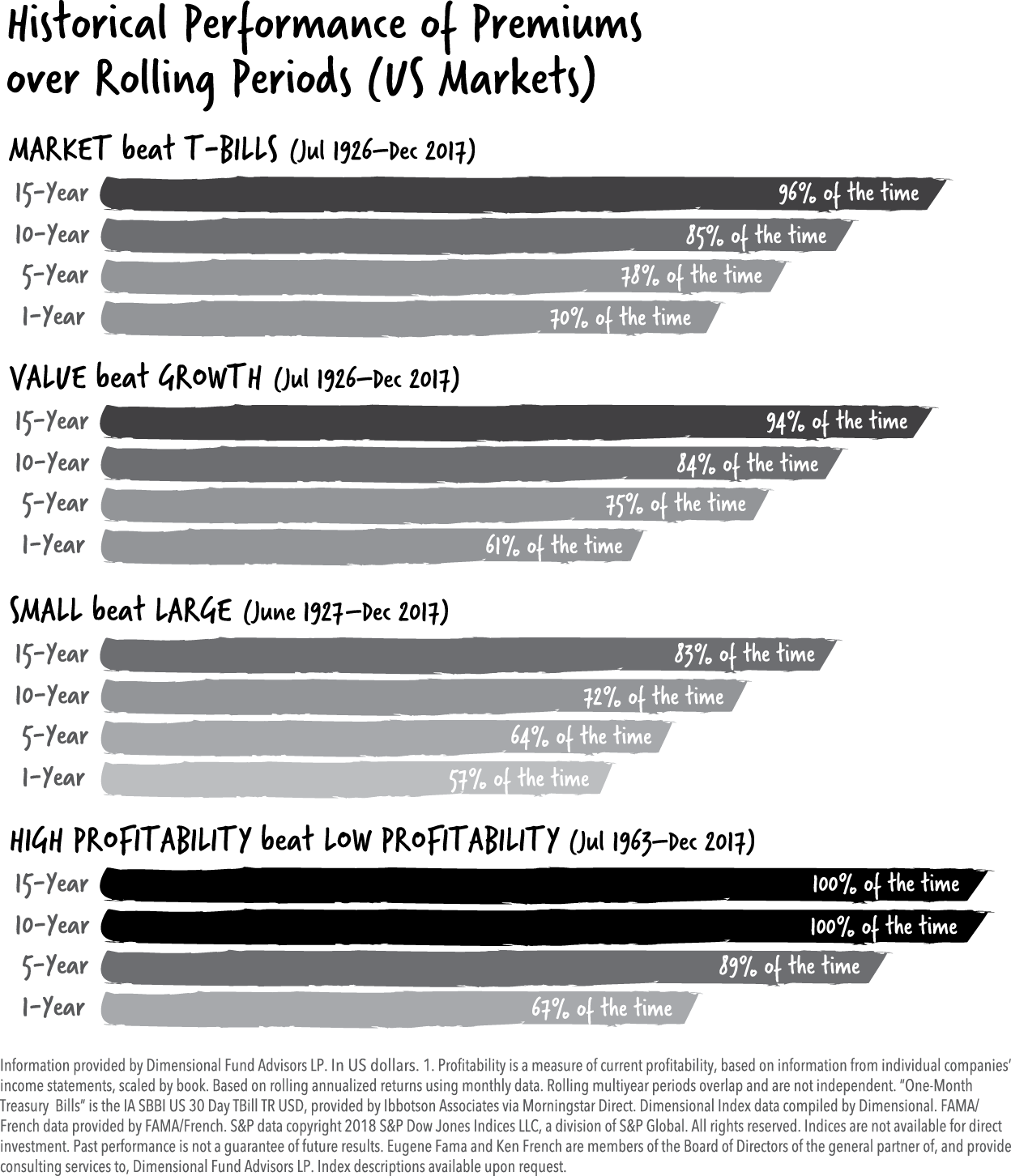

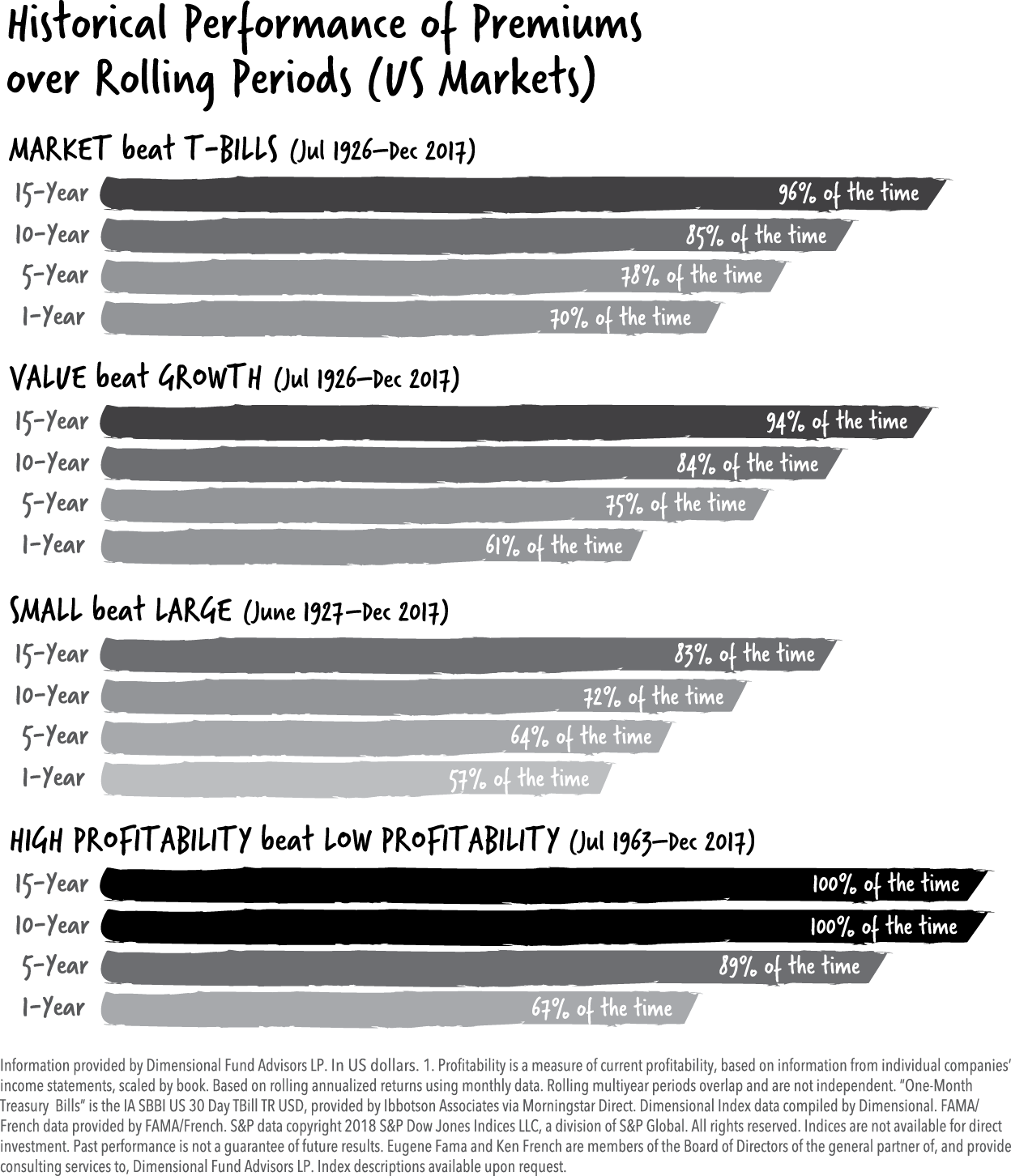

This short - term investment mindset is not a recipe for success over a lifetime. Its generally understood in the finance world that, over time, stocks (ownership interest in businesses) outperform bonds (loans to governments, businesses, or individuals), which in turn outperform cash. It follows that the biggest potential returns come from holding stocks. Evidence - based research has also shown that small company stocks outperform larger company stocks, and that you can maximize your returns further by focusing on a value orientation (i.e., buying something cheap) and focusing on profitable businesses.

This philosophy has been proven to work around the worldnot all the time, granted, but with a high probability of success if these kinds of investments are held over the long term.

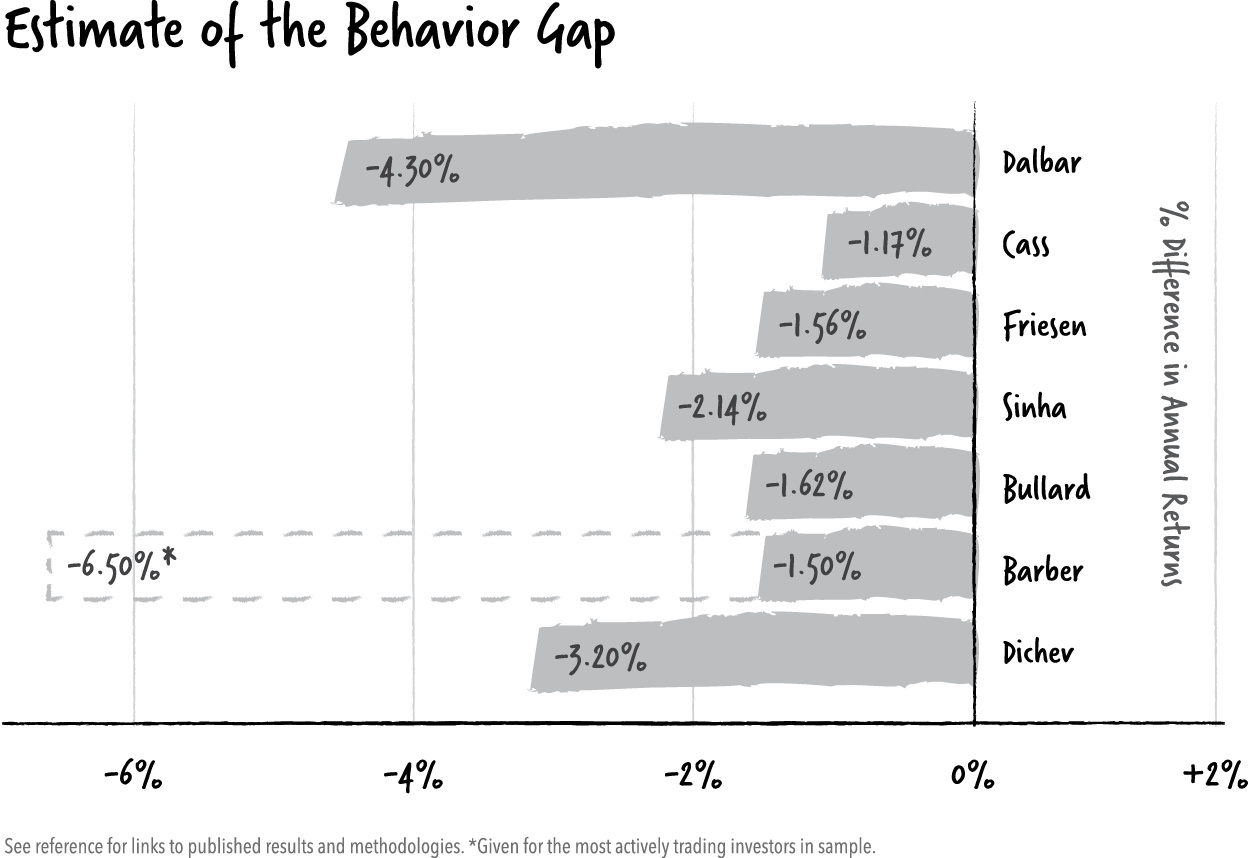

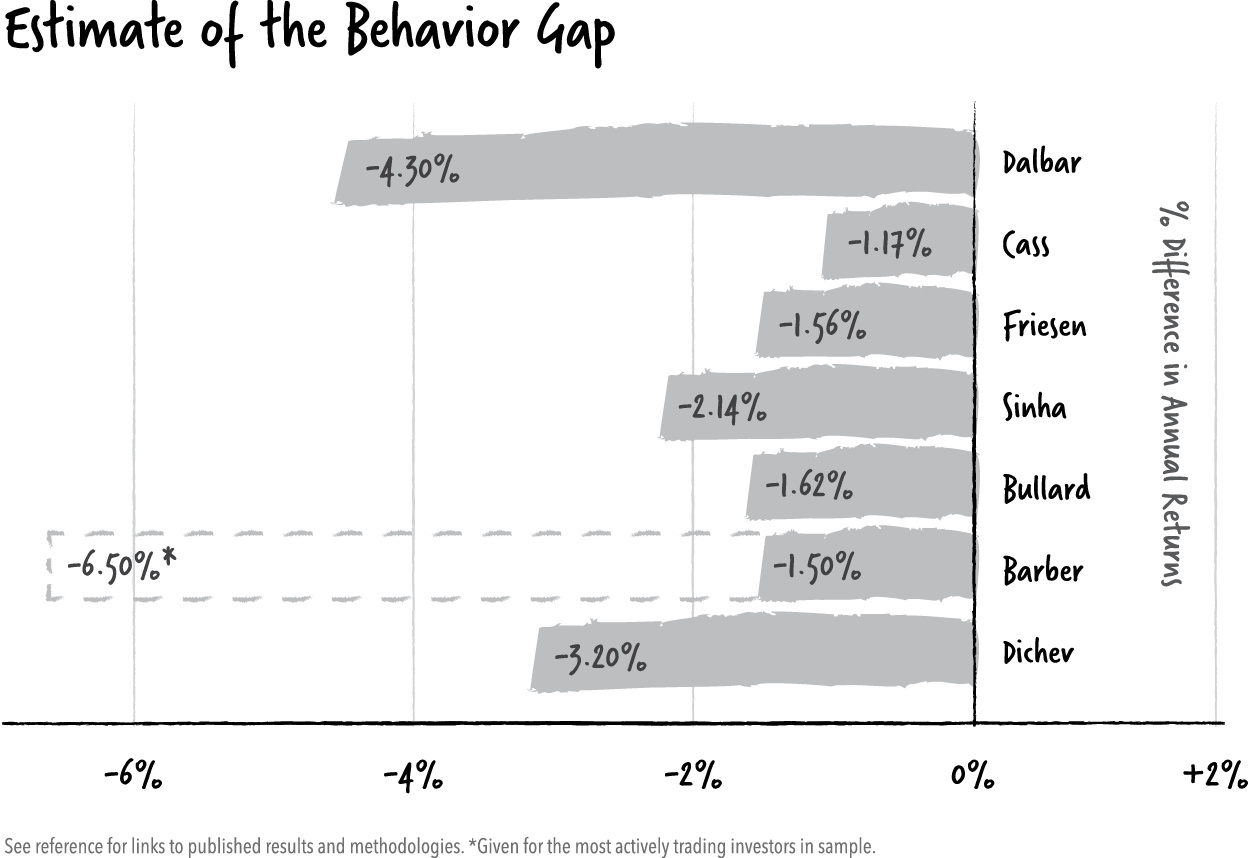

But owing to our instant - gratification culture, patience and long holding periods are no longer the norm. Ive witnessed and documented that by taking shorter evaluation periods of about three years investors routinely see their investments underperform by 1 percent to 6 percent annually over what they could have made holding the same assets for a decade. Here is a wonderful visual image that provides estimates of the Behavioral Gap.

A number of academic studies have similarly estimated the cost of the Behavior Gap. Ive made it my personal goal to eliminate this gap from the portfolios of my clientsand my hope is that discussion can help avoid the pitfalls now, for you, my readersas much as possible.

Its a shame that we dont learn basic financial literacy as part of our high school curricula. This means that most people learn to manage (or mismanage) their wealth through experience, which boils down to trial and error, leading to problems like the Behavior Gap.

Thats why I decided to write this bookin the hopes of making a positive dent in eliminating the gap and promoting better financial education. Whether youre an investor (or future investor!) seeking to educate yourself about behavioral finance and make more informed financial decisions, or a fellow fiduciary seeking to help your clients avoid falling into the trap of the Behavior Gap, this book is for you.

Guide to a More Prosperous Future

Now let me tell you a little about myself.

My name is Jonathan Satovsky, and I am the founder and CEO of Satovsky Asset Management, LLC (SAM), an independent Registered Investment Advisory firm on Madison Avenue in New York City. We advise institutions and multigenerational families around the world with assets and balance sheets in excess of two billion dollars. We have discretionary responsibility for managing more than one - half - billion dollars of those assets.

Previously, I spent thirteen years at American Express Financial Advisors (now Ameriprise) as one of the youngest advisors on the Chairmans Advisory Council, representing the top 1 percent of the firm. In 2007, I started an independent firm, becoming one of the top ten American Express advisors in the country, before finally deciding it was time for a new challenge. Thats when I struck out on my own.