Contents

Guide

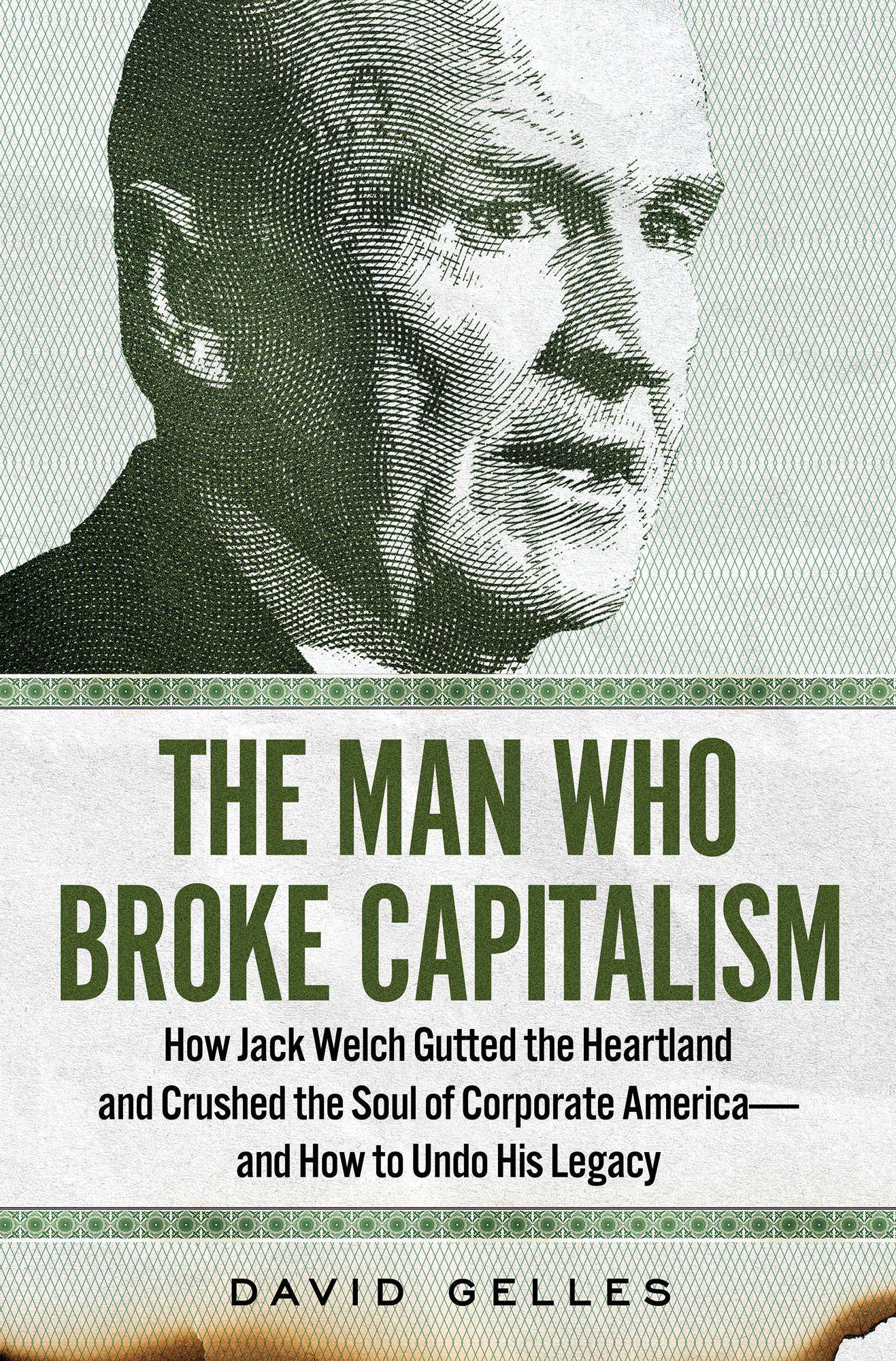

The Man Who Broke Capitalism

How Jack Welch Gutted the Heartland and Crushed the Soul of Corporate Americaand How to Undo His Legacy

David Gelles

Simon & Schuster

1230 Avenue of the Americas

New York, NY 10020

www.SimonandSchuster.com

Copyright 2022 by David Gelles

All rights reserved, including the right to reproduce this book or portions thereof in any form whatsoever. For information, address Simon & Schuster Subsidiary Rights Department, 1230 Avenue of the Americas, New York, NY 10020.

First Simon & Schuster hardcover edition May 2022

SIMON & SCHUSTER and colophon are registered trademarks of Simon & Schuster, Inc.

For information about special discounts for bulk purchases, please contact Simon & Schuster Special Sales at 1-866-506-1949 or .

The Simon & Schuster Speakers Bureau can bring authors to your live event. For more information or to book an event, contact the Simon & Schuster Speakers Bureau at 1-866-248-3049 or visit our website at www.simonspeakers.com.

Interior design by Joy OMeara @ Creative Joy Designs

Jacket design by Eric Fuentecilla

Jacket Art: Photograph of Jack Welch by Bob Daemmrich/Alamy Stock Photo; Diploma by Claudia Balasoiu/Shutterstock; Burnt Paper by Love the Wind/Shutterstock

Library of Congress Control Number: 2022932424

ISBN 978-1-9821-7644-0

ISBN 978-1-9821-7643-3 (ebook)

For my family, with thanks for all they provide

INTRODUCTION

To understand a civilization, consider its heroes. Ancient Egyptians glorified the pharaohs, intermediaries between gods and men. Romans celebrated their generals, who expanded the empire through conquests abroad. The Greeks had their philosophers, searching for the truth. Other great societies were defined by their poets, their painters, their sculptors, and composers. More recently, explorers, scientists, and civil rights leaders have emerged as the iconic figures of their eras. Our heroes reflect our collective aspirations, offering clues to our deepest desires, idealized behaviors, and societal priorities. They bend the arc of history, defining their times and influencing events long after they are gone. Generations from now, when future anthropologists try to make sense of this moment in the American experiment, looking to our idols for clues about our priorities, they will need to contend with a perplexing but undeniable fact: in America, we worship our bosses.

We put our chief executives up on pedestals, granting them wide latitude to influence our national discourse and endowing them with vast wealth while absolving them of accountability. We herald entrepreneurs and venture capitalists as our most brilliant minds, lionizing their achievements and celebrating increased shareholder value as if it were a major medical breakthrough. We elevate the richest among us to positions of moral authority, letting CEOs, not religious leaders or philosophers, shape our views on the fraught political and social issues of the day. We elect billionaires as mayors and private equity barons as senators, and have would-be monopolists for our most prominent philanthropists. Surveys routinely show that the public has more faith in CEOs than it does in politicians or priests, more confidence in corporations than in the government. Our faith in bosses is so absolute that we even elected a failed businessman who played a successful one on television as president of the United States.

Yet even when the results are disastrous, even when our heroes turn out to be crooks, we cant help but want for more. How could we not? In a nation made powerful by its staggering industriousness and titanic economy, captains of industry are the very embodiment of American success. CEOs as much as presidents have ushered us from one epoch to the next. Railroad tycoons and robber barons gave way to industrialists, who gave way to media moguls, who gave way to financiers, who gave way to technologists. And still, even in a society obsessed with successful businessmen, there is one CEO above all others who was revered as a cultural and economic hero in his own time, who radically transformed the world around him and continues to hold sway even after his demise, who seized on changes in the zeitgeist and used them to rewrite the rules of our economy: Jack Welch.

As chairman and chief executive of General Electric from 1981 to 2001, two decades that shaped the world we inhabit today, Welch exerted unmatched influence on American capitalism. In his heyday, as head of one of the countrys most powerful companies, he was lauded as a visionary. He identified the promises of globalization and rapidly reshaped GE to compete on the world stage. He could see around corners and pushed GE into the media and finance industries at just the right time. Above all, he understood the power of the stock market, and used GEs might and complexity to reward those lucky enough to own the companys shares. The financial results he delivered were undeniably great. During his tenure, GE posted annualized share price growth of about 21 percent a year, far outpacing the S&P 500 even during a historic bull market. When Welch took over, GE was worth $14 billion. Two decades later, the company was worth $600 billionthe most valuable company in the world.

All that material success obscured darker truths. Welch was not, as he would have liked us to believe, a patrician steward of sound business judgment and good character. Nor was he just another skilled manager with a knack for dealmaking and a good golf game. Rather, he was hungry for power and thirsty for money, an ideological revolutionary who focused on maximizing profits at the expense of all else. The changes he unleashed at GE transformed the company founded by Thomas Edison from an admired industrial behemoth known for quality engineering and laudable business practices into a sprawling multinational conglomerate that paid little regard to its employees and was addicted to short-term profits. And we all went along for the ride.

For the fifty years before Welch took over, corporations, workers, and the government enjoyed a relatively harmonious equilibrium. Most companies paid decent wages, employees put in their time, just about everyone paid their taxes, regulations were accepted as necessary safeguards, and the government invested in things like education and infrastructure. It wasnt perfect, and there were certainly inequities, but it worked well for much of the twentieth century, giving rise to a diverse, thriving economy and a prosperous middle class.

Then in the 1970s, the established order came under attack. A cadre of economists including Milton Friedman reimagined the purpose of the corporation and its role in society, laying the philosophical groundwork for an upending of the economic order. In their view, companies ought to maximize profits for shareholders at any cost, markets should be free, governments should stay out of the way, and the rest of society ought to take care of itself. Their views were anathema to the postwar balance that seemed to be working so well, and at first they failed to gain traction. Indeed, the dream of unrestrained markets and a world where profits came first was so drastic that for a decade it remained almost entirely theoretical. There were policy papers, academic treatises, and speeches, and some of its chief proponents began ascending to positions of power. Yet by 1981, no one had truly put this philosophy to work. No one, that is, until Welch.