Are Your Heirs Prepared?

Your A-Z Moneywise FamilyResource

by

Mitchell E. Kauffman, Managing Director,

CERTIFIED FINANCIAL PLANNER

Copyright 2016 by Mitchell E. Kauffman, ManagingDirector,

CERTIFIED FINANCIAL PLANNER

Smashwords Edition

All rights reserved. No portion of this book may beused or reproduced in any manner whatsoever without writtenpermission from the author. The information in this publicationdoes not constitute a recommendation for the purchase or sale ofany securities. Readers are advised to consult their financialadvisor, tax advisor and/or estate planning attorney forassistance.

The information has been obtained from sourcesconsidered to be reliable, but we do not guarantee that theforegoing material is accurate or complete. Any opinions are thoseof Mitchell Kauffman and not necessarily those of Wells FargoAdvisors Financial Network.

Any information herein is not a complete summary orstatement of all available data necessary for making an investment,tax or legal decision and does not constitute a recommendation.While we are familiar with the tax provisions of the issuespresented herein, as Financial Advisors of Wells Fargo AdvisorsFinancial Network, we are not qualified to render advice on tax orlegal matters. You should discuss tax or legal matters with theappropriate professional.

Dedicated to my loving wife Joanne, without whosesupport this would not have been possible, and to the clients overthese many years who have been helped to gain financialconfidence.

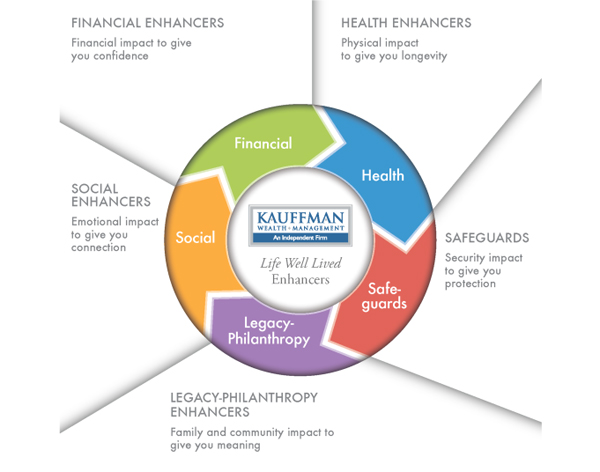

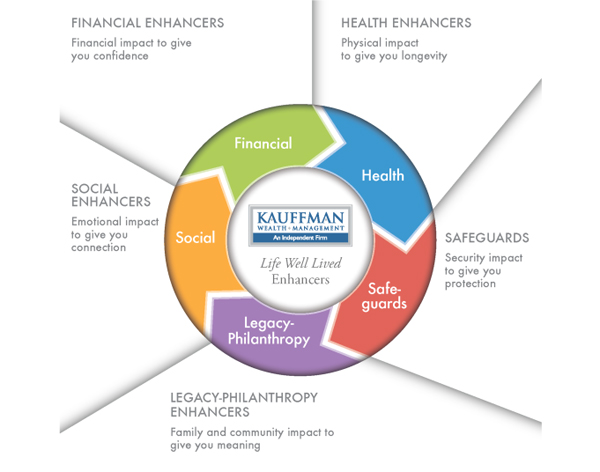

Wealth Enhancers to Help Clients Achieve a LifeWell Lived

At Kauffman Wealth Management we arededicated to helping our clients enjoy the highest quality of life.We accomplish this by providing valuable Life Enhancer resourcesto help optimize five key areas

FINANCIAL: While ithas been said that money isnt everything, Thoreaus famous quote wealth is the ability to fully experience life speaks to howresources can certainly enable us. At KWM our top priority is tohelp clients achieve financial confidence so they can focus on thethings in life that they enjoy. Our booklet Are You On Track: YourA-Z Financial Freedom Resource articulates our playbook forhelping clients define, achieve and preserve their financialgoals.

HEALTH: Health isthe real wealth and not pieces of gold and silver, as Gandhi soaptly put it. Both from a physical as well as emotionalperspective, enjoying good health is critical to achievinghappiness.

Knowing this, at KWM we offer numerousresources including articles and seminars by noted physicians andpsychologists that help clients enhance life quality.

SAFEGUARDS: Accumulating what you have is half the job; keeping it is the otherhalf and requires vigilance. We partner in that effort by helpingclients safeguard their wellbeing with initiatives ranging fromtools to help manage risk, to updates with the latest on avoidingidentity theft and protecting against internet incursions. Our goalis to help clients be in the world with less worry and concern.

LEGACY-PHILANTHROPY: The goal isnt to live forever; rather its to create somethingthat will. Knowing that nearly 70 percent of family wealthtransference and business succession plans fail, and that the vastmajority of failures were attributable to poor family trust,communication and heir preparation, we know the difference goodheir preparation can make. Our booklet Are Your Heirs Prepared:Your A-Z Moneywise Family Resource offers a step-by-step processfor helping clients articulate their values, identify how much theycan afford to gift without adversely impacting their own lifestyle,and how they can help their heirs prepare to be effective stewardsof their estate. The priority is to facilitate family cohesion andto help clients explore what place (if any) philanthropy may playin their plans.

SOCIAL: Feelingconnected not only helps us live happier lives; studies show thatpositive social relationships can actually increase average lifespan by 7.5 years! Knowing this, at KWM we sponsor a variety offinancial and non-financial events that help our clients buildrelationships within their families as well as among each other.Our priority is to help clients enjoy life to its fullest.

TABLE OF CONTENTS

CHAPTER1 How Can You Create Your Effective FamilyFinancial Plan?

CHAPTER8 How Can Your Charitable Efforts Have theMost Impact?

Introduction

Family bliss becomes even more important as people age andappreciate their own mortality. Yet the topic of money, if nothandled properly, has the potential to insert a painful wedge intoeven the best of relationships. Money changes people, plain andsimple. Where loved ones are not given an opportunity to understandhow money decisions are made and why, particularly when it comes toinheritances and bequests, anger and resentment among them canresult. Being a trusted Wealth Manager-Advisor to many familiesover the past 35 years has afforded me a unique perspective towitness firsthand what can be done right and what could be donebetter. This book strives to capture those valuable lessons andoffer them so others can benefit (See Chapter 1: Can You Create Your Effective Family Financial Plan? for an overview perspective).

Helping elders feel confident of their ownfinancial security is an important starting point and keyprerequisite to their making effective family gifting andphilanthropic decisions. Even the best giving plans can be derailedwhen an elder becomes anxious over whether his or her own lifestylecould be threatened. Having a methodical process to establish howmuch is needed to support that lifestyle is top priority. Only byhaving that insight can we then make truly informed decisions abouthow much to give away to family members and charities and enjoythose decisions without second thoughts and/or regrets (See Chapter2: Are Your Financial Goals Achievable? TheImportance of Having YourNumber ).

Whatever your family structure, embracing aprocess where clear, open communication can be enjoyed by all, is akey ingredient. We as family elders (parents and grandparents) arethe ones most influential in setting that stage. Before we can doso, it is top priority that spouses or partners are clear betweenthemselves on their own values, priorities and vision. So agreeingon that common ground before including other family members iscritical (See Chapter 3: Can Articulating YourValues Enhance Family Cohesion? ).

Once you as elders have clarity as to yourown vision and financial needs, preparing your heirs to be goodstewards consistent with your values, is the next priority.Obviously people have different comfort and skill levels when itcomes to money.

Those more fluent may need less guidance,while others will need more. Certainly a minimum competency levelis important. Understanding what skills comprise that minimum leveland helping loved ones understand where they may benefit fromguidance so to gain confidence in their functionally, is essential.(See Chapter 4: How Prepared Are YourHeirs? ).

Similarly, clients often wonder when and howto begin teaching their children (and grandchildren) about money.While opinions may differ, studies show that much can be done asearly as Kindergarten by starting with engaging games and allowancearrangements. These early seeds can be combined with a lifelonglearning program to help assure your young ones will have the keyfinancial skills needed to help them grow into highly functioning,self-sufficient, responsible adults capable of being the goodstewards that you wish they become. (See Chapter 5: If You Dont Teach Your Children to be Money Smart, WhoWill? ).