Table of Contents

ACKNOWLEDGMENTS

Research and writing by

Sarah Dewees, First Nations Development Institute

Research assistance from

Aaron Bourke,Veronica Burt, Esther Cervantes, Metric Giles, Sam Grant, Megan Headley, Caitlin Howell, Gene Hoover, Stefanie Juell, Cathi Kozen, Joe Linkevic, Nicholas Lydon, David Lysy, Amy Parker, Nieta Pressley, Amelie Racliffe, Kelly Spada, Christina Song, Liz Stanton,Talia Sturgis,Valerie Taing, Chaka Uzondu, Gretchen Weitmarschen, Katherine Winters, Jo-Ellen Yan, Stephanie Yan, Al Wang, Sheronda Watkins

Thanks to

Dr. Roger Betancourt, University of Maryland

Dr. Douglas Dacy, University of Texas-Austin

Dr. Melvin Oliver, University of California-Santa Barbara

Dr. Lodis Rhodes, University of Texas-Austin

And special acknowledgment to

Dr. Rhonda Williamsmay her spirit live on.

Chapter 1

OVERVIEW: THE ROOTS OF THE RACIAL WEALTH DIVIDE

Accumulating wealthas distinct from making a big incomeis key to your financial independence. It gives you control over assets, power to shape the corporate and political landscape, and the ability to ensure a prosperous future for your children and their heirs.... Wealth is used not just to pay the rent or buy groceries, but to create opportunities, to free you to pursue your dreams.

REV. JESSE JACKSON, SR., AND JESSE JACKSON, JR.

For every dollar owned by the average white family in the United States, the average family of color has less than one dime. Why do people of color have so little wealth? Because for centuries they were barred by law, by discrimination, and by violence from participating in government wealth-building programs that benefited white Americans. Understanding the roots of the racial wealth divide will lead to more understanding of racial inequities in general and more understanding of how to reach equality.

WHAT IS WEALTH?

In this book, when we use the term wealth, we mean economic assets. A familys net worth is their assets minus their debts, or what they own minus what they owe. Assets include houses and other real estate, cash, stocks and bonds, pension funds, businesses, and anything else that can be converted to cash, such as cars and works of art.

These are not the only kinds of wealth. Family, social, and community networks, education and skills, public infrastructure and a healthy environment, religion and spirituality: all these not only make us economically more secure, they help us feel well off in ways that money cant buy. But this book focuses on financial wealth, and the story of the governments role in influencing the racial wealth divide.

Our net worth is influenced by the net worth of our parents, grandparents, and earlier generations. Most private wealth in the United States was inherited. And even for people who do not inherit money after their parents deaths, their familys education and social contacts and financial help from living relatives make a big difference.

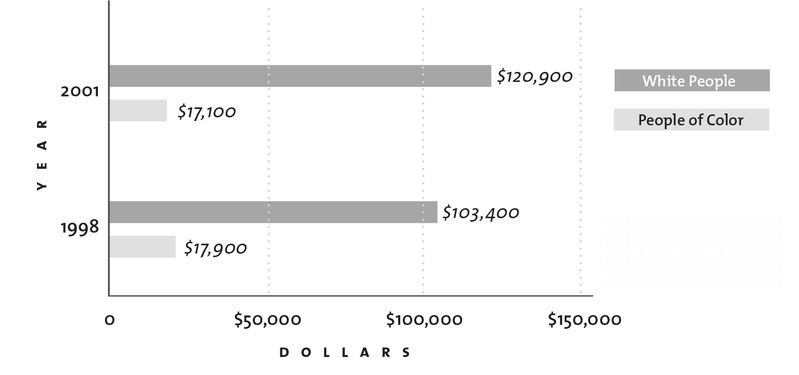

The racial wealth gap has continued to grow (see ). From 1995 to 2001, according to the Federal Reserve Bank, the average family of color saw their net worth fall 7 percent, to $17,100 in just six years, while an average white familys net worth grew 37 percent, to $120,900, in the same period.

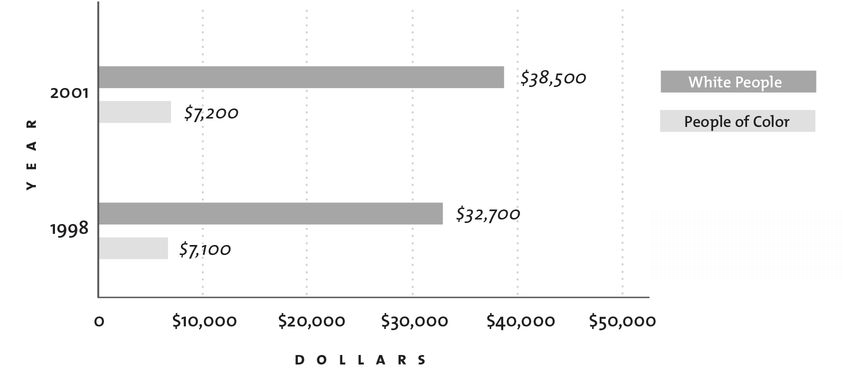

The gap in financial assets (cash, stocks, and bonds) is even greater, since most people of colors assets are invested in their home (see ).

PERCEPTION AND REALITY OF ECONOMIC INEQUALITY BY RACE

Explicit racial discrimination has been illegal since the Civil Rights laws of the 1960s, so many people now attribute racial differences in financial success entirely to individual behavior. White Americans in particular tend to believe that the playing field is now level. Every year Gallup takes a minority rights and relations poll that reveals ethnic differences in perceptions of opportunity. In the 2004 poll, 77 percent of white respondents and 69 percent of Latino respondents said they believe that African Americans have as good a chance as whites do to get any kind of job for which they are qualified. Only 41 percent of blacks felt the same.

Median net worth by race, 2001 (assets minus debts)

Source: Federal Reserve Bank, Survey of Consumer Finances.

Median financial assets by race, 2001

Source: Federal Reserve Bank, Survey of Consumer Finances.

A racially mixed group is gathered in a church basement for a workshop on the racial wealth divide. A trainer from United for a Fair Economy has just presented the facts that a typical white family has about $121,000 in assets, compared to the typical family of color, which has about $17,000 in assets.

In response, Ed, a middle-aged white man, raises his hand. I hear what you are sayingthat white people tend to have more money. But I dont like what you are implyingthat I should feel guilty about it. I swear, everything I have, I worked hard for.

Ed has a point. He says he studied hard in college, worked hard at every job, and saved steadily until he could buy a home. For the past several years, he and his wife have been contributing to a retirement account.

The trainers ask him who helped him become prosperous, and he says, No one. When the discussion turns to affirmative action, he says he opposes racial preferences and government handouts.

But then the trainers lead the group in an exercise in which participants put milestones of their familys history on a giant timeline on the wall.

It turns out that Eds great-great-grandfather got a farm in Nebraska through the Homestead Acta program only available to whites.

His father, a World War II veteran, got a Veterans Administration mortgage and went to college on the G.I. Billprograms that black G.I.s couldnt take full advantage of because of housing and education discrimination.Thanks to those boosts to earlier generations, Eds college tuition as well as the down payment on his home could be paid by his parents.

It may be true that he studied hard, worked hard, savedand so can claim some credit for his assets. But how much of the credit is his? How much is due to public investments in his family?

A Latina woman, Larisa, asks Ed,What about me? I studied hard, worked hard, and saved just like you. But I didnt get the same rewards. Doesnt that mean your money comes partly from your race? Ed admits that it does.

Not surprisingly, theres a similar division on the question of how much the government should try to improve the social and economic status of various groups. Sixty-eight percent of African Americans, 67 percent of Latinos, and only 32 percent of whites said government should play a major role. Our explanation of the racial wealth gap has implications for the solutions we favor: individual failure implies individual responsibility for narrowing the gap, while structural causes require collective efforts for public solutions.