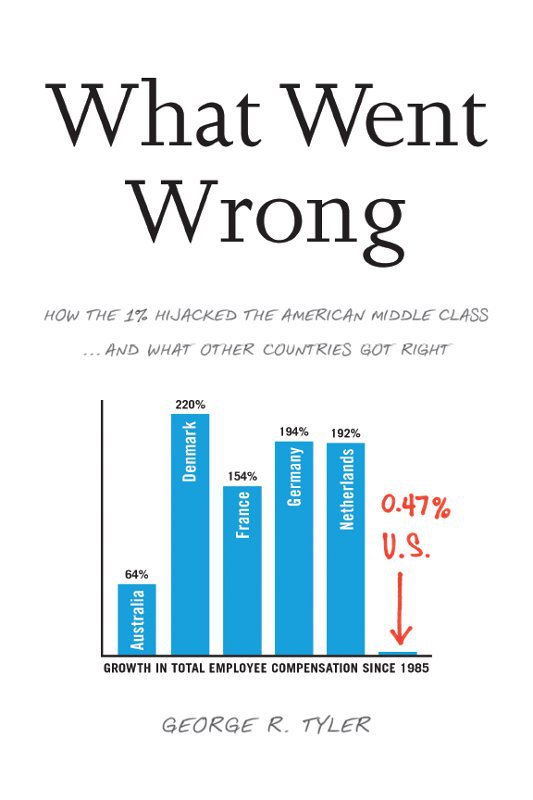

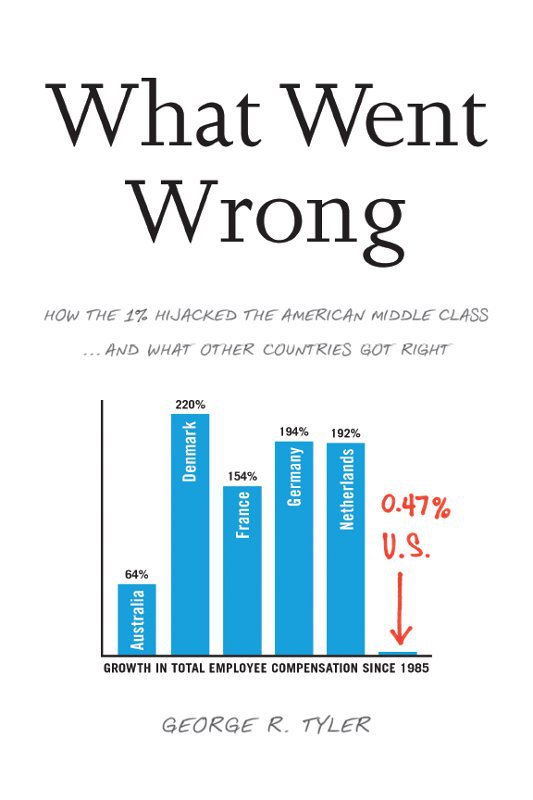

COVER CHART

The chart on the front cover shows the changes in total labor compensation between 1985 and 2008 for production employees in manufacturing, adjusted for inflation using the Consumer Price Index. Total compensation is comprehensive employer costs including: wages, bonuses, benefits, government taxes, and fees. This time series was chosen because it is the most uniform international data set on wages covering the past three decades. A chart depicting the time series for wage data alone would be similar.

Source: International Hourly Compensation Costs for Production Workers in Manufacturing (wages, all benefits, social insurance expenditures, and labor-related taxes), Department of Labor, Bureau of Labor Statistics, Washington, http://www.bls.gov/fls/pw/ichcc_pwmfg1_2.txt, March 2011, and Consumer Price Index, OECD.StatExtracts Organisation for Economic Co-operation and Development (OECD), Paris, December 2012, http://stats.oecd.org/Index.aspx?DatasetCode=MEI_PRICES#.

Copyright 2013 by George R. Tyler

All rights reserved. No part of this book may be used or reproduced in any manner whatsoever without written permission except in the case of brief quotations embodied in critical articles or reviews.

BenBella Books, Inc.

10300 N. Central Expressway

Suite #530

Dallas, TX 75231

www.benbellabooks.com

Send feedback to

Printed in the United States of America

First e-book edition: July 2013

Library of Congress Cataloging-in-Publication Data is available for this title.

Tyler, George R.

What went wrong : how the 1% hijacked the American middle class and what other countries got right / by George R. Tyler.

pages cm

Includes bibliographical references and index.

ISBN 978-1-937856-71-7 (trade cloth : alk. paper)ISBN 978-1-937856-72-4 (ebook)

1. WealthUnited States. 2. Elite (Social sciencesUnited States. 3. CapitalismUnited States. I. Title.

HC110.W4T95 2013

330.973--dc23

2013009618

Editing by Erin Kelley

Copyediting by Dori Perrucci

Proofreading by Rainbow Graphics and Cape Cod Compositors, Inc.

Cover design and interior art by Sarah Dombrowsky

Text design and composition by Elyse Strongin, Neuwirth & Associates, Inc.

Printed by Berryville Graphics

Distributed by Perseus Distribution

www.perseusdistribution.com

To place orders through Perseus Distribution:

Tel: 800-343-4499

Fax: 800-351-5073

E-mail:

Significant discounts for bulk sales are available. Please contact Glenn Yeffeth at or (214) 750-3628.

What Went Wrong

May Alexia and Tis generation prosper from the spirit of Marcia McGill and Hubert H. Humphrey

We have forgotten that the economy is a tool to serve the needs of society and not the reverse. The ultimate purpose of the economy is to create prosperity with stability.

SIR JAMES GOLDSMITH,

CEO, the Goldsmith Foundation, 1994

While Americas super-rich congratulate themselves on donating billions to charity, the rest of the country is worse off than ever. Millions of Americans are struggling to survive. The gap between rich and poor is wider than ever and the middle class is disappearing.

THOMAS SCHULZ,

Der Spiegel, August 19, 2010

That was the old curve. Then I drew the new one. It curves down: wages dont rise; you cant get on the property ladder. Fiscal austerity eats into your disposable income. You are locked out of your firms pension scheme; you will wait until your late 60s for retirement. This generation of young, educated people is uniqueat least in the post-1945 period: a cohort who can expect to grow up poorer than their parents.

PAUL MASON,

The Guardian, July 2012

A mericans have long been proud of their economy. And why shouldnt we be? From the time we were children, weve been told that we live in the best country in the world, with the most expanding and dynamic economy. Weve been told that our economy allows Americans to enjoy a lifestyle that is the envy of the world. And weve been told that we live in the home of the American dream, a country thatmore than any otherallows people to rise up from poverty into the ranks of the rich. But is it really true?

Unfortunately, the answer is no. These things havent been true for a long time. But they used to be true.

In the period from 1946 to 1972, America experienced the longest and most robust period of wealth creation the nation has ever experienced. Year after year, the economy grew substantially. Productivity growth was equally dramatic. Businesses experienced strong profits, and employees experienced steady growth in wages. It was a golden age for America, and, throughout this book, Ill refer to this period of time as the golden age.

Most of the major industrialized countries experienced similar growth. Because of the rebuilding after World War II, and the aid afforded by the Marshall Plan, many European countries grew even faster than the United States. Every countrys experience was unique, driven by their particular circumstances, but, overall, the trend was up. Economies grew, businesses thrived, and wages expanded.

Moving into the mid-1970s, Americas economic performance suffered. Stagflationinflation combined with minimal economic growtheroded wages and profits, weakening business and consumer confidence. Escalating energy prices and an overly loose monetary policy were the major causes. In August 1979, President Jimmy Carter appointed Paul Volcker as Chairman of the Board of Governors for the Federal Reserve System. Volcker is widely credited with ending stagflation by tightening credit, and by 1983 inflation was back to a relatively healthy 3.2 percent. In November 1980, Ronald Reagan was elected president and took the economy in a dramatic new direction, a direction that, with some twists and turns, has continued to this day. Throughout this book, I call this new direction Reaganomics, in honor of the man identified most closely with this new economic direction. But Reagan isnt alone. As well see, Presidents George H.W. Bush and Bill Clinton did very little to change this direction. President George W. Bush doubled down on Reaganomics, and President Barack Obama, amid a gridlocked Washington, has been stymied in efforts to change it.

Weve been living under Reaganomics since the 1980s, a span I call the Reagan era. Please be clear that Im referring to the entire period from 1980 until now, and not just the duration of Reagans presidency.

Ill define Reaganomics in detail later in the book, but for now, this brief description will suffice. Reaganomics is a version of laissez-faire capitalism that emphasizes a minimum of regulation, especially in the financial sector; a lowering of taxes, especially on the wealthiest individuals; rapid growth in government spending, especially on national defense; and an indulgent attitude toward the business community.

The Impact of Reaganomics

Economists are critical of the overall impact of Reaganomics on productivity and family prosperity. Yet millions of ordinary Americans believe it has been a positive recipe for the country, a perspective I believe ignores the big picture. As we shall see throughout this book, Reaganomics has been unkind to most Americans.

The failure of Reaganomics is not limited to income erosion. The growth in American productivity dropped precipitously over the Reagan era. Productivity growth is not discussed much in the United States (it is in some other countries, as we shall see), but its the single most important measure of economic performance. Productivity is commonly defined as total production divided by the number of labor hours. Raising productivity is the only way that inflation-adjusted salaries can increase on a per capita basis. During the golden age, productivity grew an average of 2.8 percent per annum; it slumped during the stagflation of the 1970s and then averaged a third lower, at 1.9 percent through 2011.