Contents

Guide

Thank you for downloading this Simon & Schuster ebook.

Get a FREE ebook when you join our mailing list. Plus, get updates on new releases, deals, recommended reads, and more from Simon & Schuster. Click below to sign up and see terms and conditions.

CLICK HERE TO SIGN UP

Already a subscriber? Provide your email again so we can register this ebook and send you more of what you like to read. You will continue to receive exclusive offers in your inbox.

We hope you enjoyed reading this Simon & Schuster ebook.

Get a FREE ebook when you join our mailing list. Plus, get updates on new releases, deals, recommended reads, and more from Simon & Schuster. Click below to sign up and see terms and conditions.

CLICK HERE TO SIGN UP

Already a subscriber? Provide your email again so we can register this ebook and send you more of what you like to read. You will continue to receive exclusive offers in your inbox.

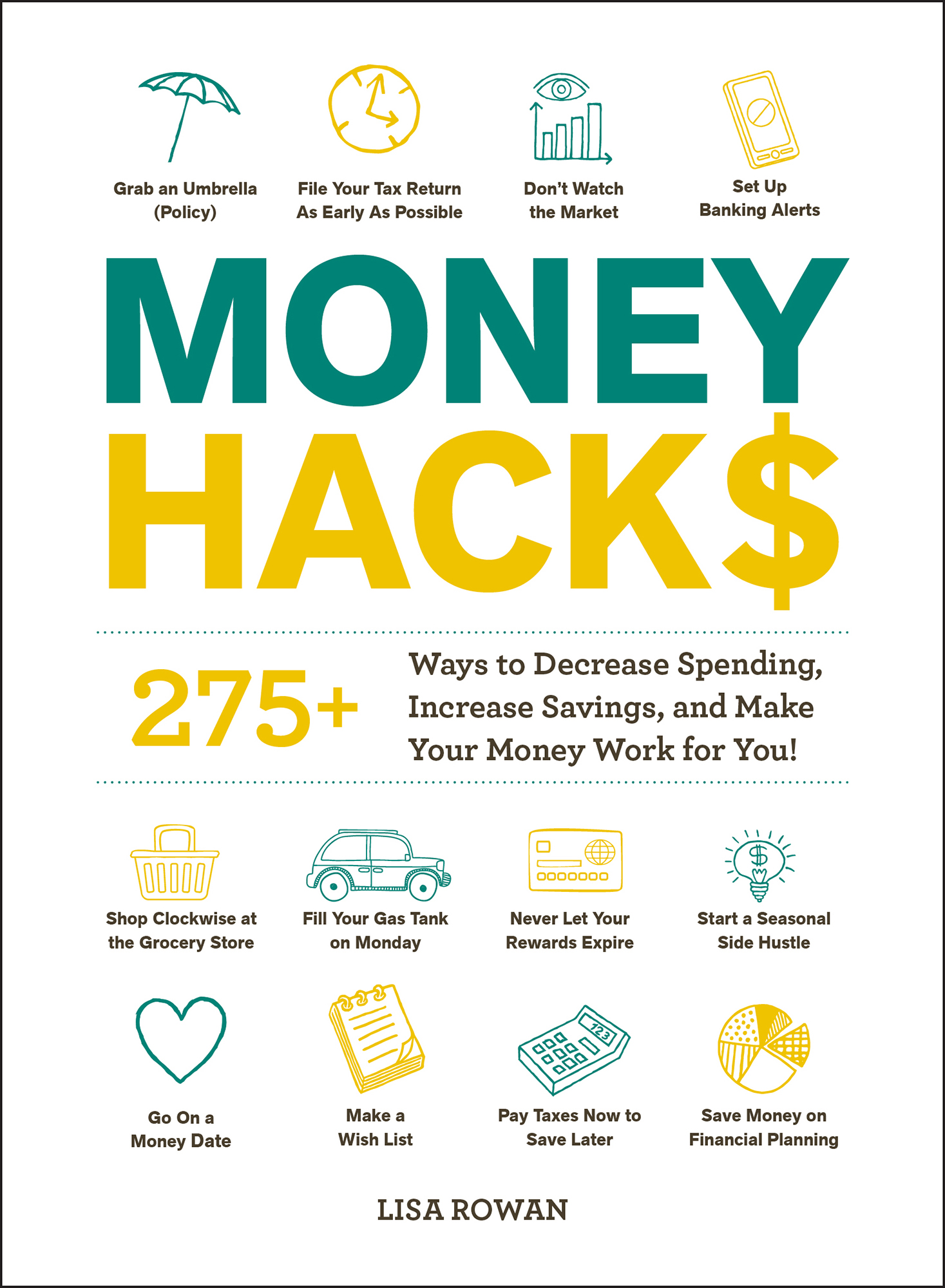

Introduction

Hacking your way to financial independence is one of the best ways to get your life on track.

If you follow the hacks in this book, youll start to see results right away. In some cases, those results may be small at first, but a penny saved is a penny earned, and if you add up enough pennieswell, you can see where this is going. Youll find that as your financial independence grows, other things in your life fall into place!

The 275+ hacks in Money Hacks will help you get started today with improving your money management. Youll find information on everything from the basics of personal finance to more complicated questions such as investment and retirement planning. Youll find simple but effective hacks that will save money and offer better ways to make it work for you.

Money Hacks will teach you how to:

- Make small changes that help you save moneywithout even noticing

- Stop overspending, even on things you think you need (like groceries)

- Choose the best repayment plan to finally tackle those student loans

- Make the most of your credit card by learning about rewards

- And more!

Whether youre making your first budget, wondering how youll ever pay off your debt, or thinking about how to afford that one big thing you daydream about, Money Hacks has your back. And when you hit roadblocks along the way and need a boost of motivation, you can revisit any page for a quick refresher to help you get back on track.

CHAPTER ONE Curb Mindless Spending

HACK 1 Avoid the Spending Trap!

How many times have you anxiously waited for your next payday, confused about where all your money went? Odds are, youre not fully aware of your spending and what triggers it. And those small purchases add up quickly to eat away at your budget.

Take a look at your debit and credit transactions for the past month or so to identify your spending patterns:

- Do you pick up breakfast sandwiches on your way to work?

- Are your bar tabs all from happy hours that went later than planned?

- Can you never get out of a big-box store for less than $50?

- Do you keep picking up the bill for lunch with friends?

Once you know when, where, and why youre spending more than youre comfortable with on a regular basis, you can strategize how to pull back. Think about breakfast the night before to avoid the morning rush. Send your friend a Venmo request for their share of the bill while youre still sitting at the diner. Set an alarm on your phone so you dont order just one more drink after happy hour has ended. Head to the store after workwhen you have less time to browse.

Its hard to avoid spending traps when you have no idea what they are. Once you get intimate with your spending habits, you can restructure your time and activitiesnot necessarily to cut out those expenses completely, but to pull them back to a more comfortable place.

HACK 2 Make a Financial Bucket List

Its possible to make a budget that doesnt feel restrictive and severe. You just have to put your money in the right bucket.

Rather than make an extensive budget spreadsheet with lines for each and every way youve ever spent money, break your budget into just three buckets:

- Essentials bucket (50 percent)

- Savings bucket (20 percent)

- Everything Else bucket (30 percent)

Your budget will look like this:

FIRST, PLAN THE ESSENTIALS

Fifty percent of your budget should go to needs. This includes everything from your rent, to the parking garage at work, to your groceries and prescriptions. If its an expense that rolls around every month and is necessary for daily survival, it goes into this bucket.

NEXT, SAVE A LITTLE

Any money you put in your savings accountswhether its short-term savings or contributions to a retirement accountgoes into this bucket. If youre paying off debt of any kind (credit cards, student loans, medical bills), put those monthly payments in the Savings bucket too. It should add up to about 20 percent of your take-home pay.

AND NOW FOR EVERYTHING ELSE

If its not essential, its not helping you save, and its not helping you get out of debt, then it goes into the Everything Else bucket. Some things that might fit here:

- Your gym membership

- Holiday gifts

- Concert tickets

- Magazine subscriptions

Having a hard time filling up that Savings bucket? See what expenses from Everything Else you can reduce or cut out completely.

HACK 3 Dont Quit Cold TurkeyCut Back

The idea of cutting out a budget category probably makes you nervous. But being mindful about your spending doesnt have to be an all-or-nothing game. Instead of forcing yourself to go entirely without, reduce spending on that category by just 10 percent each month. You wont see sudden, drastic change in your budget, but the shift will be a lot easier to stomach.

Say you spent $148 at coffee shops last month. The idea of never buying coffee is enough to make you want to hide from your budget forever, but what if you challenged yourself to spend just 10 percent less on coffee this month? Thats $14.80 less, for a total of $133.20. Then, next month, see if you can bring that expense down by 10 percent again to $119.88. By introducing incremental shifts instead of huge, radical changes, youre more likely to stick with your new, moderately reduced habits.

HACK 4 Never Miss a Payment

While you may get reminders by email when your bills are due, dont rely on them as the sole reminder of whom you owe money to and when. Whether you use a paper planner or the calendar on your phone, put the due date for every single billand the amounton your calendar each and every month.

Dont let yourself get lazy after a few months, thinking youve got all those due dates memorized. Having your bills noted on your calendar each and every month is a reminder of how much youre spending on recurring costs month in and month out. If theres an area that needs attention, itll be on your mind the minute you open your calendar.

HACK 5 Make a Wish List

The tricky thing about avoiding impulse buys is that its not the