India GST for Beginners

Jayaram Hiregange & Deepak Rao

India GST for Beginners

Published by White Falcon Publishing

No. 335, Sector - 48 A

Chandigarh - 160047

First Edition,

Copyright 2016 Jayaram Hiregange & Deepak Rao

All rights reserved

No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means without prior permission of the Author.

Requests for permission should be addressed to

Jayaram Hiregange & Deepak Rao (deepak.rao@acertax.com).

Preface

India is home for several indirect taxes. Currently, both the central government and the state governments levy indirect taxes on transactions of goods and services. Excise duty is charged on manufacturing, Value Added Tax (VAT) is charged on the sale of goods within the state, Central Sales Tax (CST) is charged on the sale of goods from one state to another, Service tax is charged on provision of services as well as on receipt of services in a few cases, whereas Custom duties or Import duties are charged on import of goods into India.

In addition to the above indirect taxes, there are other central and local taxes such as cess, octroi, entry tax etc., which are charged by the central and the state governments. Various acts, rules and regulations govern the above taxes, but every type of tax has its own compliance requirements. Over the years, too many acts, rules and regulations have made it cumbersome for businesses to understand and apply indirect tax laws to the day-to-day business transactions. Separately, the tax courts in the country are also loaded with indirect tax litigations owing to the presence of a wide variety of indirect taxes. Therefore, in order to provide an effective indirect taxation platform for businesses in India, it is very critical that the existing indirect taxes are standardised and rationalised.

A new indirect tax legislation called the Goods & Services Tax (GST) is under discussion, for more than a decade, for implementation in India. GST will replace most of the existing indirect taxes in India.

GST may be a new concept for India, but has its presence in various developed as well as developing countries. GST has helped those countries in streamlining the indirect taxes. It has also provided businesses an opportunity to efficiently manage their indirect taxes. For the record, GST is already implemented in many countries across the world.

In India, GST is perceived to be a comprehensive indirect tax legislation that would replace the existing indirect taxes and subsume many central as well as state taxes under its umbrella. GST is also seen as a possible remedy for the indirect tax issues faced by businesses in relation to application of taxes and undertaking compliances. The central and the state governments have been working on the idea of GST in India for more than a decade, and after all the ups & downs, heartbreaks and political differences, GST could be implemented in India in the coming years. The governments and businesses are very optimistic regarding the implementation of GST in India in the very near future.

Indirect taxes have existed in India for more than half a century, but the understanding of these taxes and compliance by businesses towards the same has been limited and haphazard. The primary reason behind this is complex legislations and varied procedures. In spite of both the central and the state governments exercising control on the administration and collection of indirect taxes, compliance with law by the businesses has been largely inadequate.

GST could be the much needed solution to the issues faced by businesses on the matters of indirect taxes. GST, by its very design, would limit the number of acts and rules in circulation and would simplify the frequency and manner of compliance. Furthermore, GST would also largely automate compliances and make it simpler for businesses to comply with the requirements under the GST legislation.

Given that India would implement GST in the very near future, understanding the basic concepts of GST is very essential and critical for businesses in order to comply with the GST requirements. GST, as a new concept, would be unique in nature and would be considerably different from the existing indirect taxes.

The objective of this book is to explain the key concepts of GST in an easy and simple manner with the intention that the business community, which would be impacted by GST, can have good understanding of what is in store for them under the GST regime. The book also makes an attempt to explain the concepts of GST with the help of pictures, drawings, flowcharts and illustrations so as to provide practical insights and examples into how GST would impact the day-to-day business transactions.

Through this book, an attempt is being made to simplify GST concepts for the businesses, especially the mid-size and small-size businesses, which may not have adequate access to the GST knowledge-base. We also believe that this book will be useful for tax consultants and students of GST in understanding the basic concepts of GST.

The purpose of this book would be served if the readers are able to understand the basic concepts of the proposed GST.

Jayaram Hiregange

Deepak Rao

Chapter 1

Overview of Indirect taxes

Before we proceed with the basic concepts of GST, it is imperative to understand the existing indirect taxes in India. Basic knowledge of the existing indirect taxes in India will help the reader to connect with the changes that the GST regime would bring about. This chapter provides a brief overview of the existing indirect taxes in India and their applicability.

Types of Indirect Taxes

Indirect taxes in India can be broadly classified into the following categories:

Excise Duty on manufacturing

Value Added Tax (VAT) on within the state sale of goods

Central Sales Tax on between the state sale of goods

Service Tax on provision of service

Custom Duties on import of goods into India

Entry Tax / Octroi on entry of goods into a local area

Excise Duty (ED) on Manufacturing

Excise Duty is a tax levied by the central government on manufacture of goods under the provisions of The Central Excise Act, 1944 and is administered by the Central Excise authorities. There are rules, notifications, circulars etc. that govern and support the administration and collection of the Excise Duty.

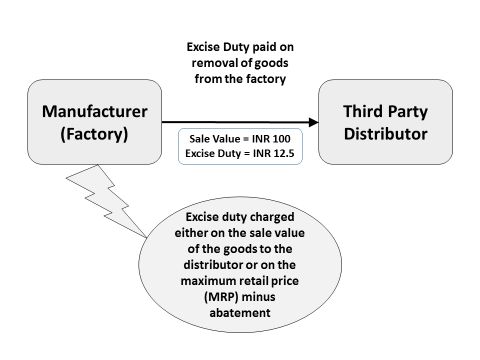

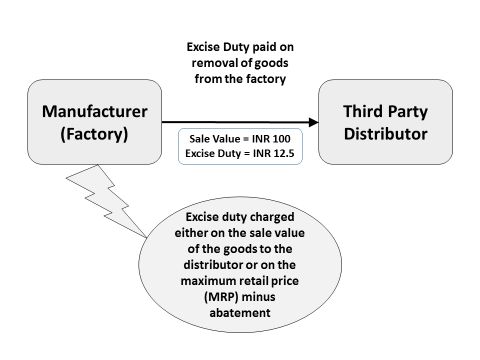

Excise Duty is, in general, levied on the manufacturer of goods. Excise Duty is collected on removal of the manufactured goods from the factory. Every factory manufacturing goods and chargeable to excise duty is required to register with the Central Excise Office having jurisdiction over the factory. Excise Duty is levied only on crossing a certain threshold (monetary limit) of turnover and hence small scale units that do not cross the threshold are not charged with Excise Duty. Excise Duty, where applicable without any concessions or exemptions, is currently charged at the rate of 12.5%. The manufacturer, who has the excise registration, has to pay Excise Duty and file returns as prescribed under the excise laws.

Excise Duty on Manufacturing

Value Added Tax (VAT) on Within the State Sale of Goods

VAT is a tax levied by the state government on the sale of goods within the state under the provisions of the respective state VAT legislation. VAT is administered by the local state VAT authorities. For example, VAT is levied by the state of Karnataka on sale of goods within the state of Karnataka by one person to another person under the provisions of The Karnataka Value Added Tax Act, 2003. Each state has its own set of act, rules, notifications, circulars etc. in order to support the administration as well as the collection of VAT. VAT is levied on the sale of goods, leasing or renting of goods or on deemed sale of goods (in some transactions, goods are transferred from one person to another person in the course of providing services, such transfers are classified as deemed sale).

Next page