Peter Schweizer - Architects of Ruin: How Big Government Liberals Wrecked the Global Economy--and How They Will Do It Again If No One Stops Them

Here you can read online Peter Schweizer - Architects of Ruin: How Big Government Liberals Wrecked the Global Economy--and How They Will Do It Again If No One Stops Them full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2010, publisher: Harper Paperbacks, genre: Politics. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Architects of Ruin: How Big Government Liberals Wrecked the Global Economy--and How They Will Do It Again If No One Stops Them

- Author:

- Publisher:Harper Paperbacks

- Genre:

- Year:2010

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

- 100

- 1

- 2

- 3

- 4

- 5

Architects of Ruin: How Big Government Liberals Wrecked the Global Economy--and How They Will Do It Again If No One Stops Them: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Architects of Ruin: How Big Government Liberals Wrecked the Global Economy--and How They Will Do It Again If No One Stops Them" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Architects of Ruin: How Big Government Liberals Wrecked the Global Economy--and How They Will Do It Again If No One Stops Them — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Architects of Ruin: How Big Government Liberals Wrecked the Global Economy--and How They Will Do It Again If No One Stops Them" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

How Big Government Liberals Wrecked the Global Economyand How They Will Do It Again If No One Stops Them

For Rochelle

A Failure of Capitalismor Liberal Social Engineering?

The Robin Hood Agenda

How a Gang of Radical Activists and Liberal Politicians Set the Stage for the Biggest Bank Heist in History

$4 Trillion Shakedown

The Lefts Activist Jihad Against American Banks

The Clinton Crusade

How Democrats Made Credit a Civil Right

Cover Your Fannie

How Fannie Mae and Freddie Mac Were Taken Over by Liberal Activists

The Golden Trough

How Liberal Politicians Used Fannie and Freddie to Rig the Real Estate Market While Lining Their Own Pockets

Do-Good Capitalists

Bill Clintons Seduction of Wall Street and the Birth of the Bailout Culture

Minority Meltdown

A Tale of Two Bubbles

Robin Hood Comes to the White House

How Barack Obamas Plans to Use Liberal State Capitalism Will Create the Next Big Economic Meltdown

A Failure of Capitalismor Liberal Social Engineering?

If you happened to be watching the MSNBC news channel in early January 2009, theres a good chance you might have fallen off the sofa after reading the crawl on the bottom of the screen: ECONOMY PROJECTED TO SHRINK 202%.

What?

It was a misprint, of course. But to many frightened viewers this nightmare scenario might not have seemed far-fetched. As the wheels started to shake and come off the American economy in mid-2008at the height of the presidential electionthere was concern verging on panic about the possibility of a total economic meltdown. Thus the Los Angeles Times asked Could Another Great Depression be Lurking on the Horizon? The Chicago Tribune offered the banner 75 Years Later, a Nation in Crisis Again. Time magazine wondered: The End of Prosperity? And from the usually sober Wall Street Journal : Worst Crisis Since 30s, with No End in Sight.

The concern and panic were real because the numbers were real. Loan defaults and bank foreclosures had skyrocketed. Real estate values collapsed nationwide, trapping many people in homes they could not sell and struggling to pay mortgages. Trillions of dollars in value were wiped out of the stock market, mutual funds, and pension funds. Millions of Americans were suddenly unable to afford retirement, their savings wiped out and the value of their retirement accounts effectively cut in half. A systemic credit market freeze was temporarily thawed by the printing of massive amounts of money by the federal government. Large financial entities such as Bear Stearns and Lehman Brothers effectively collapsed. Others, such as Citigroup, had to be pumped full of taxpayer money to keep them functioning.

The contagion quickly spread to the international system. Tiny Icelands economy completely imploded, and in central Europe and the developing world, markets tottered on the brink of collapse. Around the world a clamor arose for the Americans to save the global system.

Barack Obama came to office pledging to turn the economy around and create or save millions of jobs while at the same time enacting a transformative social agenda. A terrified Congress rammed through an enormous (and pork-laden) stimulus package, promising that it would stabilize the economy and restore hope to millions of out-of-work Americans. Yet six months later it seemed to be having little effect. Total job losses approached 6 million as unemployment edged toward double digits and welfare rolls expanded. The federal budget deficit crossed $1 trillion in 2009, and many state budgets were equally deep in the red. California was on the brink of bankruptcy. We now appear destined for massive federal tax hikes to pay for the bailouts and the underwriting of President Obamas ambitious social agenda. State-level tax hikes and cutbacks will undoubtedly follow.

And its not overnot by a long shot. Experts foresee another wave of mortgage defaults and predict that unemployment will continue to rise. In Washington the answer to every problem seems to be spend more money. No one seems to know what else to do. Meanwhile, there is talk that the dollar may cease to be the international reserve currency. There are also calls abroad for tighter global regulation and the creation of transnational bodies that will direct the international economya fatal blow to the economic supremacy that Americans have taken for granted since World War II.

All of this has led Americans to wonder: What happened? How the heck did we get here? Whose fault is it? Who do we blame? What mistakes were made? How can we get out of this mess?

There has been much debate about this question, but the ultimate source of the problem, it is generally agreedthe triggering event that caused the chain of other dominoes to fallwas the collapse of the subprime mortgage market in the United States. Banks and mortgage companies had made trillions of dollars in loans to individuals with terrible credit. They signed loans with illegal immigrants, offered so-called NINJA (No Income, No Job, No Assets) mortgages, and allowed people with bad credit to leverage their money. When the loans began to fail in large numbers, a new term entered our national vocabulary: toxic assets. And so the crisis began.

Still, an underlying mystery remained: What explains this perplexing behavior? Were they nuts? Did they simply take leave of their senses?

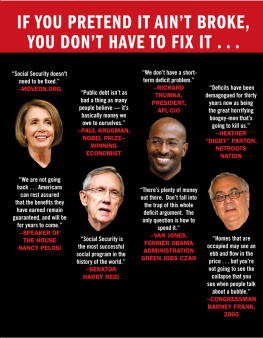

The conventional narrative was written in the first days of the collapse. And as usual, the loudest, most obstreperous voices seemed to prevail. The private sector got us into this mess, Congressman Barney Frank indignantly declared as events began to unfold; the government has to get us out of it.1

According to this view, deregulation of the banking industry had encouraged the rise of predatory lenders who had pushed home loans on people who couldnt afford them. Those loans were then sold to unscrupulous Wall Street financiers, who repackaged them in the form of mortgage-backed securities. The securities were sold in turn to mutual funds, pension funds, and various foreign investors. But their value was grossly overstated and ultimately rested on the faulty assumption that housing prices would keep rising indefinitely. Once again, the supposed result of irresponsible deregulation of financial markets.

This explanation, coming from Frank, had the obvious benefit of pinning the collapse on his political enemies, the Republicans, while completely exonerating any Democrat (such as himself) who had responsibility for overseeing Fannie Mae and Freddie Mac, the government-backed lending institutions that traditionally acted as a backstop to the housing market. It is not an accident that Frank has been in the forefront of attempts to minimize the crisis or (when it could no longer be denied) deflect the blame to his opponents. When some conservatives pointed out that Fannie and Freddie had abandoned their sober mission of stabilizing the middle-class housing market in favor of a misguided crusade to expand minority home ownership by forcing banks to lower their lending standards, Frank and his allies brazenly shouted them down.

Meanwhile, a chorus of authoritative voices in the press rushed to second the indictment. Nouriel Roubini of New York University blamed unregulated free market zealotry for the economic collapse. The Nobel Prize-winning economist Paul Krugman, who also writes a column for the New York Times , denounced the great unraveling of economic regulations pushed by conservatives. Another Nobel laureate, Paul Samuelson, claimed that the financial meltdown was an inevitable consequence of free-market economics. I wish Milton Friedman were still alive, he said, so he could witness how his extremism led to the defeat of his own ideas.2 The economist Jeff Madrick of the New School for Social Research in New York City likewise declared that the crisis represented the end of the age of Milton Friedman.

Font size:

Interval:

Bookmark:

Similar books «Architects of Ruin: How Big Government Liberals Wrecked the Global Economy--and How They Will Do It Again If No One Stops Them»

Look at similar books to Architects of Ruin: How Big Government Liberals Wrecked the Global Economy--and How They Will Do It Again If No One Stops Them. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Architects of Ruin: How Big Government Liberals Wrecked the Global Economy--and How They Will Do It Again If No One Stops Them and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.