Published in 2020 by Cavendish Square Publishing, LLC

243 5th Avenue, Suite 136, New York, NY 10016

Copyright 2020 by Cavendish Square Publishing, LLC

First Edition

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any meanselectronic, mechanical, photocopying, recording, or otherwisewithout the prior permission of the copyright owner. Request for permission should be addressed to Permissions, Cavendish Square Publishing, 243 5th Avenue, Suite 136, New York, NY 10016. Tel (877) 980-4450; fax (877) 980-4454.

Website: cavendishsq.com

This publication represents the opinions and views of the author based on his or her personal experience, knowledge, and research. The information in this book serves as a general guide only. The author and publisher have used their best efforts in preparing this book and disclaim liability rising directly or indirectly from the use and application of this book.

All websites were available and accurate when this book was sent to press.

Library of Congress Cataloging-in-Publication Data

Names: Sebree, Chetla, author.

Title: Understanding taxation / Chetla Sebree.

Description: First edition. | New York: Cavendish Square, 2020. |

Series: 21st-century economics | Includes bibliographical references and index.

Identifiers: LCCN 2019005135 (print) | LCCN 2019007371 (ebook) |

ISBN 9781502646163 (ebook) | ISBN 9781502646156 (library bound) |

ISBN 9781502646149 (pbk.)

Subjects: LCSH: Taxation--United States--Juvenile literature.

Classification: LCC HJ2381 (ebook) | LCC HJ2381 .S425 2020 (print) |

DDC 336.200973--dc23

LC record available at https://lccn.loc.gov/2019005135

Editorial Director: David McNamara

Copy Editor: Nathan Heidelberger

Associate Art Director: Alan Sliwinski

Designer: Joe Parenteau

Production Coordinator: Karol Szymczuk

Photo Research: J8 Media

Portions of this book originally appeared in How Taxation Works by Laura La Bella.

The photographs in this book are used by permission and through the courtesy of: Cover Piotr Adamowicz/ Education Images/UIG/Getty Images.

Printed in the United States of America

CONTENTS

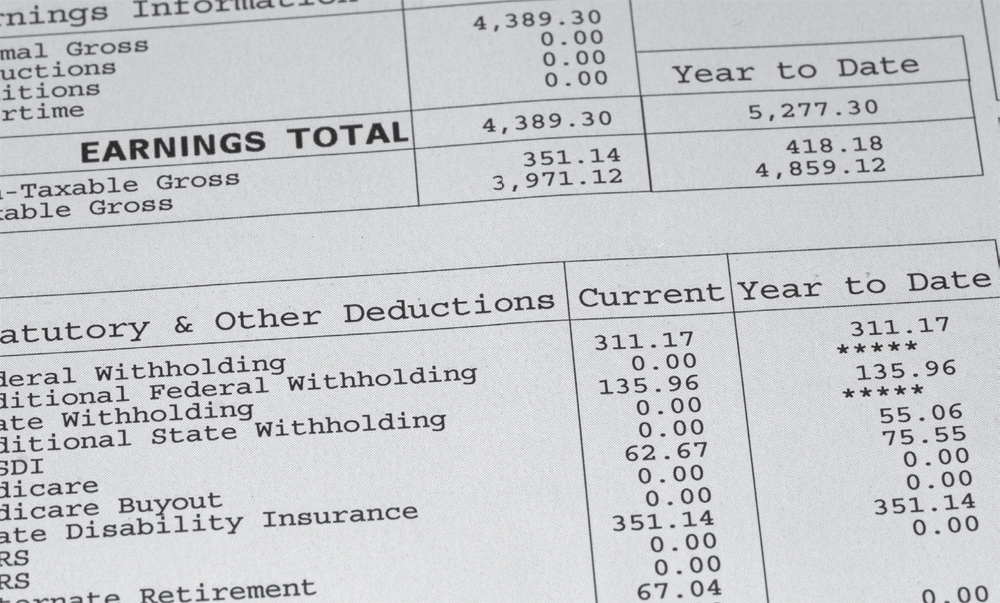

Each paycheck you receive, whether its for washing dishes or working as a camp counselor, will be taxed.

INTRODUCTION

UNDERSTANDING TAXES

P erhaps youll start your first job this summer. Before your first paycheck as a lifeguard, waitress, or employee in a store or amusement park, you might try to calculate how much youll be making by multiplying your hourly rate by the number of hours you work. But when you look at your pay stub, youll soon learn that you wont bring home every dollar you so carefully calculated. Dont worry. Your employer probably didnt forget to pay you. Instead, you are learning about an important responsibility that comes with having a job: paying taxes.

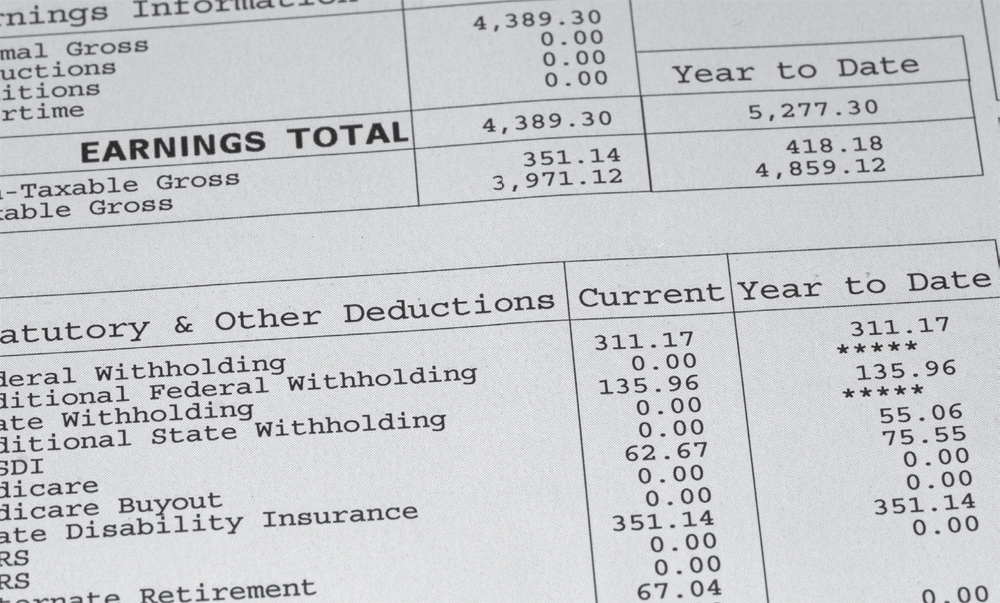

Your paystub will tell you how much money youve made so far during the year. It also shows how much money youve paid in different types of taxes, like income tax.

Paying Taxes

You probably knew that when people worked, they had to pay taxes. Theres no doubt youve heard your parents or grandparents complain about them. Your paycheck will show you that if theres one thing you cant escape, its taxes. Everyone pays them. No matter how old you are, what you do for a living, or where you live, you will pay taxes in the United States. Income tax is probably the easiest to understand. When you have a job and you are making money, a portion of your income is likely withheld to pay taxes.

While even in Monopoly you pay an income tax, not all states actually have this type of tax at the state level.

But there are many different types of taxes in the United States. You will pay separate taxes to the federal government and to the state government in which you live. Plus, you may pay taxes to your local government (the town, city, or county you live in). Youll also pay for services you might not even understand yet, like Social Security and Medicare/Medicaid.

Where Does the Money Go?

While it can be frustrating to see your hard-earned money go somewhere other than in your pocket, taxation is an important part of government. For instance, the US government acts as a very large business with a lot of debt and expenses. Many of those expenses are services citizens of the United States get to use, such as public assistance like food stamps and education. Other services, like the military, keep the country safe during times of war and peace. To handle these costs, the government needed to create revenue, or income.

Citizens in most countries pay taxes their entire lives. For that reason, its important to understand how taxes work, what kinds of taxes we pay, why we pay them, where the money goes, and who spends our tax dollars. It can help you to better prepare for your future if you have a fuller understanding of taxes.

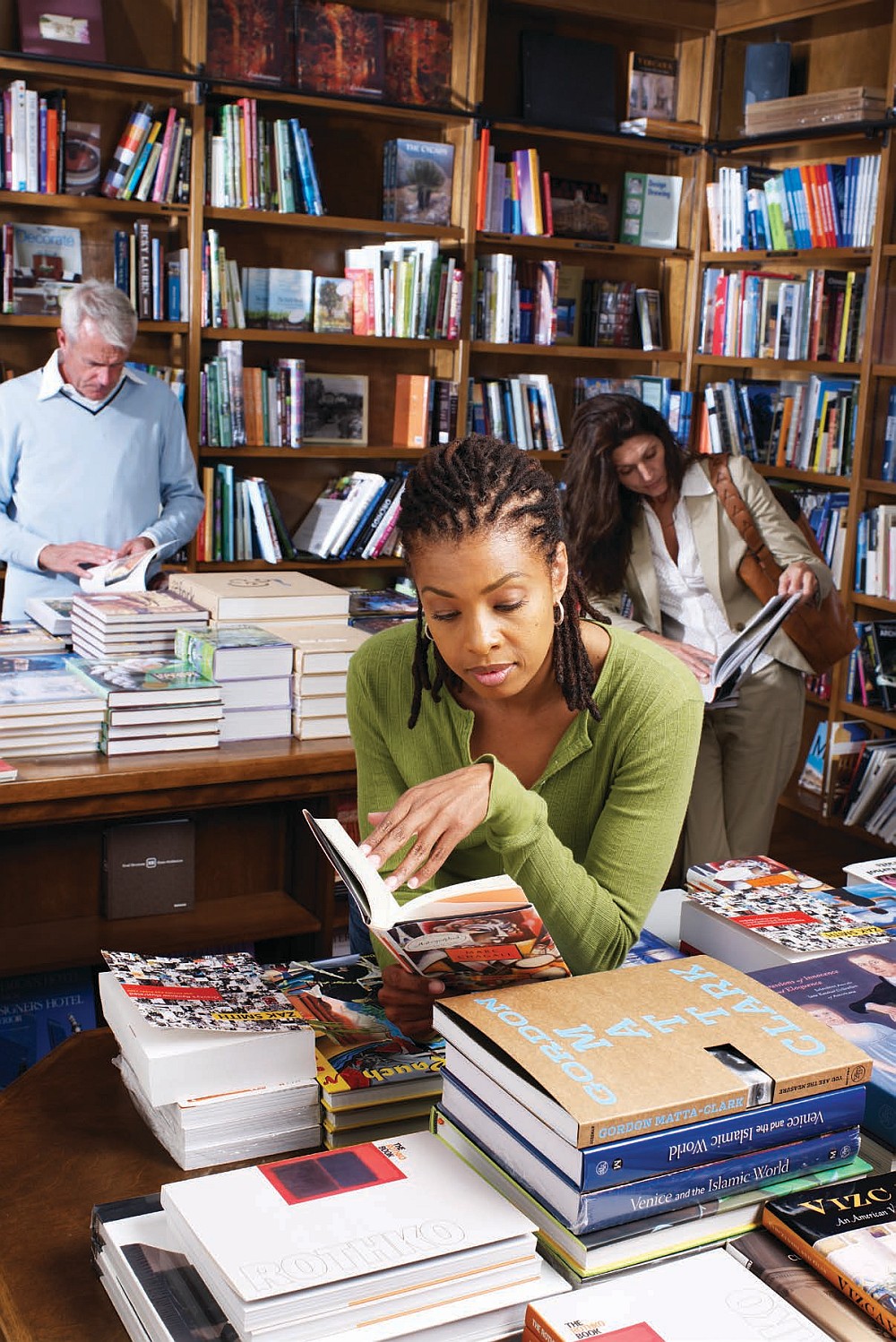

In some states, there is a type of tax called sales tax. This means that buyers pay a certain percentage in taxes for items they purchase, like books or video games.

CHAPTER 1

DIFFERENT TYPES OF TAXES

A lthough you may not understand them, youve probably heard people talk about taxes quite a bit. Youve probably heard your parents at dinner or politicians on television talking about high or low taxes. Youre also affected by them when you make purchases. For instance, depending on which state you live in, video games, books, groceries, and clothes are taxed. You might be asking yourself why we pay taxes. How can a few cents added to the purchase of Harry Potter be that important? Learning about taxes and why we pay them is important to understanding how our government works.

The Basics

In its simplest form, a government determines the way in which a country, state, county, town, city, or village is run. At every level of government, laws are created that citizens must obey. Policies are put in place for just about everything connected with our daily lives. A community needs an organized way to function, and a government provides that framework.

American colonists were frustrated by the taxation imposed on them by the British, especially since there wasnt anyone representing the colonists interests in the British government.

The US government provides public goods and services for the citizens of the country as a whole. But since the government doesnt generate any income of its own, it needs a way to pay its bills. The money that the US government uses to pay these bills comes mostly from taxes.

Taxes have been a part of US history since its earliest days. In fact, taxation forced on the colonists by the British government was one of the reasons the colonists fought for independence in the first place. However, when writing the Constitution, the Founding Fathers knew that the young country would need the money generated from taxes to help build the countrys infrastructure, or the fundamental systems that manage the country. The government generated this money by taxing imports and certain purchases like alcohol.