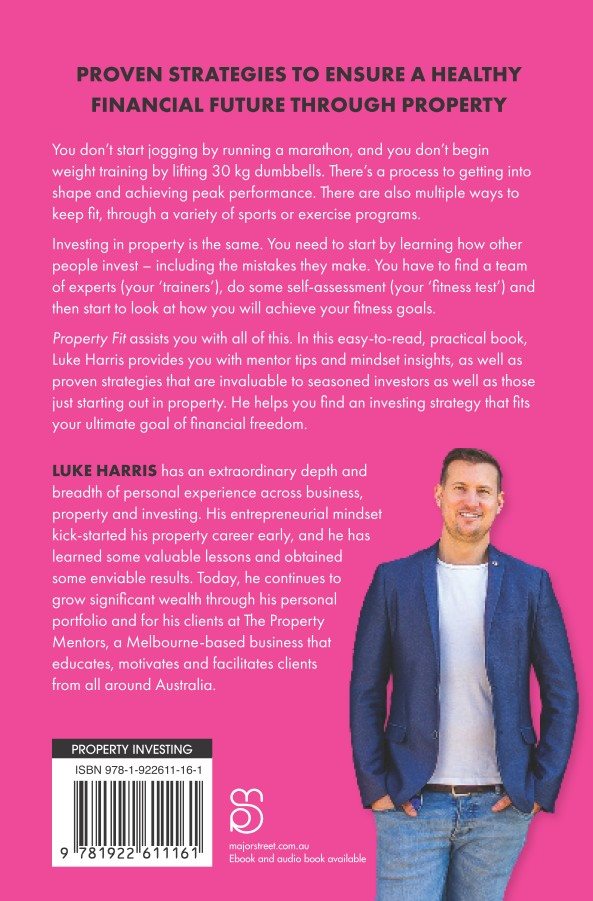

ABOUT THE AUTHOR

Luke Harris has an extraordinary depth and breadth of personal experience across business, property and investing covering more than two decades. His entrepreneurial mindset kick-started his property career early, and with nothing more than big dreams, persistence and a can-do attitude, Luke has learned some valuable lessons and obtained some enviable results.

Today, Luke continues to grow significant wealth through his personal portfolio and for his clients at The Property Mentors, a Melbourne-based agency that helps clients develop the skills, mindset and knowledge to grow their property portfolio. Lukes personal why is to help members reach financial freedom through property so they can go on to successfully fulfil their own dreams and ambitions. He is the co-author of Lets Get Real (Major Street Publishing, 2018). Property Fit is his second book.

LEARNING FROM MY MISTAKES - MY STORY

As a young kid growing up in suburban Perth, I was always thinking of creative ways to make money. I was full of ideas. The difference between me and my friends was that I did something about it, using my time on weekends and after school to try to bring my hairbrained schemes to life.

My first hustle was when I turned 12. It was a swap meet in a car-park, based at my local Warwick Grove shopping centre, where I used to take bits and pieces of hard rubbish from peoples curbsides and sell them for a profit. It took me hours to drag these things home during the week, and I couldnt believe people were throwing out perfectly good stuff when I could sell it and make a dollar or two.

From a young age, I learnt an invaluable life skill. I learnt how to negotiate with people - adults - because a lot of the people there were used to bartering competitively. I thought it was fun to get the win and a good deal. So, there I was, driving a hard bargain. I certainly didnt learn that in school! In fact, I hated school. Running the swap meets gave me an insight into how the real world worked from a young age, and it also taught me how to create a good business model.

Luckily, Mum and Dad were extremely supportive. Their garage was constantly full of my crap; Mum parked her car on one side of the garage, and I had my rubbish on the other. Dad had to park his car out in the driveway because my stuff took up all of the room. Looking back, I think I taught myself a lot about buying and selling, because my parents didnt really say to me, You should try this. It was just me saying, Hey, I found a way to make some money, this is what I want to do. And Im so thankful that they supported me. It was lots of fun. In fact, looking back now, Mum and Dad were incredibly patient and supportive, even though it may not have been clear to them at the time what my plan was. Im sure they said to each other, thats just Luke being Luke! (Actually, I know for a fact they still do.)

MY FIRST JOB

By the age of 16, Id been working at Hungry Jacks for two years. I wanted more, so I decided to reach out and see a careers coordinator while at school to help me find me a job. At the time, I was really hating school and hungry to experience the real world (and start taking it over, or so I thought). I wanted to be an electrician (again, so I thought), so I sent out 80 or so letters trying to find a job. Ive still got that list of places I sent letters to!

In the end, I left school at age 16 to do a traineeship with a company based in Carine, in the northern suburbs of Perth, one suburb over from where I was living in Marmion. Unfortunately, it was terrible! We had to sit in the back of the van with the toolboxes. There were two people in the front and one person in the back - it was completely unsafe. There were no seatbelts either, but this was just what happened back in 1997. On site, we used to stand on the top of two-storey roofs with no safety equipment, half a metre from the edge, pulling a tile off and dropping a cable down. I remember doing this on windy days, sunny days and days when it had been raining. I was standing on a two-storey roof, essentially risking my life for $4.71 an hour. It was incredible, but it did teach me resilience - a lot of it! I left after about a year - the traineeship wasnt being run properly, and I considered it slave labour given that my Hungry Jacks job paid more.

This opened the door for me to seek work elsewhere, and I found it in West Perth, at a security company called Securus. I began to realise that I could work faster and more effectively than my colleagues. The job was for better money, and the company paid for my fuel, bought roof racks for my car and threw me in the deep end with complete autonomy. I was going out on my own to install security systems. But because I was always thinking one step ahead, I wanted to speed things up and investigate how I could make more money. I worked there for a while before becoming a contractor, taking the opportunity to increase my income.

PLANTING THE PROPERTY SEED

I approached Brett Clugston - who was my mates dad in high school and my boss at Securus - and said, How can I make some more money? I thought Id be earning more money by now. He responded with two things Ive never forgotten. The first was, Luke, disappointment is the difference between expectation and reality. So, Im not getting a pay rise, I thought. The other was, Luke, go and buy a block of land somewhere and just pay it off. In the future, thatll be a good thing for you, so just get started.

It was the first time anybody had given me property advice, full stop - even though it was quite generic and not tailored to my goals. But Id never really considered it before. I sat back and gave it some thought. On a $14,500 salary, buying anything over $5000 wasnt really an option for me at that point - except for my car, which I loved.

However, it was great advice, and while I didnt really take it on board at the time, it planted the seed and gave me something to think about seriously later, when I was ready. I had always loved property, but without knowing how to even get started, nothing happened. The gaps between where I was at in life, my financial situation and the reality of buying a block of land were just far too big.

A1 SECURE SOLUTIONS

In three years, I had left school and started as a trainee, worked on the tools for another company, gone into the office for a pay rise, added weekend work and then doubled my income by becoming a contractor. The lightbulb moment arrived when I suddenly thought, Why am I doing all this work for their clients when I could go and get my own clients and build my own business?

At 19, I decided to do just that. I got myself a logo, phone number, horrible website, fax number and business cards. I even had a pager - how ridiculous! Well, at the time they were cool. But more importantly, I was in business. I named it A1 Secure Solutions, and I was on my way. Over the next few years, I focused on growth and learnt how to build a business. At one point I had three vans on the road and owned a 2001 Monaro, which was my pride and joy. I was killing it and life was good. That was a huge amount of risk for someone my age to take on, but I loved the challenge and it was light years ahead of the alternative, which was working for someone else.

MY FIRST PROPERTY

It was 1999 and I was about to turn 20, and ready to make my debut on the Australian property market. I found the right place, too: a four-bedroom, one-bathroom property on a 682m2 block in the Perth suburb of Duncraig. The house was small but solid, and as it was my first, I didnt care about pools or double storeys. I just wanted to get started. It cost me $157,500.

Next page