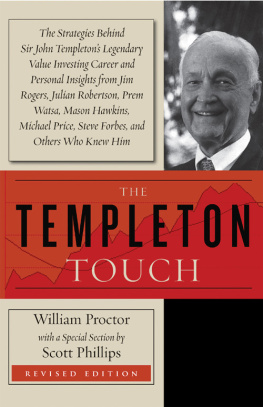

The Templeton Touch

William Proctor

with a Special Section by

Scott Phillips

TEMPLETON PRESS

Templeton Press

300 Conshohocken State Road, Suite 550

West Conshohocken, PA 19428

www.templetonpress.org

originally published by Doubleday in 1983.

Preface 2012 by William Proctor

1983 by William Proctor

2012 by Templeton Press

Front jacket photo credit: Julia Ann States

Reprinted with permission.

All rights reserved. No part of this book may be used or reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the written permission of Templeton Press.

Designed and typeset by Gopa & Ted2, Inc.

Library of Congress Cataloging-in-Publication Data

Proctor, William.

The Templeton touch / William Proctor; with a special section by Scott Phillips.

p. cm.

Includes.

originally published by Doubleday in 1983. ISBN 978-1-59947-397-0 (hbk.: alk. paper) ISBN 978-1-59947-421-2 (ebook) 1. Templeton, John, 1912-2008. 2. Capitalists and financiersUnited StatesBiography. 3. Templeton FoundationHistory. 4. Investments. I. Phillips, Scott, 1974- II. Title.

HG172.T45P76 2012

332.6092dc23

[B]

2012027593

Printed in the United States of America

12 13 14 15 16 17 10 9 8 7 6 5 4 3 2 1

To Pam, my lifelong collaborator,

spiritual advisor, and wife William Proctor

To my three girls

Scott Phillips

Preface to the 2012 Edition

T HIRTY YEARS AGO in the early 1980s, I was deeply involved in researching and writing this authorized biography of Sir John Marks Templeton, who is still widely regarded as one of the greatest value investors and financial prognosticators of all time. Today, in 2012, the centennial year of his birth, after reflecting on our conversations and on my contemporaneous journal entries, I find myself even more impressed by the power and durability of his insights into the wise management of wealthand life.

Of course, the economy and geopolitical landscape are quite different today than they were when Sir John and I conducted our discussions in the early eighties. In December 1980, about one month after our first meeting, the prime rate peaked at 21.5 percent. In contrast, as I write today, that rate has dipped to 3.25 percent. The Dow Jones Industrial Average stayed just below 1,000 as we pursued our conversations; today, the Dow is many times higher, having hit an all-time high above 14,000 in the fall of 2007. Thoughts of a dot-com boom and bust or a global governmental debt crisis had not registered in the minds of the top economic policymakers.

On the international scene, things have changed at least as much. The Cold War still prevailed in the early eighties; the Soviet Union lurked overseas as the evil empire, according to President Ronald Reagan in a 1983 speech; and the tragedy of 9/11 and the specter of world terrorism had not yet entered our thinking. The idea of broad-based global investingthough pioneered by Sir John with his highly profitable investments in Japanhad not reached full stride.

On a personal note, our situations were also quite different. Thirty years ago I was just turning forty; Sir John was turning seventy. In fact, he was not a Sir at the timeQueen Elizabeth II knighted him in 1987. Today, regrettably, he is no longer with us, having passed away at the age of ninety-five on July 8, 2008. As for me, Im about the same age today as Sir John was when we engaged in those stimulating, face-to-face discussions at his mansion on Lyford Cay in Nassau, the Bahamas, and during our flights to various business meetings and philanthropic gatherings.

But even though Sir John is gone and the world has changed dramatically, the principles he lived bythe qualities that made him a wise man and billionaire and swept him into the pantheon of the greatest investorsremain applicable today. Though treated in more detail in the pages that follow, the following maxims that he passed on to me still remain at the front of my consciousness, as though I were hearing them from him for the first time today.

MAKE MAXIMUM USE OF YOUR TIME.

Sir John conveyed this message to me in a number of ways. For example, we had arranged to board a plane from New York City to Nassau on one occasion, and he arrived at the terminal before me. As I walked over to join him, I noted that he was studying a sheaf of papers. Curious, I said, You always seem to keep busy.

He replied, I always bring reading material on stocks or theology in case the person Im meeting is late or a meeting is delayed.

Then he leaned over and said quietly, You see that man sitting over there, staring into space?

I told him I did, and he said, Hes wasting time.

But dont you think its okay just to sit and relax and think of nothing after a hard day?

Thats fine if youre meditating or praying or pursuing some other constructive mental activity. But I dont believe in wasting time. At your age, you may feel you can waste some time. But at my age, I dont have time to waste.

Now that I am his age, I can understand a little better the message he was trying to convey.

FOLLOW THE DOCTRINE OF THE EXTRA OUNCE.

At first blush, this maxim may seem just a corollary of the previous one, but in actuality the extra ounce takes hard work to the next level. Sir John believed that most people will do rather well if they just put in a reasonable amount of time at the tasks assigned to them. But the elite few will do even bettereven brilliantlyif they first work hard but then contribute only an extra ounce of effort.

In passing on this advice to younger people, I often cite the principle this way: First, study or work as hard as you can. Then, back off and examine your work. Finally, have another go at the project, even if you spend only a relatively limited amount of time or effort. That extra ounce can pay dividends that go far beyond the energy expended.

CONCENTRATE ON VALUE.

Sir John was known as a value investor, or one who examined prospective investments closely to see if their financial health was solid and their selling price was considerably lower than what they were actually worth. He was the consummate bargain-hunter.

His focus on securing a good deal and paying no more than what a product or service was worth carried over to his private life. When I was working with him, he always flew coach class even though he was a billionaire. First class wasnt worth the price in his estimation. Also, from the beginning of his career, he avoided consumer debt. He even chose to buy his very first house for cash, believing that a mortgage would lock him into interest payments that might be used more effectively in his investments.

But in this commitment to no debt, we must remember that the principle applied only to his personal money management. In business , as well see shortly, he was ready to borrow in order to finance the purchase of investments that he regarded as superior values at bargain prices.

STRIVE FOR SERENITY.

Sir John Templeton was one of the most even-tempered, serene top executives Ive ever met. He believed in disciplined thought control, which, among other things, involved focusing on happy, productive thoughts and avoiding negative emotions. In that serene state of mind, he found that he could arrive at the wisest judgments and render the best decisions.