The Players

THE BUYERS

Who are the players in this marketplace of homes? There are buyers, which means you, the domestic consumer. There are marketers, whose role is to sell and transact the exchange of goods and services. The builders or contractors, both small and large, provide the houses for buyers. There are also several sub-industries that support the system but are largely invisible to the public. They include national trade organizations, materials suppliers, companies that specialize in providing stock designs, and media outlets.

You are the consumer and you know your particular tastes and needs, but the building industry relies on broad profiles to target its markets. The profiles of generic buyers today are more complex than they were fifty years ago. Conventional ideas about the size of a family (two adults and three children) have given way to smaller numbers of children (and maybe only one parent), as well as unconventional arrangements of partners, lifelong singles, people marrying at older ages, and the tides of baby boomers now entering retirement. The housing industry has an obvious interest in defining its potential clients, and it conducts detailed studies of likely buyers. Few industries are more sensitive to the needs and desiresand vulnerabilitiesof its potential consumers.

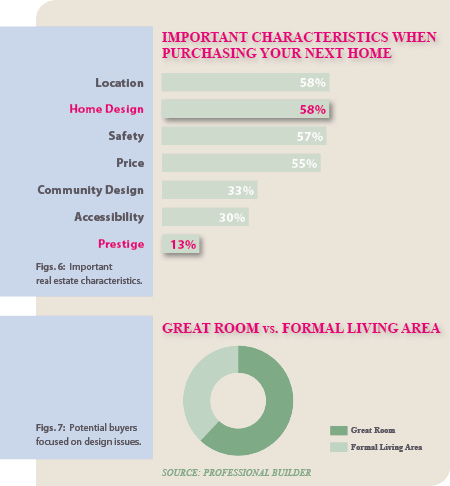

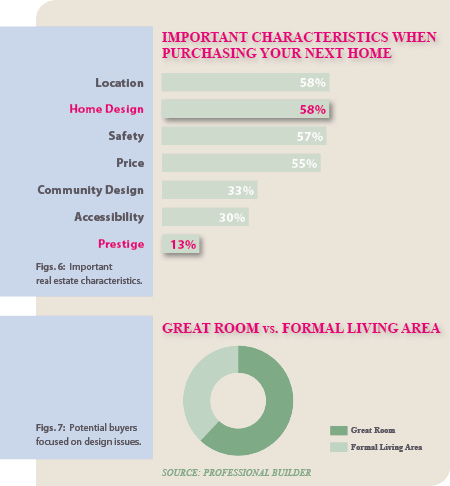

In July 2012, Professional Builder, a major trade journal, published the results of a survey that asked 20,000 potential buyers about design issues. When asked about the most important characteristics when buying their next home, almost 60 percent of respondents indicated that home design was as important as location. Safety followed closely behind. Price came in fourth place (55 percent), followed by community design and accessibility. The least important factor was prestige: only 13 percent of respondents said it was important (Fig. 6). With respect to specific rooms in a house, buyers were asked whether they preferred a great room or a formal area. The great room, an expanded den turned into an open family room, trounced the formal living area, 62 to 38 percent. Formal spaces were seen as privileged spaces for more affluent buyers (Fig. 7).

Other points that emerged in this survey on design preferences:

- House designs should start from the inside and work out, particularly for people with children. The role of social spaces, inside or out, was seen as critical.

- Great home design need not cost the builder more than mediocre design.

- Outdoor space has more than entertainment value; buyers see it as an important buffer of privacy between neighbors.

- Connections between indoor and outdoor spaces are a must.

- Buyers prefer a casual look.

- Most buyers do not really want urban living. Suburban and detached homes are still preferred by all age groups. But Generation Ys (roughly, those born from 1980 to 2000) without children are more likely to pick attached or rental houses close to their jobs. Married people with children have different preferences.

- Interest in contemporary interior styling has risen dramatically. Contemporary exteriors are still at the bottom of preference lists, but people are becoming more interested in clean lines and a contemporary feel. This preference is reflected in Pottery Barn being the most popular home furnishings retailer in 2011. Crate and Barrel and even Ethan Allan, a company long associated with traditional taste, are adding contemporary lines. This trend may be seen in the increasing availability of contemporary-style cabinetry, faucets, fixtures, and sinks.

The diversifying U.S. population will have a big impact on the industry and the homes it builds. A few figures underlie this trend. In 2010, whites made up 63.7 percent of the population. But Hispanics accounted for 55.5 percent of U.S. population growth from 2000 to 2010, compared to 8.3 percent for whites . These figures mean the Hispanic population will become increasing important in every aspect of America lifeas will Asian communities, which also showed impressive growth rates over the last decade, through immigration as well as births. Other studies indicate that seven out of ten new households will be formed by minorities. The days of baby boomers as the primary home buyers will change as more of them retire. Married couples are now a minority as heads of families. And baby boomers are less mobile than younger Americans; people in their twenties are eight times more likely than boomers to move, and the economic downturn has kept many of the older generation in place.

Going from general categories to more concrete pictures, the industry benefits from psychographic market research. These are studies that try to define the psychological profiles of prominent buyer groups. For example, the National Association of Home Builders (NAHB), the major professional organization of the building industry, keeps itself informed about consumers wants and needs. At its January 2011 meeting in Orlando, Florida, attended by 47,000 people, the NAHB surveyed the industry by getting feedback from 238 builders, manufacturers, designers, and architects on what buyers want. The respondents pointed to compact, energy-efficient, affordable houses situated on smaller lots near walking trails and open spaces. These trends reflect what consumers themselves want: smaller homes, in part because empty nesters are seeking energy-efficient dwellings. The Economics and Housing Policy Group, a professional survey company, reported at the meeting that by 2015 the average size of the new house will be 2,0002,399 square feet, versus the current size of 2,500 square feet. The living room will disappear as it merges into another living space.

The findings from the NAHB meeting further confirm that builders are highly aware of their consumers priorities: because we still have enough income to acquire more stuff, more storage is necessary; we still have time for leisure activities that require space; and energy consciousness is deepening as a fact of everyday life for most consumers. In other words, despite an economic downturn, political anxiety, a polarized populace, and global unrest, Americans still have a good life, and the housing industry will continue to shelter us.

Something is missing, however, from the survey findings in Professional Builder and from the NAHB meeting: discussions about the styles of homes. Although design was of special interest in the magazine survey, the topic referred to spaces within a house and how people use them. In other words, design was treated as the equivalent of a building program corresponding to a clients desires. Consumers want relaxed and informal atmospheres, but their preferences for one style over another are not apparent. What a house looks like is far less important than consumers specific needs and desires. The significance of this trend is twofold: either what houses look like has become irrelevant, or the image of a house has a meaning that operates at a vague, unconscious level.

It pays to remember that you as the buyer are the subject of the building industrys nearly constant process of surveying your wants and needs. As a result, you may be more powerful in influencing your housing choices than you realize.

THE MARKETERS

Weve looked a bit at the buyer as revealed by national surveys. Now lets look at the marketer, a central player in the home-buying process. There are two types of professionals whose job is to sell you a house: an independent real estate agent and a marketing person who works for a building company or contractor. First, we will look at the real estate agent, the facilitator of deals between buyers and sellers. Real estate agents may represent either buyer or selleran important distinctionand they receive a percentage of the sale price in commission.