The information in this book is revised and updated from time to time. For information about recent changes, write to Christensen & Combs, Inc., 4525 South 2300 East, Suite 202, Salt Lake City, Utah 84117

All rights reserved. No part of this book may be reproduced in any form or by any means without permission in writing from the publisher, Shadow Mountain. The views expressed herein are the responsibility of the author and do not necessarily represent the position of Shadow Mountain.

Christensen, James P.

Rich on any income.

p. cm.

1. Finance, Personal. I. Combs, Clint. II. Durrant, George D.

III. Title.

Preface

Our business is helping people solve their financial problems. Almost always, financial problems have little to do with how much money you make. We once counseled an executive who was making $200,000 a year. He was nearly bankrupt, and his marriage was crumbling because of the stress caused by the fact that he and his wife did not know how to live on his salary. An elementary school principal we know was in danger of having her sports car repossessed. She felt like a complete failure because she had overextended herself in her personal debt.

No matter what your income, financial freedom is essential if you are to have an overall sense of well-being. And financial freedom comes not from having a large income, but from managing the income you have. Careful money management, or the lack thereof, can tip your emotional scale toward happiness or misery.

Our years of experience in counseling thousands of individuals and couples have taught us over and over again that financial freedom is always part of the ground upon which happy people stand. Those in financial bondage are enslaved by circumstances that hold them bound to misery.

The vast majority of womens worries are related to money problems. Nearly 89 percent of all divorces occur because the couples could not deal with the pressures related to their family finances.

A Bold Promise

Based on the experiences that we and the other personnel of Christensen & Combs Corporation have had in working with over 50,000 people from all walks of life, we can without hesitation make this bold promise: We promise you that by faithfully following the principles and procedures set forth in this book, you can set out on a road that will ensure your future financial security and will bring you the joy and peace that come as you gain and maintain your financial freedom.

In fact, we guarantee that if you follow this method sincerely and carefully, you will be living within your means in ninety days. Now, this doesnt mean that your house will be paid for, that your car will be paid for, or that educational loans or other necessities will all be wiped off the slate. But by following the simple system in this book, you will experience the thrill of seeing how all of these debts can be taken care of, and at the same time you will be walking into the light of financial freedom.

To reap the benefits of this promise, you must firmly resolve to follow the system for at least ninety days, and you should decide now exactly when you will start. If you are married, you and your spouse must also commit to each other that you will follow this plan for ninety days. The first month you will learn the system; the next month you will love it; and the third month it will become an integral part of your life. After ninety days, using the system will have become spontaneous, and you will have formed a habit that will keep you out of financial bondage for the rest of your life. Is it worth ninety days of your time? Forgive us for asking such a ridiculous question.

1

The Financial Freedom

Budgeting System

You can be rich on any income by using the Financial Freedom Budgeting System, which is a simple way for you to manage your budget in your checkbook in seven seconds per financial transaction.

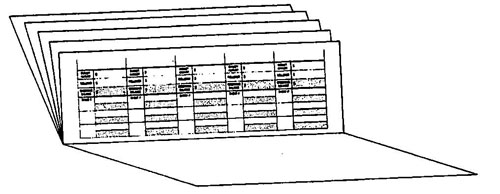

This simple budgeting tool is shown here, and you will find some actual budget booklets in the back of this book.

How does this tool work? First, you take the total of your monthly income and divide it into twenty-five or fewer budget categories. (Well say more about how to do that later in the book.) Then you list each of the allocated amounts in one of the twenty-five columns in the budget booklet. For example, in a spending category you have labeled groceries, you might list the amount of $315.

Now you are ready to head to the grocery store. You have your checkbook (including your check register and your blank checks), and you have also inserted your budget booklet into your checkbook.

As you select your groceries, you mentally note the portion of the month still remaining and the number of dollars left in your grocery budget as recorded in the budget booklet. This will enable you to not deplete the remaining amount of allocated grocery money before the end of the month. You then proceed with your cart to the checkout stand. The clerk says, That will be $62.37. You proceed in the usual manner to write out a check to the store for $62.37. As you always do, you record the transaction in your check register and subtract the amount of the check from your previous balance.

But now you do something newsomething that will require only seven additional seconds and that will put you in control of your money. You turn to the page of your budget booklet that has the groceries column, and in that column you write down the check number and the amount, $62.37. You subtract that figure from the remaining amount left in thegroceries column for that month, $315. That leaves $252.63 still available for groceries until the end of the month. The next time you purchase groceries, you do the same thing. And, of course, you handle the other spending categories in a similar manner. By doing this, you will know at all times exactly where you have spent your money and how much you have left to spend in any budget category.

This system is powerful, but it is also simple. There are no complicated papers to carry with you, and there is no complicated bookkeeping to do at home. You can now keep track of your budget in seven extra seconds right in the store, at the service station, or wherever you write out a check.

This system is not overwhelming, as other budgeting systems are. Any man, woman, or child can, with little effort, understand, follow, and benefit from it.

As you read on, you will see how couples can harmonize two checkbooks into one system. You will learn how to use this budgeting system to make credit cards a positive tool rather than a nagging problem. You will learn how to handle emergency spending without having a financial disaster. You will learn how to save a years supply of money. You can do it, and when you do, you will be rich on any income.

Weve now given you a brief overview of how the Financial Freedom Budgeting System works and of what it will do for you. Lets back up now and look at the system from front to back. In other words, lets get you started on the road to financial freedom.

2

Getting Started