Mark Douglas - The Diciplined trader

Here you can read online Mark Douglas - The Diciplined trader full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 1990, genre: Religion. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

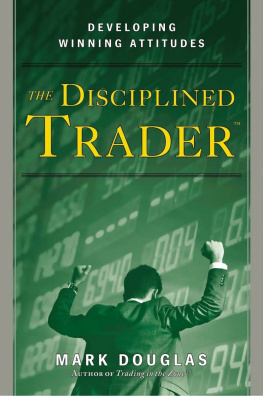

- Book:The Diciplined trader

- Author:

- Genre:

- Year:1990

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

- 80

- 1

- 2

- 3

- 4

- 5

The Diciplined trader: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "The Diciplined trader" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

The Diciplined trader — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "The Diciplined trader" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

The

Disciplined Trader

Developing Winning Attitudes

Mark Douglas

NEW YORK INSTITUTE OF FINANCE

Library of Congress Cataloging-in-Publication Data Douglas, Mark.

The disciplined trader: developing winning attitudes / by Mark Douglas.

p.

cm.

ISBN 0 13-215757-8

1. StockbrokersAttitudes. 2. Stock-exchange. I. Title.

HG4621.D68 1990

332.64dc20

90-30237

CIP

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional service. If legal advice or other expert assistance is required, the services of a competent professional person should be sought From a Declaration of Principles Jointly Adoptedby a Committee of the American Bar Association

and a Committee of Publishers and Associations

1990 by Mark Douglas

All rights reserved No part of this book may

be reproduced in any form or by any means without

permission in writing from the publisher

Printed in the United States of America

10 9 8

New York Institute of Finance

A division of Simon & Schuster. Inc.

2 Broadway

New York. NY 10004-2207

To Paula Webb for her love, understanding and beingthere throughout the process of writing this book.

Contents

Foreword

Acknowledgments

1 Why I Wrote This Book

2 Why a New Thinking Methodology?

Part II The Nature of the Trading Environment

from a Psychological Perspective

3 The Market Is Always Right

4 There Is Unlimited Potential for Profit

and Loss

5 Prices Are in Perpetual Motion with No

Defined Beginning or Ending

6 The Market Is an Unstructured Environment

7 In the Market Environment, Reasons

Are Irrelevant

8 The Three Stages to Becoming a Successful

Trader

9 Understanding the Nature of the Mental

Environment

10 How Memories, Associations, and Beliefs

Manage Environmental Information

11 Why We Need to Learn How to Adapt

12 The Dynamics of Goal Achievement

13 Managing Mental Energy

14 Techniques for Effecting Change

15 The Psychology of Price Movement

16 The Steps to Success

17 A Final Note

Index

Foreword

My unique position in the financial community has allowed me the rare opportunity to talk to and question thousands of traders, brokers, and trading advisors since 1979. I am not a broker or a letter writer. I am the chief executive officer of CompuTrac, a company that supplies technical analysis to stock and futures traders. I perceive my position as being neutral, one that allows people to open up and talk to me freely. I started trading for my own account in 1960

and very quickly became aware of the underlying psychological blocks to good trading and money management. This realization has been confirmed by all who have counseled with me.

As a result, I sincerely feel that success in trading is 80 percent psychological and 20 percent one's methodology, be it fundamental or technical. For example, you can have a mediocre knowledge of fundamental and technical information, and if you are in psychological control, you can make money. Conversely, you may have a great system, one that you have tested and has performed well for a long period of time, yet if the psychological control is not there, you will be the loser.

A good trader knows from experience that over a period of time he may engage in more losing trades than winning ones. But money management, and a careful assay of the risks protected by realistic stops, will keep the trader out of trouble and ensure that on the "big" moves, he will profit.

Money management is composed of two essential elements: psychological management and risk management. Risk management stems from the psychological factors being truly understood by the trader and "in place"

before risk is even considered.

I would especially caution new traders and market participants that reading and passively analyzing your motivations are certainly a necessity, but the acid test comes with active trading under pressure. Start slowly.

Question every trade. What motivated it? How was the trade managed? Was it successful? Why? Did you lose? Why? Write down your assessment and refer to your comments before making your next trade.

At all major CompuTrac seminars I try to have a workshop leader address the attendees on the psychological aspects of trading. The grim reaper who kills off "your equity" and disappears with your profits is not the mysterious and ubiquitous "they" but a simple misguided "you." Medea said just before she murdered her children, "I know what evil I'm about to do, but my irrational self is stronger than my resolution." If this sentiment reflects your mind set when you trade, then The Disciplined Trader is definitely the type of book you should be reading.

What a pleasure to read this book. My own education cost me a lot "the hard way." I can read myself into the pages - that's me, that's me! Mark has carefully fashioned his book into a comprehensive logical dialogue. It reads as if you are at his side and he is explaining it as a friend, which I know you will enjoy. You are fortunate because you are taking the time now, before you have made a serious mistake, I hope, to learn about yourself and to study your craft. The traders who take the time to reflect and practice will survive and possibly prosper.

TIMOTHY SLATER

President

CompuTrac Software, Inc.

Preface

The Disciplined Trader is a comprehensive guide to understanding the psychology of self-discipline and personal transformation needed to become a successful stock or futures trader. This book will serve as a step-by-step guide to adapting successfully to the unusual psychological characteristics of the trading world.

I say "adapting" because most people venturing into the trading environment don't recognize it as being vastly different from the cultural environment in which they were brought up. Not recognizing these differences, they would have no way of knowing that many of the beliefs they acquired to enable them to function effectively in society will act as psychological barriers in the trading environment, making their success as traders extremely difficult to achieve. Reaching the level of success they desire as traders will require them to make at least some, if not many, changes in the ways they perceive market action.

Unlike other social environments, the trading arena has many characteristics requiring a very high degree of self-control and self-trust from the trader who intends to function successfully within it. However, many of us lack this self-control because as children we learned to function in a structured environment where our behavior was controlled by someone more powerful than ourselves, whose purpose was to manipulate our behavior to conform to society's expectations.

Thus, we were forced by external forces to behave in certain ways through a system of rewards and punishments. As a reward, we would be given the freedom to express ourselves in some desired manner. As a punishment, we 8

would either be prevented from getting what we wanted, causing emotional pain, or we were inflicted with various forms of corporal punishment, causing physical pain. As a result, the only form of behavior control that we typically learned for ourselves was based on the threat of pain - either emotional or physical - from someone or something we perceived as having more power than ourselves. And since we were forced to relinquish our personal power to other people, we naturally developed many of our traditional resources for success (the particular ways in which we learned to get what we want) from the same mental framework. Accordingly, we learned that acquiring power to manipulate and force changes upon things outside of us was the only way to get what we wanted.

Next pageFont size:

Interval:

Bookmark:

Similar books «The Diciplined trader»

Look at similar books to The Diciplined trader. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book The Diciplined trader and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.