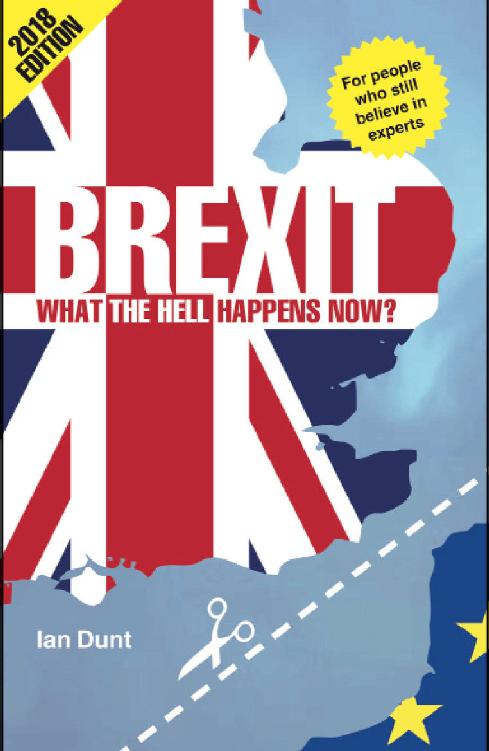

European Union - Brexit: What the Hell Happens Now?

Here you can read online European Union - Brexit: What the Hell Happens Now? full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. City: Grande-Bretagne;Great Britain, year: 2017, publisher: Canbury Press, genre: Politics. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Brexit: What the Hell Happens Now?

- Author:

- Publisher:Canbury Press

- Genre:

- Year:2017

- City:Grande-Bretagne;Great Britain

- Rating:3 / 5

- Favourites:Add to favourites

- Your mark:

- 60

- 1

- 2

- 3

- 4

- 5

Brexit: What the Hell Happens Now?: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Brexit: What the Hell Happens Now?" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Brexit: What the Hell Happens Now? — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Brexit: What the Hell Happens Now?" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Brexit: What the Hell Happens Now?

2018 Edition

Ian Dunt

Published in October 2017

Canbury Press, UK

www.canburypress.com

All rights reserved Ian Dunt, 2016.

The right of Ian Dunt to be identified as the author of this work has been asserted in accordance with Section 77 of the Copyright, Designs and Patents Act 1988

ISBN: 978-0-9954978-5-6 (Paperback)

Introduction

30 March 2019

The clock strikes midnight and Britain is out of the European Union. The talks have fallen apart in mutual acrimony. The UK has not secured continued membership of the single market. It doesnt even have access. It is out of the customs union, too. It has no trade deals with Europe or anyone else. It is on its own.

In the early morning, a lorry is loaded in Glasgow with radio equipment bound for the Czech Republic. When the lorry arrives at Calais, it is stopped by a customs official. Until today, Britain has enjoyed a seamless trading relationship with Europe. It means that European Union countries recognise UK standards and paperwork and vice-versa, allowing goods to be transported over borders without additional checks. Now the paperwork is worthless. Everything has to be checked.

The lorry is stopped and detained. Inspectors come on board and take samples to send off for testing. Everything will have to be assessed, from the information on the packaging to the environmental impact of the components. This will take several days, during which the lorry is barred from entering the European market.

Behind the Glasgow lorry, several other vehicles are taken to one side. By sunset, the bottleneck on the French side means that lorries can no longer drive onto Calais-bound ferries at Dover. They queue on the slow lane of the A2. Within a few days, the tailback stretches back to London.

For exporters of animal products such as meat and eggs the problems are more severe still. They are only allowed into the EU through specially designated entry inspection posts, but it has been so long since the UK needed them for trade with Europe that none exist. British exports of salmon, beef, and lamb collapse overnight. In Westminster, ministers demand the immediate creation of the inspection posts, but they have limited leverage with their European partners. A key export industry starts to rot.

The problems arent restricted to goods heading to the Continent. The EU has mutual recognition agreements with Australia, Canada, China, Israel, Japan, New Zealand and the United States, mimicking the bureaucracy-free trade on the Continent. British goods for the US had been verified by virtue of their EU accreditation. Now they also need to be checked. Shipments heading for Americas west coast are stopped at customs, detained and sent off for inspection.

In the complex world of freight, with one shipment arriving as the other leaves, the effect is devastating. Brexit detonates like a bomb across global trading networks.

Thousands of large businesses start haemorrhaging cash, but the effect is not limited to goods going out it hits those coming in, too. Laptop computers from China and Japan are stopped, alongside jeans from the US, French cheese and wine and chocolates from Belgium. Gaps start to appear on shop shelves.

Other bureaucratic requirements re-emerge from the past like zombies. One of them is proof of country of origin. Britain had previously been in the European customs union, which sets tariffs for non-member countries. Imports into the customs union must undergo laborious checks to ensure that they are paying the right tariffs. Each stage in a global manufacturing process must be accounted for; British firms need to present paperwork detailing the origin of every component in their products.

Her Majestys Revenue and Customs hires an army of inspectors to speed up the process, but they are trying to learn on the go. Many products dont receive their papers in time and dont make it to the border. They sit in the stockroom. In the first year alone, the country of origin requirement costs Britain 25 billion. By 2030 it has reduced GDP by 4.5%.

Products which do make it past border control have tariffs slapped on them. For decades they had been traded freely on the Continent, but those days are over. Cars heading from Britain to Europe almost half the vehicles made in the UK are hit by a 10% tariff. Electronic goods are badly affected, as are warships and commercial liners.

Britains aerospace industry, the second largest in the world, is damaged. The rates of the tariff themselves are fairly modest, hovering between 2.7% and 7.7%, but they dont only go on the finished product when it is sent to Europe. They are also applied to the components shipped from Europe to the UK to make the product. Shares in BAE Systems, Rolls Royce and Airbus plummet. These businesses costs have rocketed, and their product has shot up in price, without any of the additional revenue flowing to them.

Multiple parts of the British economy, from space stations to cakes, suffer a sudden hit. Companies that still make tangible physical products in Britain Unilever, Imperial and Penguin among them are the first to feel the pain.

The big banks in the City of London had been dreading this day. They did what they could to prepare, sacking thousands of middle and low income workers and moving their jobs to EU states. They are desperate to maintain their passports, a legal mechanism which allows them to sell financial products across Europe, but to do so they must prove to European regulators that they have a significant presence on the Continent. So they take the cheaper, back-office admin roles and move them, along with one or two executives. Anything else would be a waste of a crisis. This way the banks can kill two birds with one stone: minimising salary costs by transferring the jobs to countries with lower incomes and reducing the damage done by Brexit.

If they are lucky, firms transferred enough functions in time for the March deadline. But others got caught up in another bottleneck this time of financial authorities. The sleepy, understaffed regulators in Paris, Warsaw, Frankfurt and Luxembourg couldnt handle the demand for recognition from City firms. Many companies cannot now sell financial products to customers on the mainland. They lose tens of millions of pounds of sales as customers drift off to competitors.

The transfers cut the capacity of Londons financial services sector by 10%. Within a year, the City has lost 100,000 jobs and 12 billion in revenue. The pound plunges again. Foreign direct investment falls further. The deficit begins to look unsustainable.

Ironically, immigration starts to decline. Not just from Europe, where immigration controls have been introduced, but from across the world. The economy is tanking and Britain is no longer a country of opportunity.

Years pass, but 2019 comes to be seen as the start of a significant downsizing in the power of the City. Financial services dont have a heart attack. They bleed out.

European regulators start making increased demands on the investment banks with branches in their cities. It starts with requests for more staff but soon includes additional requirements on risk management and capital investment. Firms have to divert more resources to the Continent, but gradually a political dimension develops too. If Europe is where the regulatory decisions are made, perhaps that is where they need to focus their efforts. What began as a technical requirement starts to change into a general financial migration. More and more functions are transferred to the Continent. Less and less money flows into the UK Treasury.

Nissans car plant in Sunderland is able to survive because of a side deal with the government, in which it was offered relief for any losses caused by Brexit. An offer is also made to BMW. The symbolic effect of Minis with Union Jack roofs being produced in the Czech Republic would have been too much for ministers to bear. Jaguar Land Rover considers the location of its assembly plants in Birmingham, Halewood and Solihull and its three research and development facilities around Warwick. Its not so much the 10% increase in the price of cars, but future regulation that is the worry. Cars are changing. Driverless technology is turning what used to be a lump of metal around some tech into a tech product with a metal shell. Regulations established now will be with producers for years and they are being made in Brussels, not London. Jaguar Land Rover needs to be whispering into the right persons ear, but British ministers no longer have a seat at the table.

Font size:

Interval:

Bookmark:

Similar books «Brexit: What the Hell Happens Now?»

Look at similar books to Brexit: What the Hell Happens Now?. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Brexit: What the Hell Happens Now? and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.